New truck orders remain ‘above normal’ as fleets jockey for build slots

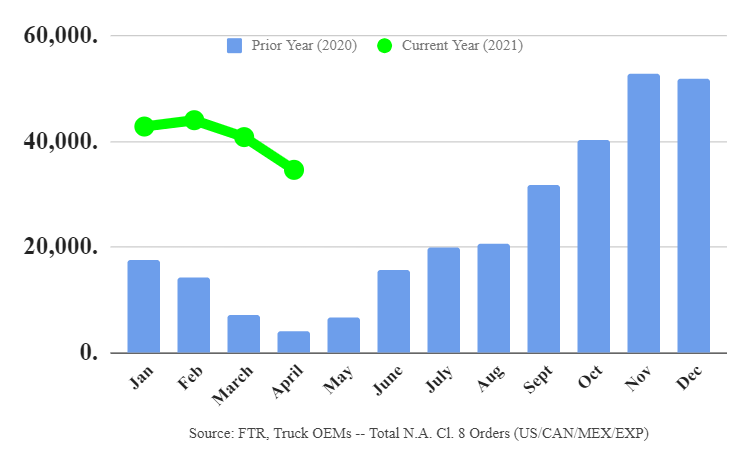

Class 8 truck orders totaled 34,600 units in April, reflecting continuing strong demand and putting more pressure on OEMs to keep pace in the face of supply chain challenges.

FTR noted orders strength was “above normal,” marking the strongest April since 2018. Orders fell 15% from March but a whipping 30,500 units above April 2020 when the pandemic curtailed demand.

Don Ake, FTR’s vice-president, commercial vehicles, said fleets are scrambling to secure new equipment by year’s end.

“Fleets see the need for more trucks extending out the entire year. Orders remain elevated, as carriers evaluate their needs in Q4. This indicates they expect freight conditions to continue along at healthy levels right into 2022,” he said.

“The supply chain is stressed right now, limiting the number of new trucks that can be produced. With orders continuing at this pace, it is possible that the supply chain will not be able to catch up with the fantastic truck demand for months. Last year, the industry was faced with all the negative challenges of the pandemic. We came through that surprisingly well under the circumstances. This year we have a whole new set of challenges. It’s almost as if conditions are too good. But the people in the commercial vehicle industry are working extremely hard to catch up with the tremendous demand.”

ACT Research reported 33,500 Class 8 orders, with Classes 5-7 demand slipping 15% from March to 27,300 units.

“For the past several months, we have been counting down the remaining open Class 8 build slots in 2021. For that exercise, we use three numbers: year-to-date Class 8 build, the Class 8 backlog analysis from ACT’s State of the Industry report, and a materials-shortage-constrained 2021 forecast,” said Kenny Vieth, ACT’s president and senior analyst.

“We start with that preamble to highlight that it is not a surprise that Class 8 orders fell to their lowest level since September and that the decline was strictly driven by the supply of open build slots in 2021, rather than a change in new equipment demand.”

Regarding the heavy-duty market, Vieth added, “Like Class 8, April’s Classes 5-7 net orders moderated, even as activity remained at high levels.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.