Commercial vehicle populations, aftermarket demand expected to grow

Conventional thinking suggests that when the Class 8 truck market is suffering, the aftermarket is thriving. As fleets extend lifecycles – and they are – it stands to reason there’ll be greater demand for replacement parts.

But this unprecedented downturn is different. It’s been so bad, that many fleets have trucks parked against the fence and are cannibalizing them for parts, taking much of the breeze out of the aftermarket’s usual tailwind in down-cycles.

Dave Kalvelage, senior market analyst at MacKay & Company, gave an aftermarket update at Heavy Duty Aftermarket Dialogue. He presented data that confirmed 69% of surveyed fleets indicated they are holding off purchasing new equipment in the current market, while 54% are bringing more repairs in-house, 37% are seeking less expensive parts and 32% are delaying repairs (mostly cosmetic).

Fleets listed operating costs as their top concern heading into 2026 with 45% of them saying price controls or reductions are the greatest way their dealers and distributors can help them navigate the current market.

Vehicle population will continue to grow

Class 8 U.S. retail sales fell 13% in 2025 and are expected to increase by 8% this year, Kalvelage said, citing data from FTR and Ward’s. Trailer sales in the United States also fell 13% and are expected to decline by another 8% this year, he added.

Classes 6-7 truck sales in the United States fell by 11% and are expected to recover by 4% this year.

In Canada, both Class 8 and trailer sales dropped by 11% in 2025 and are only expected to increase by 1% this year. Classes 6/7 vehicle sales actually jumped 14% in Canada and will fall 5% this year.

The U.S. rolling population of Classes 6-7 vehicles grew 0.2% in 2025, Class 8 trucks by 0.7%, while the trailer population declined by 0.3%. MacKay & Company’s five-year forecast suggests the operating population will grow by 0.9% (Classes 6-7), 6.1% (Class 8) and 2.9% (trailers).

Canada’s medium-duty vehicle rolling population grew by 1.2% in 2025, its Class 8 fleet contracted by 0.7% and the trailer population fell by 0.5%. Looking five years out, Kalvelage said he expects Canada’s Classes 6/7 vehicle population to grow 6.8%, Class 8 by 2% and trailers by 2.4%.

Independent aftermarket suppliers the winners

Looking at the aftermarket itself, the U.S. saw 5% growth with Canada trailing slightly at 4%, according to MacKay & Company’s Aftermarket Index. In both the United States and Canada, independent aftermarket suppliers outpaced OEs when it came to growth.

Kalvelage said asset utilization is a key metric in forecasting aftermarket demand. Classes 6-8 utilization closed 2025 at 84%, just off the four-quarter average of 84.7%. Trailer utilization closed the year at 83.2%, down from the four-quarter average of 85.3%.

Interestingly, surveyed fleets were far more pessimistic about their expectations for asset utilization in 2026 than MacKay & Company itself.

The value of the aftermarket

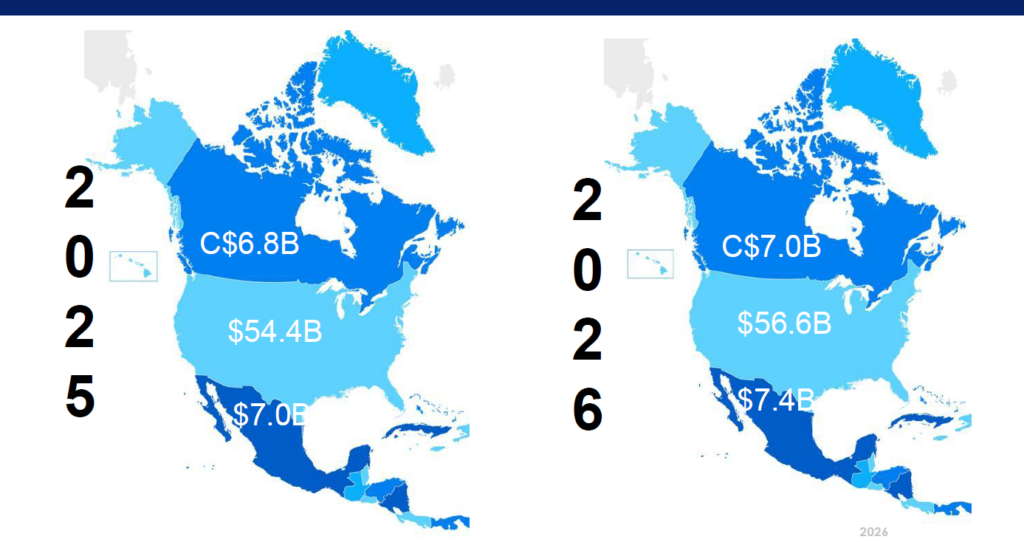

Putting dollar figures behind its aftermarket forecast, MacKay & Company believes it was a $52-billion industry in the United States in 2025, up 3.9% from the prior year (factoring in Classes 6-8 vehicles, trailers and container chassis).

Canada’s came in at $6.34 billion (Canadian figures are reported in CDN currency), reflecting 1.8% growth from 2024. However, Kalvelage noted most of the gains stemmed from price increases, not necessarily improving demand. However, he added distributors are signaling price increases should return to more historical levels of around 2.5% this year.

The value of the U.S. aftermarket is expected to grow to $56.6 billion this year, while Canada’s will grow to $7 billion.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.