Court documents tell the story of Pride Group’s troubles

Court documents related to Pride Group Holdings’ filing for creditor protection paint a picture of a once-thriving transport and real estate conglomerate, caught out by rapidly deteriorating trucking industry conditions.

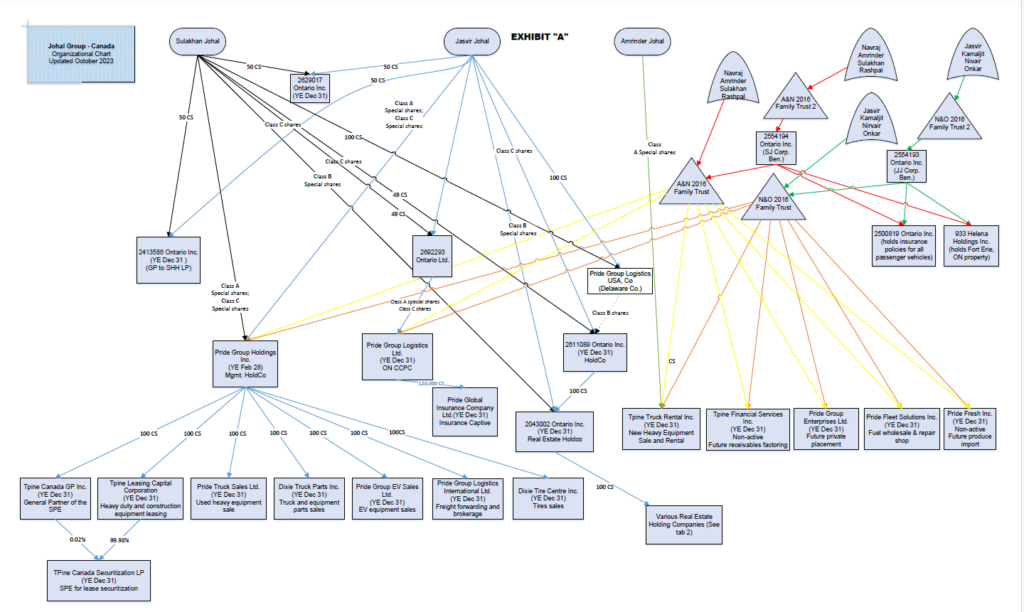

Included in the filing for creditor protection are 16 transport companies, 45 real estate holding companies, and 10 other holding companies founded and controlled by Sulakhan “Sam” Johal.

Collectively, the companies owe creditors about $1.6 billion Canadian and US$637 million. Last week, Mitsubishi HC Capital America filed suit against Johal, and brother Jasvir Johal, accusing them of defaulting on credit lines taken out to build inventories for Pride Truck Sales and Tpine Leasing. The lender is seeking damages of about US$100 million, claiming the Johals personally guaranteed the loans and then defaulted on payments.

Thursday night, Pride issued a press release indicating it had been granted CCAA creditor protection in order to buy time to get its affairs in order and restructure the business. The documents related to that CCAA filing detail what went wrong.

Creditors come calling

Sulakhan Johal’s affidavit indicates the Pride Group operates from more than 50 leased and owned facilities in the U.S. and Canada, controlling more than 20,000 trucks, including those on the companies’ dealer lots.

More than 20 lenders have claims to about $1.6 billion in debt from the Mississauga-based company. These include major financial institutions such as Mitsubishi Capital, as well as truck OEMs including Daimler Truck Financial Canada ($193 million), Daimler U.S. (US$69.7 million), Paccar Financial ($46.9 million), and Volvo Financial Services Canada ($9.8 million).

Pride Group’s business focused on offering a “one-stop solution” including truck sales and leasing, repairs and maintenance for entrepreneurial owner-operators, primarily from the South Asian community.

In his affidavit, Johal indicated this owner-operator truck driver demographic is in peril.

“The North American trucking and logistics industry is facing a prolonged downturn, the effects of which are exacerbated by the trucking and logistics boon that preceded the downturn, which can be traced to the Covid-19 pandemic and major geopolitical events,” court filings say.

“Spot freight prices, diesel prices and interest rate trends were all initially favorable for the trucking industry following the onset of the Covid-19 pandemic. They have all deteriorated significantly since that time. The bottom-line result is made significantly worse by virtue of the increased trucking and logistics supply that was brought to market during the upturn, which is currently sitting as unused excess capacity in the market.

“The effects of all of the foregoing have been disproportionately borne by smaller trucking and logistics companies and owner-operators in particular. Of the latter group, those persons that entered the market during the initial demand ramp-up following the Covid-19 pandemic’s onset have been affected most of all as they bought or leased trucks when valuations were at or close to peak prices and financed their acquisitions operations when interest rates were low, both of which have since reversed dramatically.”

Delinquencies and non-payments followed, Johal explained, impacting Pride’s financial position. Before long, Pride itself was unable to pay its own debts.

Affidavit tells story of fast-changing fortunes

In his affidavit, Sam Johal blamed rising interest rates and diesel costs, sharply dropping spot freight rates, increasing customer delinquencies and defaults on leases and contracts on the sudden turn in fortune for the company.

Pride Group itself has received more than 40 default notices since December 2023. Lenders have indicated they will no longer fund new lease assets.

Court documents say some 30,000 truck drivers interface with Pride Group annually, as employees, customers, lessors or contractors. It has roughly 1,000 employees and independent contractors in the U.S., Canada and India, most of them in Canada.

“Until very recently the Pride Group was highly profitable,” Johal said in his affidavit. “The onset of the Covid-19 pandemic in 2020 disrupted the Pride Group’s historical trajectory, initially causing unprecedented growth but then ultimately leading to the Pride Group’s inability to meet its financial obligations. This situation is not unique to the Pride Group and has affected the trucking and logistics industry as a whole.”

Pride Group found its fate directly tied to that of the struggling owner-operator community. “Any delinquency by a single owner-operator has ripple effects across multiple business lines,” said Johal.

Pride made attempts to shore up its financing and wait out the downturn, said Johal in his affidavit. It reduced its workforce and wound down less profitable business lines. It was also forced to suspend payments to lenders in order to remain actively in business.

“The downturn has continued and the Pride Group can no longer sustain the status quo,” said Johal.

Meanwhile, the company determined some trucks were financed by multiple lenders, making competing claims against the same collateral, “unbeknownst to both the Pride Group and the affected lenders.”

Currently, Pride Group has some 18,500 trucks leased to customers in Canada and the U.S., with more than 4,500 trucks inventoried. The company has shut down its EV and green energy division, founded in 2021, “selling and returning equipment when possible.”

Pride’s main OEM supplier was Daimler, but it also sourced trucks from Volvo, Navistar and Paccar (Kenworth and Peterbilt).

Pride Group has some 405 independent contractors, mostly based in Ontario. “While these individuals are hired as independent contractors, they rely solely on the Pride Group for their income,” Johal said. “The continuation of the independent contractors’ relationship with the Pride Group is critical to its ongoing operations.”

Johal asked the court to allow it to continue paying its independent contractors and employees. Johal, and his brother Jasvir, have personally guaranteed more than $200 million in loans. They say they also injected about $18.5 million into the business from funds borrowed from Bank of Nova Scotia personal credit lines.

The Bank of Nova Scotia has declared a default and has threatened to initiate proceedings against Sam Johal, who secured a mortgage against a home he’s building.

Can Pride survive?

Can the company survive after a restructuring under CCAA protection? Johal hopes so. “A liquidation will mean significant losses of jobs,” the company contends. “A liquidation would also mean thousands of trucks being sold on the market at once, which would decimate the value of trucks across the North American market. This would have far-reaching effects.”

The company also said if Pride were to enter bankruptcy, “The fallout from an unorganized demise of the Pride Group on the Canadian and U.S. owner-operator trucking communities in particular will be catastrophic, as will the spiral effects on all of the businesses that they support in their local communities. The livelihoods of many thousands of families are at stake.”

TruckNews.com has requested an interview with Pride Group leaders. Mitsubishi Capital refused comment on its lawsuit against the company.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

-

Very true and lots of other companies who are doing the monkey business should be closed so that the trucking can become like eighty’s & ninety’s. Right now there’s not much respect and money left in the trucking because of these people.

-

Pride’s woes don’t stem from awful business practices. The trucking industry is unhealthy.

We saw a glimpse of things to come or what can happen when the trucking industry unravels during the pandemic. The ”awful business practices that we don’t need in the industry” come from the very custodians of our industry who allocate freight at unsustainable rates and parasites who resell these loads even cheaper.Too many pimps not enough–well you know where this is going….

Trucks move freight.

Period.-

Simple fella, say no to cheap freight!!!!!

-

-

Pride was a caring well run company

We have too many trucks and drivers in Canada. A much better solution would be for the gov of ont to step in along with the agriculture industry and the M T O and ont hydro for the ont gov provide $250 .million as a safety net to work with the receiver to aquire the equipment and put up 200 million to provide a captive for insurance for small fleets of under 100 units in transit of people and goods and construction in ont Canada. The gov needs to set min wage and freight rates for those companies that use this insurance model and set up 12 tow and 20 first response service and rescue service units. The current model of poorly paid and poorly trained foreign lease ops is very bad and unsafe in my opinion

Pride closing will cause peak season shortage of equipment and more food wasted unless major changes are made in ont

We have no housing or work from mid Dec to April 1st for the numbers of truck drivers in ont in my opinion.-

This isn’t an Ontario problem– it is a North American problem.

Deregulation in the 90s opened the flood gates and the buyers of transportation allowed this to become a perpetual buying for the cheapest cost, mostly well under sustainable levels. Driver Inc. isn’t the cause of all this, it’s a knee-jerk reaction to the reality that isn’t trucking-friendly. People flock to buy sustainable coffee, maybe it’s time we buy goods hauled equitably, giving drivers and trucking companies fair prices. -

” A well run company”?

Is this the consequence of any “well run company “? I think not. Like almost all businesses, Pride is/was in existence to make a profit for the owners, which is the goal of most entrepreneurs. Greed and naivety produced the current result. The Capitalist System has a way of leveling the playing field.

By the way, the ten most feared words in Western Society? ” I am from the Government and I’m here to help”.

-

I’m not sure how it’s the responsibility of the institutions that loaned them money in good faith to save everyone associated with the Pride group. It was a risky business model from the start,fueled by low interest rates and a shortage of trucks. The same thing will happen in the real estate industry sooner or later and lending institutions or the tax payer ( I can see some politicians using this for political points) shouldn’t be bailing out this operation

A very foreseeable consequence of questionable business practices and high leverage. Shame on the greedy lenders enabling this malfeasance (OEMs and finance companies) who will now pass their losses onto their customers who use good judgment and prudent decisions in the operation of their businesses. You didn’t have to be Nostradamus to see this coming.

-

Also: NEWS FLASH!

The Business Cycle isn’t something that has two wheels and you just jump on it and go for a ride. ( Maybe not such a bad analogy after all?) What goes up comes down.

Remember the most feared words on Wall Street: ” It’s different this time!”

We have far to many trucks in the industry now & we need this thining of the herd & maybe we will get rid of some of the ridiculous rate cutting we are seeing from carriers that circumvent the rules & just plain don’t know their cost to operate successfully

-

Kevin in 2020-2021 we didn’t have enough trucks…

The problem is too many pimps and not enough prostitutes…

Driver and equipment haul leads, not office workers adding value, not block chain encryption and cloud-based systems…

Doesn’t this just make you laugh !!

I am an owner operator and lease my 2023 Volvo 860 off of TPine leasing for the last year

This all makes sense now I was emailing and calling there office in Mississauga last week and was not able to reach anyone and all messages I left went unanswered

I’m just one man one truck but I’m wondering what will happen now

I can’t imagine

Terrible news for a lot of people and businesses

-

You will continue on. IF Pride survives, you will continue to go down the road in your truck. If Pride folds, your lease will be bought by the highest bidder, and you will continue down the road, now making payments to the new leaseholder.

All the doom and gloom of potential job losses is overblown.

Unfortunately this will hurt people personally. Fortunately it’ll take lots of Driver Inc out of the system.

-

Many small trucking companies and lease ops will leave Ontario

Until we have better truck drivers protection with overtime pay truck drivering is going to remain a very bad job.

They will just take what they can and flee the country, same old story with different players.

“Pride Group’s business focused on offering a “one-stop solution” including truck sales and leasing, repairs and maintenance for entrepreneurial owner-operators, primarily from the South Asian community.”

So James, Is this the end result of the Driver Inc. greed based business model?

Sure looks like it.

There will be more companies going bankrupt. It’s mostly to do with the rate Cutting. Carbon tax on fuel There will be shortage of trucks on the road. The supply chain will slow down. This is all to do with the liberal government. They brought this country down to his knees by one idiot called Justin Trudeau.

-

It doesn’t matter if the Kool-Aid is red, blue or orange. It all tastes bitter. It’s all poison.

Stop drinking it man. -

Unsustainable rates & practices from shippers, and 3rd parties/brokers making 10-30% margins while assets-based guys are getting scraps.

I do not feel sorry for them. They operated under the Driver Inc model. They were evading millions in taxes which affects every Canadian.

When the freedom convoy wanted changes to truck driver treatment and pay and too look at the effects of the carbon tax and treatment of disabled I did not see the support of the major trucking companies. We need to limit the number of people that come in to the peak season

Over 7000 trucks as small companies and lease ops shutdown last year I understand that over 3000 more can not get insurance in ont to move agriculture goods and supplies in onr. Can someone else give me better advice and numbers on this

That’s what happens when you try to get too big too fast! How can some of these guys have multiple creditors for a truck? When I owned mine it was 1 bank

It all started in 1980-s with the Deregulation. From 1930 to around 1981 Trucking was How it is really supposed to be, just Great. After the 1981 De-Regulation…there was no fix in sight. We need a Regulated Trucking Industry, just like it was for the first major 50 years.

-

Mr. Cipi: As someone who was an owner-operater starting in 1977, the “Regulated” Era was only great for the few at the top of the pyramid. Deregulation is not without its flaws but it has benefitted many hard workers, entrepreneurs, and society as a whole much more than the regulated “Old Boy’s Club” ever did, when the “fix was in” for those who were connected or paid to get those connections. I paid plenty for my first very limited MC Authority and was glad to get out from under that feudal system.

How could all these finance companies be so stupid to nor see through this obvious scam.

If you’re borrowing money to be an owner operator working from week to week to pay your truck off in your bills you shouldn’t be in business to begin with the TRUCK ing industry was flooded with all these Owner operators and it made it competitive and the prices went went low so everybody’s a bottom feeder now it’s inevitable that a weak link is going to ruin everything for everybody like the old saying it’s all fun and games until somebody gets poked in the eye with a stick

20, 000 Pride off the road

22,000 Yellow off the road

Convoy brokerage $3 billon bankruptcy

Meadow Lark off the road

Over 100,000 US Dot # Gone no longer valid in the last 1 1/2 year .

Rates still low …….

Pot of gold end of the rainbow

Let them sink, they had no problem piling on the number of trucks when things were good, thinking it would stay that way!!

Those of us who have done this for a while know what a joke that is!!

The transportation industry always has a downturn after a really good run, shame on you for betting against it!

They deserve what happens. Hauling for less than cost of trucking is what is their demise.

Say goodbye to a company that was destroying the industry. Let the responsible carriers do their job. The CCAA & protection is not the answer because they will just repeat the same business

process.

So the house of cards came crashing down. Greed runs toxic in some peoples veins. Look at how many tentacles this octopus has and each one kept piling on more debt.

To anyone that says government needs to get involved, I have to ask if you are out of your mind? Taxpayers backing additional mismanagement is not feasible. Let it go and the rest will carry on.

Meanwhile, he can see if he can rob a piggy bank somewhere to get his new mansion finished.

Pride comes before the downfall. There is a lot of blame to go around, from the credit companies to the owners themselves. If you want to play the roll of a big shot, expect to get knocked down.

I grew up in the trucking business and it would seem to me that during Covid 19 they were selling trucks to So. Asian buyers at prices 1 1/3 times the new value or in dollars approximately as high as $150 to $160,000. The price of the units were approximately $118,000 new. Remember these units were 3+ years old! In my opinion they should have seen the writing on the wall!

In my opinion they were totally mismanaged!

**Justice is served** The demise of Pride is a result of the owners incompetency of managing

a trucking business. Their excuses for the bankruptcy protection is faced by all that are

ever other trucking company in North America. There is no denial that the industry is facing

tight times. When your freight rates are below the costs this is what happens. Double and

triple financial on the same chattel is illegal. I sure hope that the principals will ware chrome

bracelets. This is a pure example of ** Greed exceeding expectations** My sympathy goes

out to all the unsecure creditors. Good riddance!! Don McMaster

Just let them fold. Obviously they have awful business practices that we don’t need in the industry.