ECONOMIC TRUCKING TRENDS: Plenty of good news in this week’s trucking data

If you’re a Class 8 truck maker or dealer, a carrier, or a spot market freight hauler, industry conditions are improving, both in the United States and Canada.

That’s according to the latest data to hit our inboxes over the past week. Let’s get right into it…

Outlook improving for Class 8 truck demand

ACT Research says the outlook for Class 8 truck demand is improving, driven by three main factors.

“First, the economy continues to exceed expectations, growing 4.4% quarter over quarter in Q3 2025. The Atlanta Fed’s GDPNow expects 4.2% growth in Q4,” said Ken Vieth, ACT’s president and senior analyst. “AI- and wealth-driven economic growth helped to absorb overcapacity into the end of 2025, and the economy appears to have good momentum into early 2026. Looking forward, the high likelihood the Supreme Court strikes down IEEPA tariffs as unconstitutional may lead to an inventory restock, further bolstering for-hire volumes.”

He added, “Second, following nearly three years of stagnant freight rates, successive winter storms across the Midwest in December and January caused aggregate DAT spot rates to surge 17% year over year in January. DAT’s load-to-truck ratio rose from 5 in November to just above 9 at the end of last month. The run-up in rates has likely given deep-pocketed large fleets confidence that the improving supply-demand balance will allow some of the early 2026 freight rate spike to stick beyond recent bad weather impacts.”

“Lastly,” Vieth concluded, “part of the recent order uptick has been attributable to clarity around the EPA’s Clean Truck low NOx rule after months of crickets following the EPA’s ‘review’ announcement last March. With fleets aging, and new engine technologies expected at the start of 2027, better economic growth and improving rates support some prebuying ahead of the coming mandate.”

In its “North American Commercial Vehicle Outlook” report, ACT also said the vocational market should enjoy tailwinds as a result of data center construction in the United States.

Don’t look now, but trucking conditions sharply improved

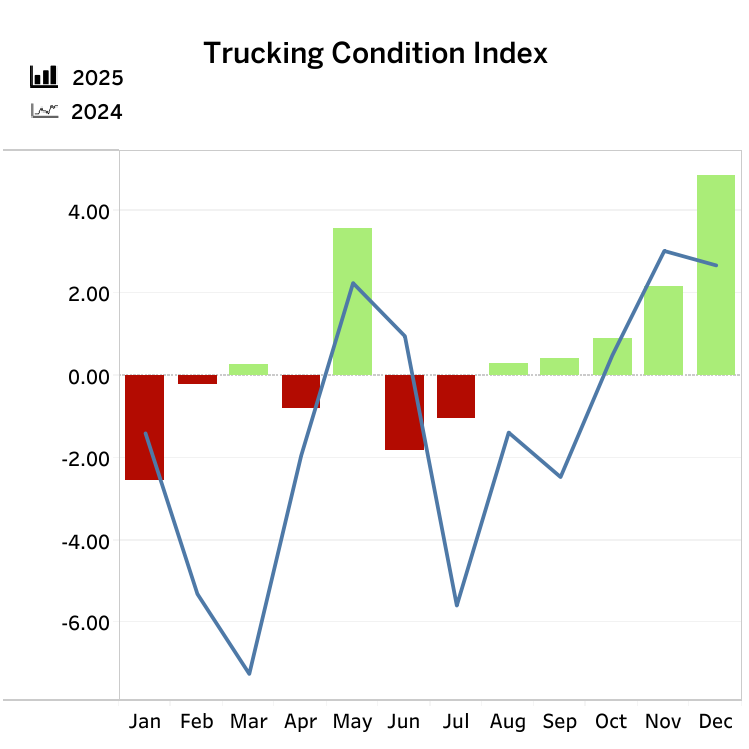

FTR’s Trucking Conditions Index (TCI) rose to 4.85 in December, from 2.14 the prior month. More notably, however, it was the strongest reading since February 2022.

Strengthening freight rates and capacity utilization drove the improvement and FTR now projects conditions to remain favorable through its forecast horizon.

“The TCI already indicated consistently favorable conditions for trucking companies over the next couple of years, but the latest outlook is even stronger,” said Avery Vise, FTR’s vice president of trucking.

“FTR’s forecasts for the economy and for industrial activity improved significantly in the latest adjustment. We caution that the economic data fueling our improved forecasts is quite recent and subject to revision. However, other independent signals also point to a stronger truck freight market, including extraordinary spot rate increases in the wake of recent severe winter weather and the Institute for Supply Management’s healthy manufacturing index reading for January. FTR is not forecasting anything like the 2021 market, but something close to it no longer seems inconceivable.”

Canadian spot market swings in carriers’ favor

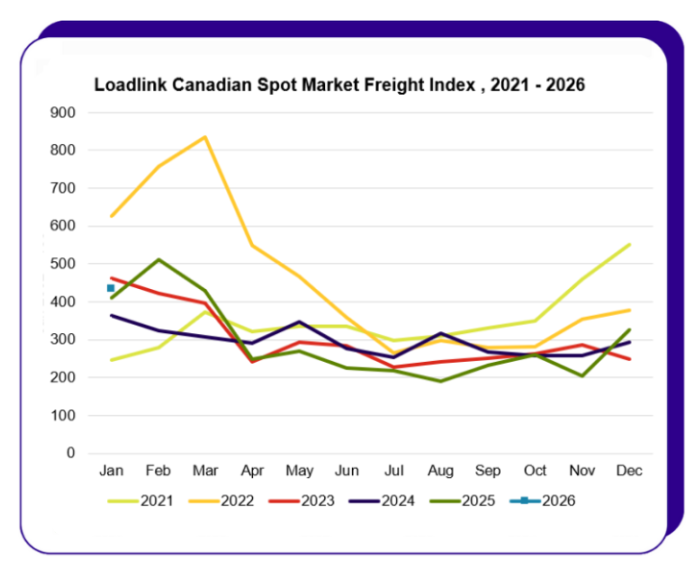

January load volumes on the spot market surged 33% from December and were up 6% year over year, according to the latest data from Loadlink Technologies. That’s on the heels of a 60% surge in December volumes from the prior month.

Capacity tightened, with the truck-to-load ratio dropping from 2.07 in December to just 1.37 trucks per load in January. Year over year, the truck-to-load ratio tightened by 16% in January.

“The tightening conditions signal improving leverage for carriers heading into Q1, as demand continues to outpace available equipment,” Loadlink said in its monthly update.

Northbound cross-border loads into Canada led the way.

“January’s momentum didn’t reset after the holidays; it built on December’s,” said James Reyes, general manager at Loadlink. “Inbound freight into Canada sets the pace, and when capacity tightens, the market moves faster, and teams have to move with more intent. Carriers gain more control over what fits their network, and brokers who commit earlier on priority lanes stay ahead of the curve.”

U.S. spot market rates remain elevated

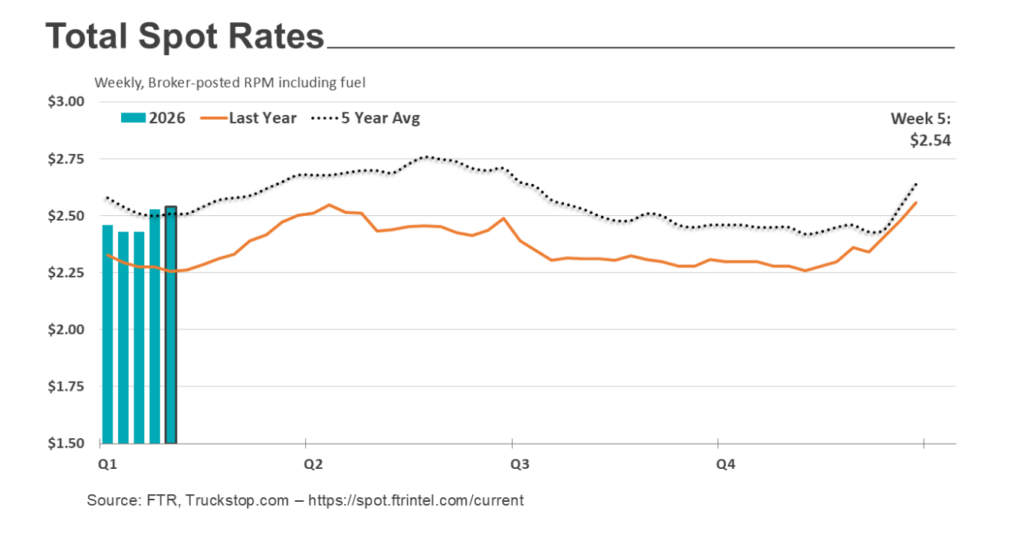

Truckstop.com and FTR reported the U.S. spot market remained stressed and rates stayed elevated in the week ended Feb. 6. Dry van and flatdeck rates led the upswing, while reefer rates fell slightly after a record 45-cent/mile week-over-week-surge driven by weather.

Truckstop.com noted the West Coast saw the strongest van and reefer rate gains, despite volumes remaining steady. This could be due to increased activity in the east pulling equipment away, or an increase in English-language proficiency enforcement in California.

“After months of wrangling with the Trump administration, California began enforcing inadequate English-language skills as an out-of-service violation in January,” truckstop.com said in an update. “According to FTR’s analysis of inspection data, OOS violations in California are already running at the second-highest rate in the nation after Texas. While the OOS violations themselves would not be material, the shift in California’s enforcement posture could significantly reduce spot market capacity.”

Truckstop.com warns warming weather could lead to softer rates, particularly since refrigerated rates almost always fall during this week of the year.

“Although load postings rose only slightly, the small decline in truck postings resulted in a Market Demand Index of 148.4, which is the highest level since late March 2022,” Truckstop.com said.

Carriers and brokers express increased optimism

A new survey from truckstop.com and Bloomberg Intelligence reflects improving optimism among carriers and brokers. More than 600 respondents surveyed in late 2025 reported year-over-year declines in rates, volumes and revenues, but were generally positive looking ahead to the next three to six months.

“Sentiment among small carriers appears to be turning more positive heading into 2026, even though challenges persist from tepid demand, inflationary pressures and slack capacity,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “Spot rates appear poised to move higher as the federal government’s crackdown on noncompliant truck drivers, carriers and commercial driving schools pushes more capacity out of the market.”

Carriers reported choppy volumes and rates in Q4 2025, with 45% reporting lower year over year volumes and only 14% seeing rate increases in the quarter. Peak season appeared to be a letdown, with 42% of carriers and 39% of brokers reporting weaker holiday demand compared to 2024.

“Unlike previous downcycles, which lasted 12 to 18 months, this trucking recession has now exceeded its third year,” said Todd Waldron, vice president of carrier experience at Truckstop.com. “Transportation companies remain hesitant to allocate resources to a recovery until market signs clearly indicate one is happening. Yet, despite low volumes and rates in 2025, optimism remains for a turnaround in the first half of 2026.”

Despite Q4 pressures, 52% of carriers and 53% of brokers said they expect demand to rise over the next three to six months while 42% of carriers and 44% of brokers anticipate spot rates to increase.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.