Trucking in ‘early adopter’ phase of electrification

Trucking’s road to electrification is in the early adopter stage, but by 2025 it will be mainstream. And hydrogen-fuel-cell trucks won’t be far behind.

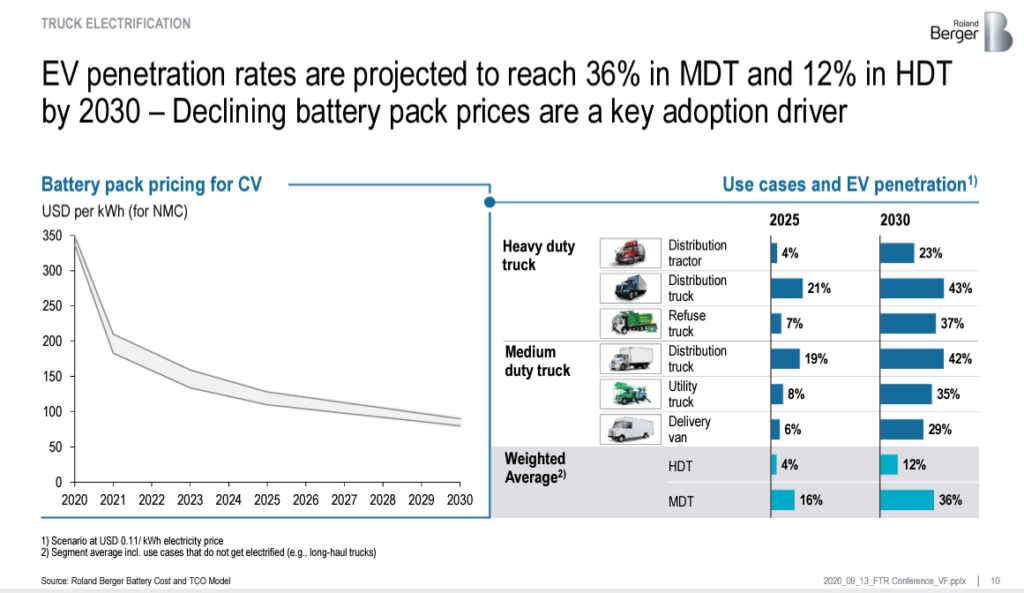

Wilfried Aulbur, senior partner with Roland Berger, gave an update on truck electrification during an FTR webinar Monday. He said total cost of operation (TCO) is approaching parity with diesel as battery costs come down with greater economies of scale.

“We will continue to see a decline in battery costs,” said Aulbur, which will be complemented by savings in maintenance costs, which are about 40% lower than on an internal combustion engine, he added. By 2025, many use cases will achieve TCO parity with diesel, Aulbur predicted. By 2030, he said fuel-cell-electric trucks will be viable for longhaul trucking.

By 2025, Aulbur said, about 4% of Class 8 trucks and 25% of medium-duty trucks sold will be electric, climbing to 12% and 36%, respectively, by 2030.

But he also indicated challenges remain, including widely variable electricity rates depending on jurisdiction. A utility in one metro area charges US 20 cents/kWh, while neighboring counties charge six cents. This means adoption of electric trucks will be faster in areas with lower electricity rates, and electricity costs could dictate which terminals fleets choose to first install charging infrastructure.

When it comes to longhaul transport, hydrogen-fuel-cell trucks will be required. And don’t underestimate how soon they’ll be ready, Aulbur noted. The challenge will be to produce green hydrogen at cost-effective prices. Today, plenty of ‘grey’ hydrogen is available and for cheap, but it has no environmental benefits as it can be generated by coal-fired plants.

Blue hydrogen production requires any carbon produced be captured and put back into the ground. But green hydrogen production forms no pollutants and will give the environment the greatest benefit. Currently, only 2% of hydrogen produced is green, Aulbur noted.

Hydrogen producers will also have to consider between two options: centralized production that will incur heavy transportation costs to get to the end user; or more localized production near end users but in smaller volumes. An example of the latter would be along Hwy. 401 in Ontario, Aulbur said.

Because hydrogen-fuel-cell trucks are still not produced in large numbers, Aulbur noted they’ll initially be quite expensive. How expensive? How about US$270,000 in 2023, decreasing to $160,000 by 2030 as production ramps up. By that time green hydrogen should cost about $5 per kilogram.

Aulbur said there will be about 30,000 hydrogen-fuel-cell trucks on North American roads by 2030, representing about 11% of the market, increasing to 47,000 units of 17% of the Class 8 market by 2035.

“It makes sense for fleets to start investing in these technologies today,” Aulbur said of electric trucks.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

It would be good to see what it would cost for a conversion from Diesel to Hydrogen Fuel-cells for the single operator today. That is a BIG QUESTION that faces the operators today.