Cummins

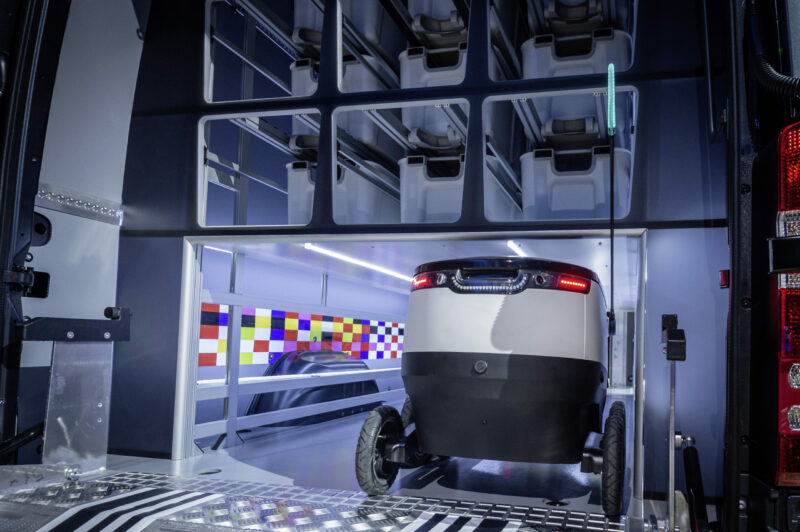

Final mile introducing new maintenance demands

ATLANTA, Ga. – Evolving delivery models are leading to a new generation of vehicles as fleets look for new ways to serve the all-important final mile of e-commerce orders. Against the backdrop of dense urban centers that are demanding an end to emissions, the trucks and vans are also more likely than ever to be electric. “The economics of those are starting to become positive in some applications,” said Thomas Dollmeyer, Cummins’ director of electrification technology, during a panel at the annual meeting of the Technology and Maintenance Council. Electric urban buses are already economically viable, while the same could be said about electric Class 4-7 distribution vehicles as early as 2020, he said. But changes like that will lead to new challenges on the shop floor.

Little engines that can: Big power from small displacements

TORONTO, ON -- Canada has always been big-bore territory: big trucks, big loads, big hills, big engines. Right? If you're one of those with feet firmly planted in the big bore camp, it might be time to re-think that position. Some of today's smaller engines are surprisingly capable. They are lighter and more fuel-efficient, and deliver performance that's nearly equal to their larger brothers.

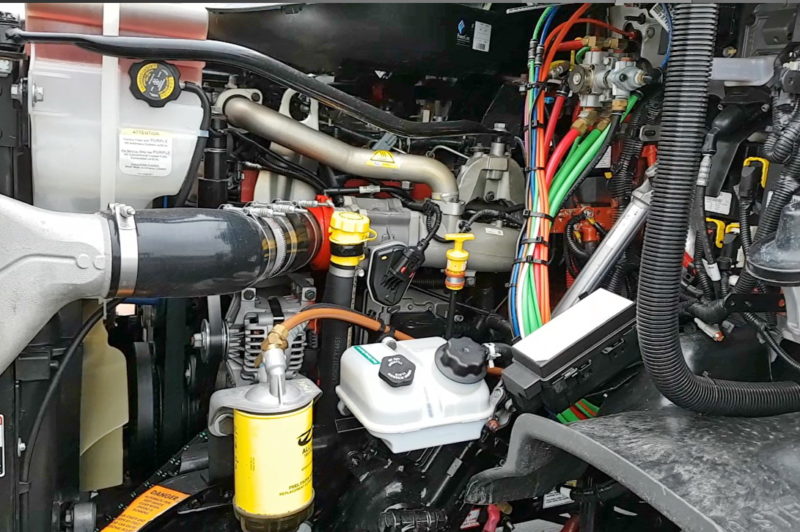

REVIEW: X12 fights above its weight class

JAMESTOWN, NY - Cummins' new X12 engine is slated to hit the street sometime early this year, probably shortly after its formal launch in February or March. The engine was introduced in August 2016 and I had a short drive with it then around the 11-kilometer track at the Transportation Research Center in East Liberty, Ohio. It wasn't much of an opportunity to get to know the engine, but it whet my appetite. Cummins invited me to drive the new X12 this past November on a longer real-world route, starting from the plant in Jamestown, New York, where the X12 is to be built. The X12's 11.8-liter displacement puts it smack dab in the middle of the medium-bore market, but its published ratings put it squarely in 13-liter territory for torque and horsepower. Tipping the scales at just 2,050 pounds, it has the highest power-to-weight ratio of any heavy-duty engine from 10 liters to 16 liters in size, but it's actually lighter than any of the 11-liter blocks on the market (subject to interpretation on how "dry weight" is determined).

Electric Avenues: Cummins sees future in diversity

COLUMBUS, IN -- If you're one of those who's been thinking that Cummins is a dead duck, and that's been the tone of more than a few conversations I've joined over recent years, think again. Nothing could be further from the truth. First off, the company presently maintains an 80% market share in the North American medium-duty market, more than 90% of the school and transit bus markets, and still a decent lead on the class-8 side of things with something like a 40% share through June of this year. Dead in the water? Not exactly. Globally, the company is very strong. In 2015 it manufactured more than a million engines in the heavy-duty, mid-range, and light-duty markets -- from 50 to 650 hp -- and nearly half of them were from its joint-venture partner plants around the world.