U.S. Bank Freight Payment Index points to improved pricing for carriers

Tightening capacity helped push truckload rates higher late in 2025, even as freight demand remained weak, according to the latest U.S. Bank Freight Payment Index.

National shipment volumes rose 1.5% quarter over quarter in Q4 but were still down 4.9% from a year earlier.

Shipper spending, however, climbed 4.6% from the third quarter and rose 5.2% year over year — the first annual increase in three years — signaling that higher prices, not higher volumes, are driving transportation costs.

For carriers, the shift reflects a prolonged contraction in capacity. Extended rate pressure over the past two years has forced fleet reductions, carrier exits and a decline in the number of independent contractors, U.S. Bank said in its report.

Stricter regulatory enforcement, including tougher English-language proficiency requirements, has also sidelined drivers, further tightening available capacity.

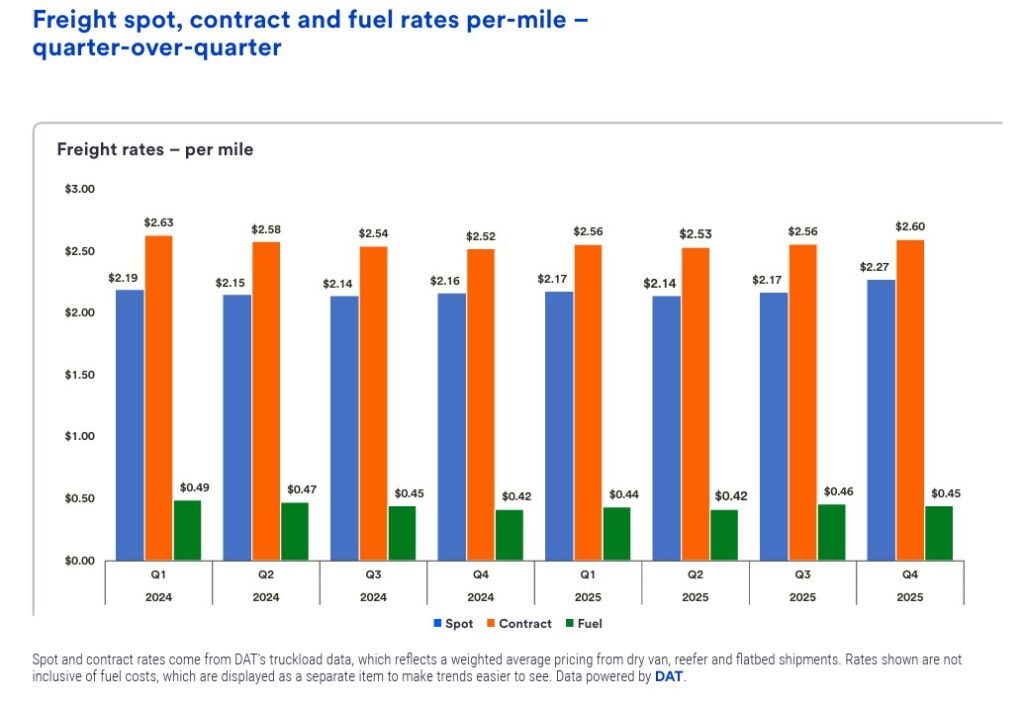

Spot market data shows the impact on pricing. Spot rates rose an average of 10 cents per mile in the fourth quarter, up nearly 5% from the previous quarter and more than 5% from a year earlier. Contract rates also increased for a second straight quarter, though at a more modest pace, suggesting pricing momentum is beginning to filter into longer-term agreements.

Regionally, conditions varied, but pricing pressure was widespread. The Northeast stood out with growth in both shipments and spending, while the Southwest saw sharp volume declines paired with some of the strongest cost increases, underscoring how tight capacity is influencing rates even in soft freight markets.

The report suggests carriers are gaining some pricing leverage but stronger freight growth and continued capacity contraction are still needed.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.