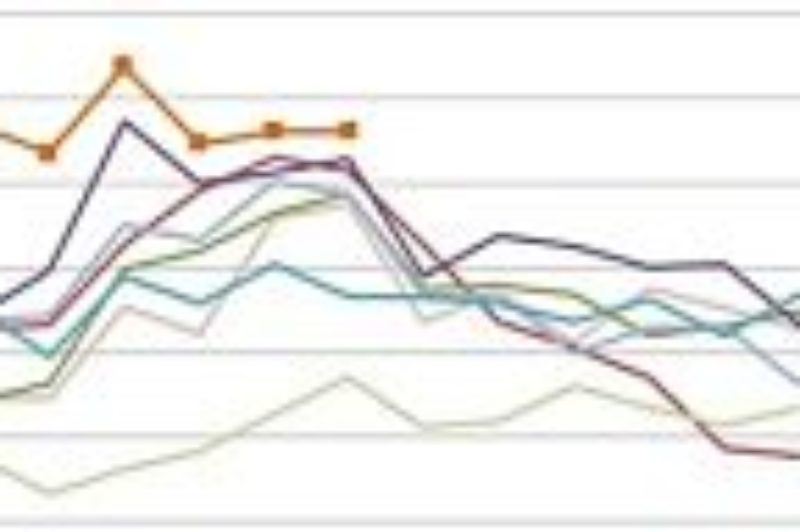

freight volumes

Can the hot trucking market continue?

NEWPORT, R.I. – It is a good time to be in trucking in the U.S. The economy is strong, freight needs to move, and rates are on the rise. Eric Starks, the chairman and CEO of FTR, pointed to several indicators during a business symposium for Volvo dealers and customers. The ATA Tonnage Index and FTR Loadings Index, which track absolute freight levels, are both trending upward. The flatbed market in particular has been going “crazy”, in part because of increasing demand to move pipe and fracking sand, the latter of which is moved in boxes, he said. “It’s eating up a huge amount of capacity.” Everything from consumer spending to home sales are adding to the demand.

Freight volumes, rates to rise in ’18: Analysts

MISSISSAUGA, ON - The coming year appears to hold the promise of a growing economy, tighter capacity, and ultimately higher rates for those who haul freight. "When you have the economy doing reasonably well, transportation tends to be generally picking up," said Carlos Gomes, senior economist - Scotiabank, in a presentation during the Surface Transportation Summit in Mississauga, Ontario. He projects economic growth of about 2% in 2018, compared to the 3% seen in 2017. "The Canadian economy recently has been very strong," agreed Walter Spracklin, equity research analyst - transportation sector at RBC Capital Markets. But where railways have enjoyed higher volumes against the backdrop of recent growth, trucks didn't fare quite as well. Railway volumes surged in part because of the demand for fracking sand, feeding into the 6.5% boost in overall freight that moved over iron highways, he said. Intermodal freight volumes are growing as well, although grain volumes are likely to drop when compared to the strong crops of 2016. Of the Canadian railways, CN is seeing capacity tighten, leading to congestion challenges and a projected boost in capital spending.

U.S. rates steady despite volume increases: DAT

BEAVERTON, OR - While U.S. truck volumes increased in many van lanes last week, rates are holding steady because of available capacity, DAT RateView reports in its latest findings. Combined with lower fuel surcharges, van and reefer rates actually dipped a penny a mile. Average flatbed rates rose a mere cent on their own.