ECONOMIC TRUCKING TRENDS: Latest spot market rate data point to recovery while trailer orders remain weak

Spot market rates are slowly improving, suggesting a recovery may be underway. That’s the good news.

The bad news for those in the trailer industry is that demand remains weak and fleets seem set on deferring new purchases until late 2026 or even 2027.

Trailer orders slumped in November

Trailer orders slumped 19% in November from October levels, FTR reported in its preliminary data, reaching just 13,071 units.

That marked a 45% fall year over year and puts to rest any excitement over a spike in October orders. Trailer orders remain well below historical norms, FTR reported, suggesting fleets are still deferring orders likely into late 2026 or maybe even 2027.

Production was pulled back in November with builds down 23% from October. However, FTR warns that production continues to outpace demand drawing down backlogs.

“The U.S. trailer market is increasingly constrained by trade policy, elevated input costs, and cautious fleet behavior. Policy-related actions are now a central driver of both cost inflation and demand uncertainty. Limited visibility on trade outcomes continues to complicate pricing, sourcing, and capital allocation decisions across the industry,” said Dan Moyer, FTR’s senior analyst, commercial vehicles.

“Section 232 tariffs remain the industry’s most significant and durable cost headwind, and trade risk is also building around van trailers…Overall, tariffs and expanding trade actions are locking in higher costs and sustained uncertainty across the U.S. trailer market. OEMs and suppliers likely will respond by prioritizing localized sourcing, tariff-aware design, and flexible pricing. Dealers must manage inventory carefully and set clear expectations as higher price floors constrain demand. For fleets, rising acquisition costs and policy risk favor selective ordering, longer trade cycles, and a sharper focus on total cost of ownership.”

ACT Research reported 13,000 orders, 37% off last November’s tally.

“Sequentially, a slight dip in net orders is expected, as October is usually the strongest order intake month of the annual cycle, with order boards for the next year beginning to open,” said Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research.

“November’s tally brings the year-to-date net order total to 151.3k units, or 9% more net orders than were accepted through year-to-date November 2024. Not only do net orders continue to underwhelm, cancellations remain elevated. Looking forward, concerns about moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous government policies remain as challenges to stronger trailer demand. While pent-up demand is building, and fleets will eventually need to divert capex to trailing equipment purchases deferred over the past few years, stronger revenues will be needed before the purchase spigot is opened wider.”

Freight volumes rose in November, but pace of contraction slowed

ACT Research reported in its latest For-Hire Trucking Index that its Volume Index rose in November by 7.6 points to 54.6.

“Though housing-related sectors remain soft, consumer spending is growing and supporting freight as inflation slows,” said Carter Vieth, research analyst.

“Low oil prices and the failure of feared tariff price increases to materialize amid legal questions likely all contributed to the month-over-month improvement in volumes. Tariffs will continue to drag on growth, but some reversals have begun, and the future of IEEPA tariffs looks tenuous. If reversed, it would aid affordability, reduce inflation, and help lower interest rates, which is needed to spur the housing market. The outlook in the near term is choppy for volumes broadly, just as pre-tariff shipping activity earlier this year was temporary, so too will be the paybacks.”

Capacity edged upward by 2.1 points from October levels, with the pace of contraction slowing, ACT reported.

“Capacity continues to contract as current levels of profitability remain a constraint on investment,” said Vieth. “The pullback of private fleets, as well as the necessary evil of small fleet failures, will also continue to tighten capacity. Mid-November’s clarity regarding EPA27 may be helping to reduce the capacity contraction, but pre-buying will likely be modest amid limited investment budgets.”

U.S. spot market truckload volumes fell to year’s lowest levels

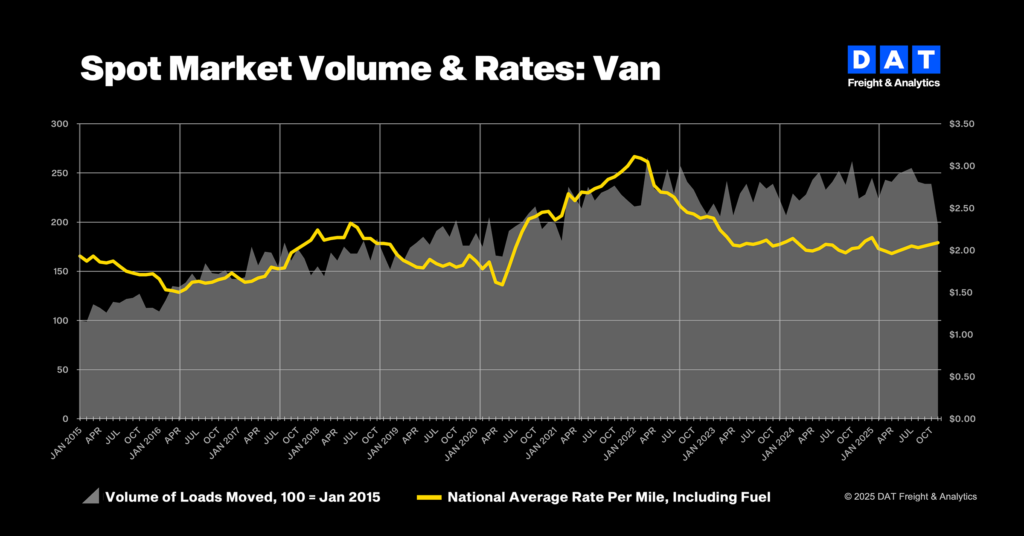

DAT Freight & Analytics noted November truckload volumes fell to their lowest levels of the year in November, with double-digit declines among van, refrigerated and flatbed segments.

DAT reported its Truckload Volume Index fell 18% for vans, 11% for reefers and 22% for flatbed freight from October levels.

“With Thanksgiving and Black Friday falling nearly as late as possible on the calendar, there was less urgency to move freight until the final week of the month,” said Ken Adamo, DAT chief of analytics. “With the short holiday week, winter weather, and other disruptions, it was a busy end to an otherwise soft November, but not enough to offset the earlier weakness.”

Spot van rates climbed 2 cents/mile to $2.09, reefer rates rose 6 cents/mile to $2.54 and flatbed rates fell 4 cents/mile to $2.47. Contract rates were up across the board compared to October; 4 cents for van, 3 cents for reefer and a penny for flatbed.

“The market remains fundamentally inverted,” Adamo said. “Oversupply persists, shippers are cautious amid economic uncertainty, and many carriers are still operating unprofitably. December should bring some seasonal lift, but we will need to see sustained strength after the holidays to gain confidence that the market is poised to flip.”

Signs of a recovery sprouting in latest weekly data

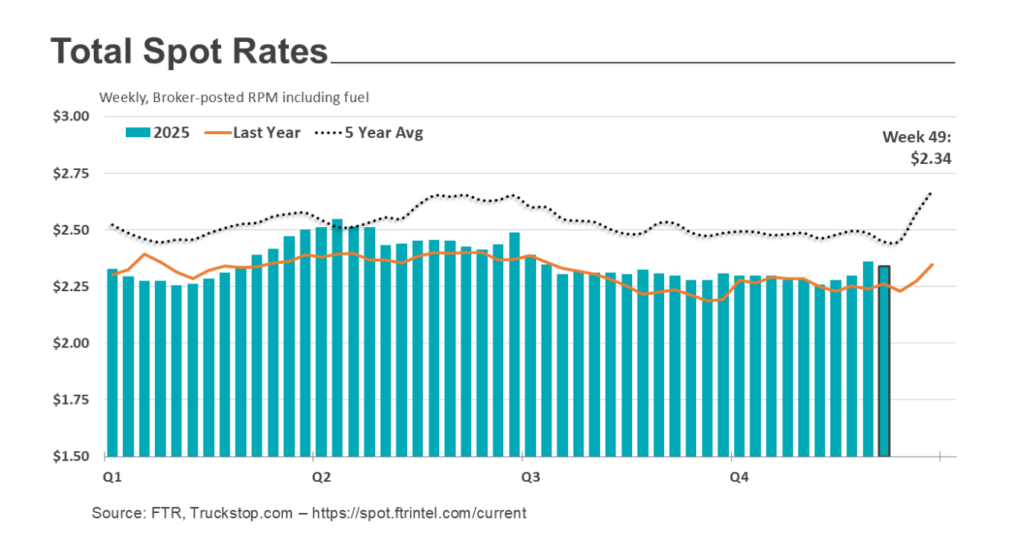

The latest week’s data from truckstop.com and FTR continue to show signs of a spot market rate recovery.

Rates for dry van equipment were “more resilient than usual” for the week ended Dec. 12, truckstop.com reported.

“Refrigerated spot rates fell sharply week over week, which is typical for this time of year. The decline offset most of the previous week’s steep increase. However, the decrease of less than 1 cent for dry van equipment spot rates was much smaller than the long-term average drop of about 10 cents during similar weeks. Flatbed spot rate performance is much less consistent over time during similar weeks,” the company said.

The year-over-year comparison for each segment showed an increase of just over 4%.

The decrease in load postings, along with a slight rise in truck postings, led to a Market Demand Index of 100.5 — down from the previous week but still the strongest since International Roadcheck week in May.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.