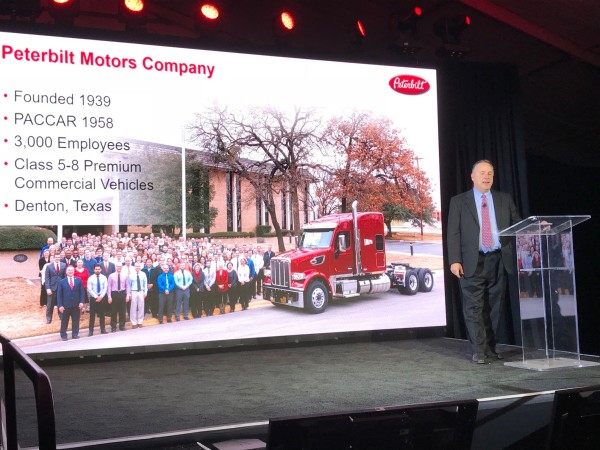

Peterbilt looks to strong 2018 after record-breaking year

SCOTTSDALE, Ariz. – Peterbilt is coming of a record-setting year and planning to take advantage of a strong truck market in 2018.

The company says it achieved a new Class 8 heavy-duty market share high in 2017, at 15.3%, surpassing its previous record of 14%. It also set a new record for vocational market share at 20%, according to Kyle Quinn, Peterbilt general manager and senior vice-president of Paccar.

The company built 43,000 vehicles last year, 70% of which were the models 579 and 567, and added 25 dealer locations. It also grew its MX engine penetration to 43%. These achievements came along with a US$100-million investment in the company’s Denton, Texas, truck plant.

Quinn said the company is bullish about the year ahead, thanks to the “strongest economic outlook in many years.”

He said GDP is expected to grow by more than 2.5%, the manufacturing sector is strong, capital spending is growing at an annualized rate of about 8%, and motor vehicle sales are strong. Unemployment remains low, and recently passed U.S. tax law reforms are creating opportunities for customers to grow their businesses, Quinn said.

“All in all, we are in a very healthy environment,” he said. “Our industry is heating up as well. Freight tonnage is at record levels. The driver shortage continues to be a major headwind keeping a lid on rapid fleet expansion.”

Peterbilt is forecasting a Canada/U.S. Class 8 retail truck market of 235,000-265,000 units this year, which would represent the third strongest market in history. The medium-duty truck market is projected to remain steady at about 85,000 units.

Also driving growth is a recovery of the oil industry.

“We started to see a little strength last year,” Quinn said of the oil and gas services segment. However, he said this year orders are truly picking up.

“We are seeing the smaller oilfield services fleets coming to us and ordering some trucks,” Quinn said. “I think anything north of $60 a barrel is healthy. It’s strange to say, given where we were in 2014, but it appears to be the threshold right here at $60 that’s made a difference. Many energy customers are ready for growth, but some of that growth has arrived.”

“We have seen an uptick in orders and activity from a number of energy services companies,” agreed Robert Woodall, assistant general manager of Peterbilt. “There’s a lot of optimism around the energy sector. It has always been a big part of our business.”

Peterbilt officials pointed to some of the work the company is doing to prepare for the future. It has set up an office in Silicon Valley, Calif., to work on advanced driver assist technologies. Asked when fully autonomous trucks will hit the road, Quinn said it’ll take some time.

“It’s hard to say when,” he said. “My particular perspective about autonomous vehicles is that it’ll be a while. But I do think there’s a tremendous opportunity in the near-term to dramatically improve the safety of vehicles and reduce the burden on drivers.”

He cited lane-keeping assist and other advanced driver assistance technologies as being capable of relieving the stress and fatigue on drivers.

Peterbilt is also working on electric-powered trucks, with 16 such refuse vehicles running in California. They have an 80-mile range and take six hours to recharge. They produce no emissions and are very quiet, driven by a 400-hp electric motor.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.