Freight downturn drags into third year as capacity stubbornly clings on

If there was a theme of the year in the Canadian freight market, it was 'uncertainty.' Uncertainty over the economy, over tariffs, over relations with our largest trade partner, over emissions regulations and over myriad other regulatory actions. Uncertainty hung over the industry like a dark cloud as the freight market entered its third year of recessionary conditions. Read more

PULSE

READER SURVEY

Tell us your thoughts on

Equipment Buying Trends

As the freight recession is approaching its fourth year, tariffs and shifting emissions regulations are reshaping fleets' 2026 equipment plans, according to trucknews.com's annual Equipment Buying Trends Survey. Read more

What best describes your fleet's primary activities?

How many trucks or tractors does your fleet operate?

How many trailers does your fleet operate?

What is the average age of your tractor fleet?

What is the average age of your trailer fleet?

Are tariffs affecting your equipment buying plans for 2026?

What percentage of your truck/tractor fleet are you planning to replace in 2026?

What percentage of your trailer fleet are you planning to replace in 2026?

How much do you anticipate tariffs will add to the cost of a Class 8 truck?

Will the cost of the tariffs influence the brand of truck or trailer you order?

How has your company responded to the lengthy freight downturn when it comes to equipment?

(Select all that apply)

Will changes to emissions regulations affect your buying plans for 2026?

Do you anticipate parts and labor rates in 2026 to:

Are you considering purchasing any alternative-fueled vehicles in 2026?

If you selected Yes to the previous question, what types of alternative fuels are you most likely to invest in?

Have you ordered truck and/or trailer parts online in the past year?

Approximately what percentage of your maintenance activities are outsourced?

Did market conditions cause you to alter your equipment capital investments in 2025?

Today's Trucking Pulse Surveys are conducted once per month, covering a variety of industry issues. Questions are distributed through email and social media channels. Responses rounded up to nearest percentage. Totals may not add up to 100%.

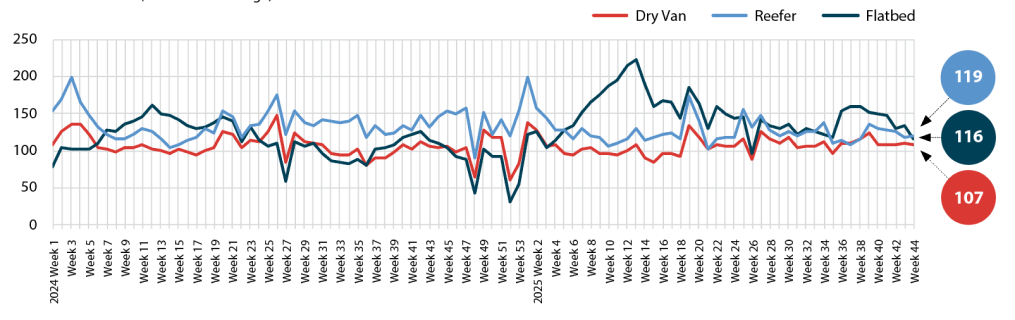

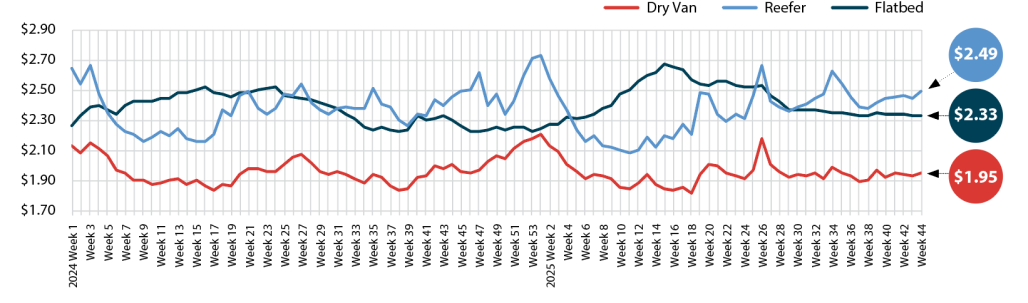

U.S. Spot Market Rates & Loads

Modest improvement in store for U.S. spot market rates

The spot market in 2025 has been defined by steadier footing and disciplined operations. After several years of soft demand and elevated capacity, the market finally showed signs of stabilizing. Average van and reefer rates held near $1.95 and $2.36 per mile (all figures USD), while flatbed performed slightly better at $2.43. Volumes have remained consistent, suggesting that supply and demand are moving back into alignment rather than working against each other. Read more

Canadian Spot Market

Volatile Canadian spot market to give way to steadier 2026

The Canadian spot market in 2025 opened strong, cooled through mid-year, and is entering the final months with steady momentum. We saw truck capacity at its most limited in the first quarter, as demand pulled forward ahead of early March tariff changes. The truck-to-load ratio dipped to about 1.04 in February before loosening quickly in April. Read more

Canadian Spot Market Freight Index

(Source: Loadlink)