ECONOMIC TRUCKING TRENDS: Trailer market comes to life, Class 8 fleet older than it’s been in a decade

Trailer buyers stepped up in December, possibly in an attempt to get ahead of tariff pass-throughs.

The Class 8 fleet continues to age and is older than it’s been in a decade. And the spot market has entered a seasonal lull and continues to normalize after some strong gains.

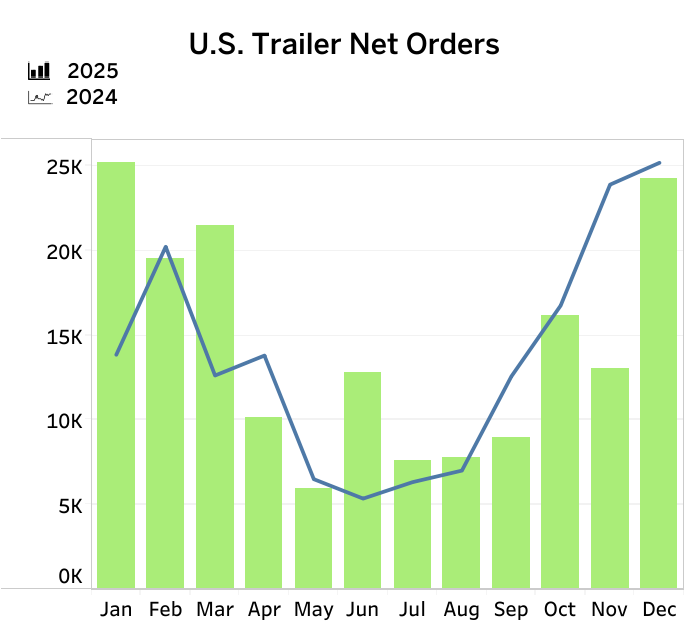

Trailer orders spiked in December

The trailer market finally sprung to life in December, with FTR reporting preliminary net orders of 24,282 units – an 86% jump from the prior month. However, FTR noted they were still down 4% from last December and well below the 10-year December average of 33,623 units.

Dry van segments led the way. FTR attributed efforts to get ahead of tariff pass-throughs as a potential reason for the surge and perhaps an ongoing anti-dumping and countervailing duty investigation into trailers imported to the United States from Canada and other markets. The industry forecaster was unwilling to declare that a sustained demand recovery has begun.

“The U.S. trailer market is increasingly constrained by policy-driven cost inflation and trade uncertainty, which are now the primary forces shaping pricing and demand. Section 232 tariffs on steel, aluminum, and downstream products, including heavy-duty cargo trailers and key components, have established a durable higher-cost base with little prospect of near-term relief. The potential for higher van trailer costs due to the antidumping investigation also might already be influencing sourcing and pricing decisions,” said Dan Moyer, FTR’s senior analyst, commercial vehicles.

“Overall, entrenched tariffs and unresolved trade actions are likely to keep demand cautious and costs elevated, reinforcing selective purchasing and a stronger focus on total cost of ownership.”

ACT Research, for its part, reported 25,300 orders, a 112% increase from its November tally.

“Sequentially, a slight uptick in net orders was expected, as December is usually the second strongest order month of the annual cycle,” said Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research.

“That said, preliminary data showed new vehicle demand for power units jolt awake in December, and those same factors of a firmer economic foundation, December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are also in play for trailing equipment demand.”

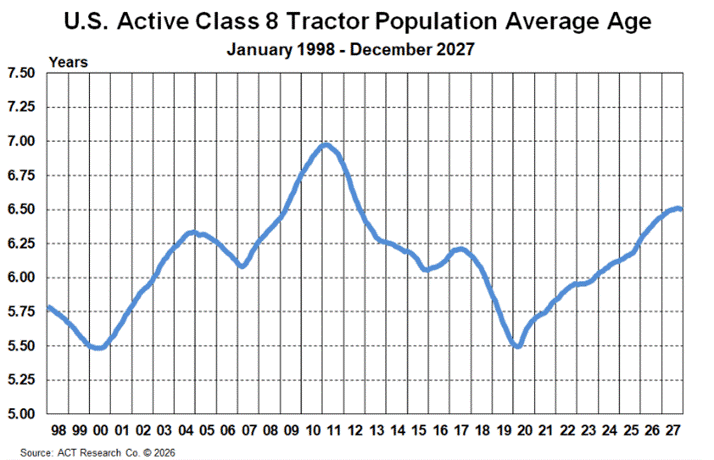

Truckload rates firming up, Class 8 fleet continues to age

ACT Research reported truckload spot rates were up year over year by double digits in three of four weeks in late December and early January.

“Most of the jump in spot rates was due to severe weather, but Class 8 orders also rose in December with improved truckload conditions and a degree of clarity for EPA27 low-NOx regulations. We expect a small equipment capacity contraction in 2026, but one that will likely continue in 2027,” said Tim Denoyer, ACT’s vice president and senior analyst.

“Growth has been led largely by a narrow segment of the economy, but it has room to broaden out if the looming Supreme Court tariff decision brings tariffs down. This would lead to additional broad disinflation, providing more leeway for the Fed to further lower rates, spurring freight-sensitive sectors like housing and durable goods. After destocking in Q425, we think the Supreme Court decision on IEEPA tariffs could provide a positive catalyst for freight demand.”

If the tariffs are upheld, Denoyer said they’ll continue to extend recessionary conditions for the trucking industry.

“The average age of a U.S. Class 8 tractor is now 6.3 years old, the highest in more than a decade, which should help usher in a new phase of the truckload cycle,” he added.

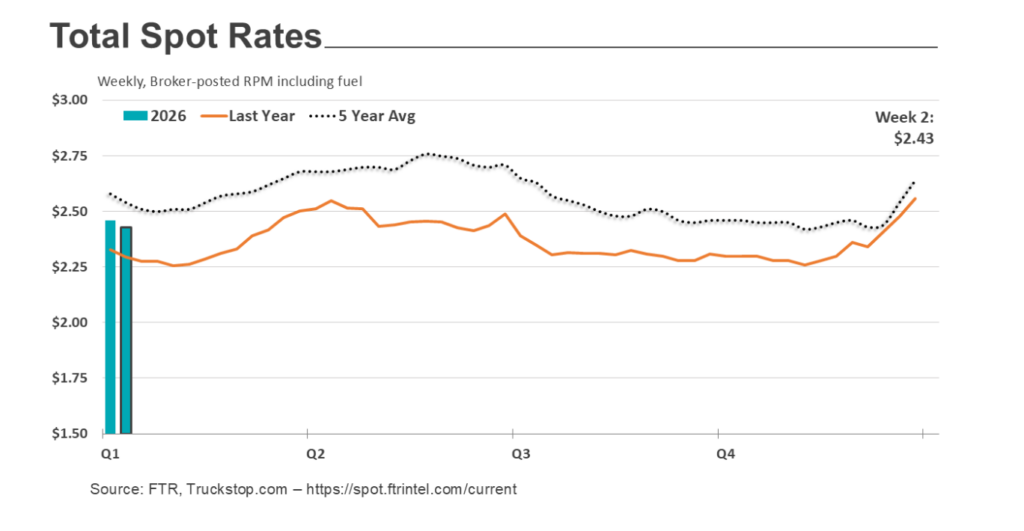

U.S. spot market ‘normalizing’

The latest U.S. spot market rate data from truckstop.com points to continued normalization as they follow seasonal trends downward after peak retail season. Flatbed rates bucked the trend and continued to rise.

For the week ended Jan. 16, both van and reefer rates fell by more than they did the prior week and more than normally do for the comparable week of years gone by. Flatbed rates rose for the eighth time in nine weeks to their strongest level since mid-2025.

An incoming winter storm across much of the United States could put upward pressure on rates.

“A modest week-over-week increase in spot volume, driven almost entirely by flatbed, coupled with a solid increase in truck postings, resulted in a Market Demand Index of 116.9 – down from the prior week’s extreme level but otherwise the strongest level since May 2022,” truckstop.com reported.

Other economic news from the past week:

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

I am seeing a lot of fleets that did maintenance based on a 10 to 12 yr cycle for trailer and a 4 to 6 yr cycle for power units except service units and local delivery going well past that

With the shortage of good quality service personnel and the higher cost of owing or renting a multi bay repairs are being left undone. The gov and the industry know what solutions are to fix this