Commercial vehicle market rebounded sharply, but full recovery not imminent

BLOOMINGTON, Ind. – The commercial vehicle market bounced back much more quickly and strongly than expected, but it will be late 2021 before it reaches pre-pandemic levels.

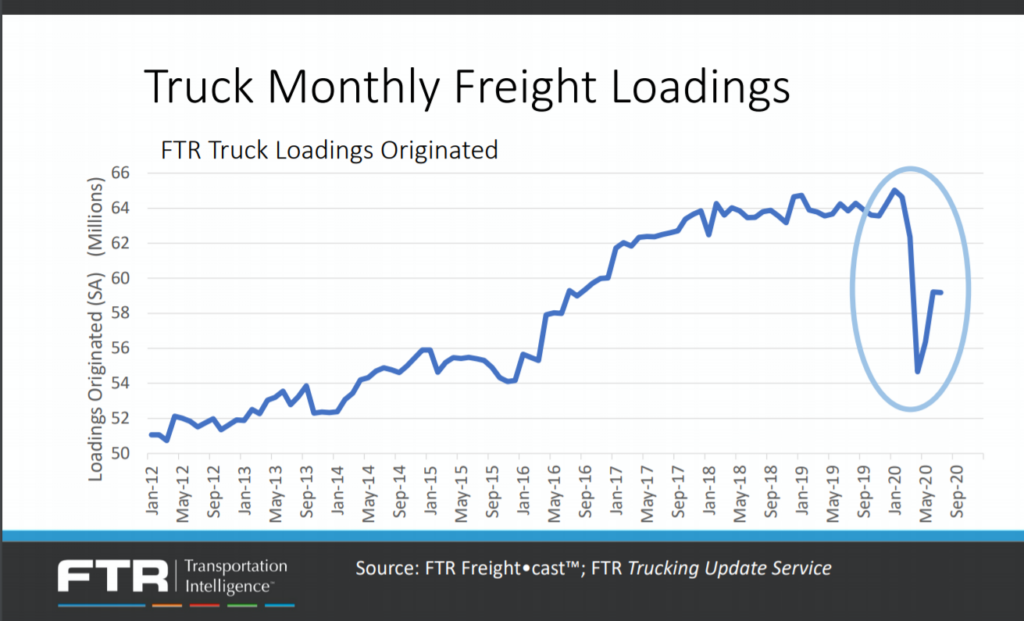

During an FTR Engage webinar, the industry forecaster gave an updated outlook on the commercial vehicle markets. Truck loadings are what drive Class 8 truck demand, and FTR chief executive officer Eric Starks pointed out loadings have recovered strongly since falling off the cliff in the second quarter. But they have only recovered halfway from pre-pandemic levels.

“This is telling us the market is not back to normal in any way, shape or form,” Starks said.

But there’s a disconnect between various data points. For example, the spot market is back above pre-pandemic levels. But in terms of total truck loadings, Starks said it will be the second half of 2021 before pre-pandemic levels are reached.

Also of concern to commercial vehicle manufacturers and dealers, total transportation revenues are down by more than 15% year-over-year, meaning fleets have less cash to deploy on new equipment purchases.

Class 8 market outlook

Don Ake, vice-president, commercial vehicles, explained the Class 8 market suffered from a flash recession caused by a global natural disaster in Covid-19. FTR has been increasing its market forecast since April, since the U.S. economy has continued fighting back even through a second wave of Covid cases.

By September, FTR forecast 192,000 factory shipments of Class 8 trucks for 2020, up from an earlier forecast of 150,000 in April. There’s no comparison to previous recessions. Ake noted it took 48 months for Class 8 builds to fully recover during the 2000 recession, but this year Class 8 build has already climbed back to within 8% of pre-pandemic levels.

However, said Ake, “our production forecast is expected to be flat for a while.”

Class 8 order activity rebounded sharply to more than 20,000 units in August, which Ake expects to hold fairly steady. Ake warned of high Class 8 inventories, which hit a record in August 2019 and remain bloated. Inventory levels were reduced as truck production was halted during the worst of the pandemic, but they’re now creeping back up as order activity is now being supported by large fleets that prefer spec’ing trucks to their requirements rather than buying off the lot.

“We still do not have enough small and medium fleets buying out of that inventory,” Ake warned.

Retail sales are expected to be strong in August, which will help draw down inventories slightly, but Ake said the inventory-to-sales ratio has been too high for five to seven months.

“There is an inventory problem we expect to drag on production until it’s resolved,” he said.

Ake projects Class 8 factory shipments will be flat until the second quarter of 2021, when things will begin to “break loose.” Expect 192,000 factory shipments this year, 222,000 in 2021, 295,000 in 2022, 348,000 in 2023 – finally nearing 2019 levels of 349,000.

Trailer outlook

Trailer demand has also bounced back strongly, after “barely positive” orders in April and three months of “very poor order activity,” Ake said. August orders totaled 28,000 units, and dry van and reefer orders led the recovery.

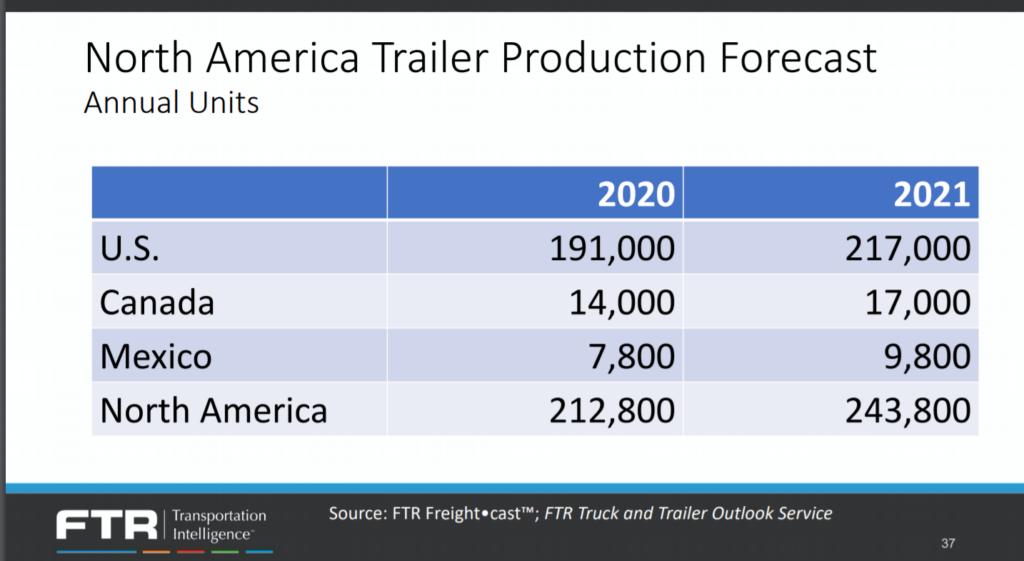

The flatbed market remains in a rut, because it is tied to the still-struggling industrial sector. FTR is predicting a “fantastic” 2023 for trailer orders with 330,000 units being built, up from 191,000 this year.

For this year, Ake expects refrigerated van trailers to lead the way as restaurants reopen and the food supply chain ramps back up. In Canada, trailer production will total 14,000 units this year, growing to 17,000 next year, Ake predicted.

The medium-duty outlook

The Class 5 category continues to lead the way in the medium-duty segment, thanks to a surge in e-commerce deliveries, FTR reported. But the overall medium-duty segment has seen a “muted” recovery.

North American Classes 4-7 factory shipments went from 55,000 in the first quarter to 29,600 in Q2. FTR expects a rebound to 52,000 in Q3 and fairly consistent results through 2021.

The downside risks to its commercial vehicle forecasts include: Covid-19 persistence; a lack of government aid to support the economy; continued high unemployment; and delays in getting a vaccine. Upside risks are the exact opposite of all those factors, Ake said. They could swing demand up or down by 20,000 units annually in each forecast.

The upcoming U.S. election isn’t factored in, as Ake said the “outcome and response is unknown.”

He doesn’t anticipate a short-term impact but will evaluate the longer-term impact once the result is known.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.