ECONOMIC TRUCKING TRENDS: Spot market improves in both Canada, US

The spot market became more favorable for carriers in both Canada and south of the border, according to the latest data to cross our desks.

The U.S. increase is typical for the week ahead of the Thanksgiving holiday, but Canada’s improvements were broad-based with both cross-border and domestic loads getting a boost.

However, ACT Research indicates fleets continue to see little reason to invest in new trucks, especially with tariffs pushing sticker prices upward.

New truck affordability adds to headwinds

There’s little hope of a quick turnaround in the Class 8 truck market, according to ACT Research’s latest Freight Forecast: Rate and Volume Outlook report.

Fleets continue to struggle financially and now are looking at higher sticker prices on new Class 8 trucks thanks to tariffs.

“Truckload fleet margins are at historic lows and unable to find traction, so the dollars aren’t there for equipment investment, particularly as tariffs push costs up,” said Tim Denoyer, ACT Research’s vice president and senior analyst. “Our ACT Research commercial vehicle outlook foresees considerable declines in equipment demand in 2026, with rates insufficient to offset cost inflation.”

He added: “Demand remains choppy, but highway tractor capacity is contracting at a quickening pace, with ongoing closures in the for-hire market, the reversal of private fleet expansion, and elevated driver enforcement. The issue for the freight cycle is now the affordability reductions tariffs are imposing on U.S. businesses and consumers. Many of these taxes could be reversed if the Supreme Court upholds rulings that the IEEPA tariffs are unconstitutional, which seems more likely after oral arguments.”

Canada’s spot market continues to improve

October marked the second straight month of improving Canadian spot market conditions, according to Loadlink Technologies.

Overall load postings jumped 12% in October and were up 1% year over year. Momentum was spread across cross-border and domestic markets, led by southbound lanes to the United States, Loadlink reported.

Canada-U.S. loads jumped 17%, while northbound loads to Canada rose 8% from the previous month. Capacity tightened, putting some upward pressure on rates. Domestic loads jumped 10%.

The average truck-to-load ratio for the month was 3.06, down 11% from September and 16% tighter than last October.

“October continued the market’s upward momentum, driven by stronger cross-border freight to the United States and increased activity on key regional routes within Canada,” said James Reyes, general manager, Loadlink Technologies.

“These developments create clear opportunities for carriers to keep trucks moving and for brokers to secure capacity early as the final quarter progresses. Concentrated lanes are creating clearer paths for profitability, especially on core cross-border routes. The carriers and brokers who lean into those routes now will stay ahead through year-end.”

U.S. spot market rates get Thanksgiving boost

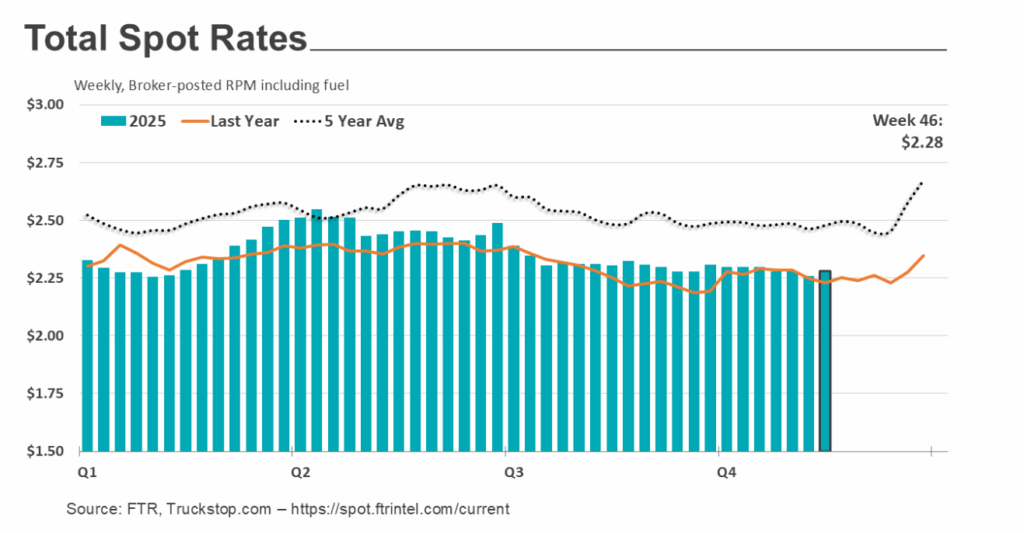

And south of the border, the spot market saw rate increases across all equipment types for the week ended Nov. 21, just ahead of the Thanksgiving holiday. That, according to truckstop.com and FTR Transportation Intelligence.

Dry van rates hit their highest peak since January and reefer rates reached their highest level since before Labor Day. Flatbed rates even got a bump, their first increase in four weeks.

Load postings rose significantly more than truck postings, causing the Market Demand Index to rebound to 80.0, essentially the same level as two weeks earlier.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

This glimmer of hope is likely because of DOT in the USA putting drivers OOS due to not being able to speak or understand signs in English. Canada has benefited from the USA DOT efforts. We desperately need Canada to do the same ASAP. If done, it’ll increase rates for Canadian truck companies too. Let’s GO CANADA !!!