ECONOMIC TRUCKING TRENDS: Winter storms cause spot rate surge and truck buyers stepped up in January

Truckers hauling spot market freight through recent winter storms were rewarded with unprecedented rate increases, according to the latest data from truckstop.com.

And the news was also good for truck OEMs and dealers this week, as January order activity was up sharply from year-ago levels.

However, CMVC is expecting truck sales to remain “subpar” this year due to carrier margins that are still under pressure combined with the effects of Trump’s trade policies.

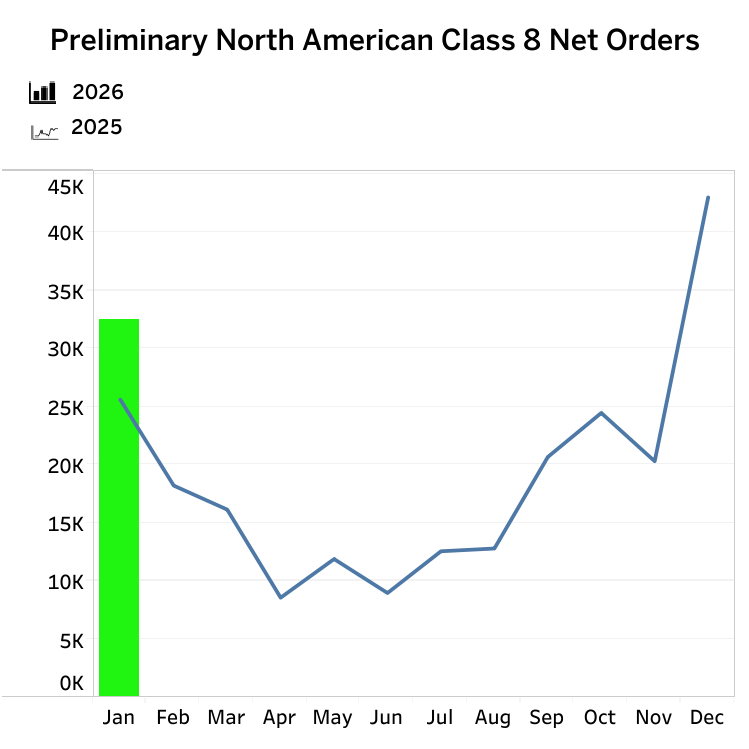

Class 8 orders showed continued strength in January

Class 8 truck orders remained stronger in January, according to preliminary data, with FTR reporting 32,500 orders. That’s a 27% year over year gain, but down 24% from December activity.

It’s just the second straight month of year-over-year growth since April and May of 2024, FTR reported. Orders even surpassed the January average of 26,300 units, driven mostly by the on-highway segment.

FTR is hesitant to define January’s gain as cyclical, noting cumulative orders through 2026 order season (September through January) are still down 13% year over year.

“Some stabilization and improvement in the freight market since late 2025 also may have provided modest support at the margin, but fleet profitability and capital discipline remain binding constraints. Purchasing behavior continues to be replacement-driven with only modest early EPA 2027 influence,” said Dan Moyer, FTR’s senior analyst, commercial vehicles.

“Lingering downside risks include fragile freight fundamentals, elevated cost pressures, geopolitical uncertainty, and broader macroeconomic risk. These risks temper at least some of the enthusiasm around the recent improvement in orders. A durable recovery would require notable and sustained y/y order growth as 2026 progresses and meaningful improvement in freight demand, freight pricing, and overall economic conditions.”

ACT Research reported 30,800 orders, a 20% year-over-year increase.

“After a weak October and November, a few things have happened that, in our thinking, have helped spur recent order activity. The U.S. economy continues to outperform expectations, clarity surrounding EPA27 bolstered demand, and arguably most importantly, since the end of November, we’ve seen a sustained run up in spot rates after three successive Midwest snowstorms,” said Carter Vieth, research analyst at ACT Research.

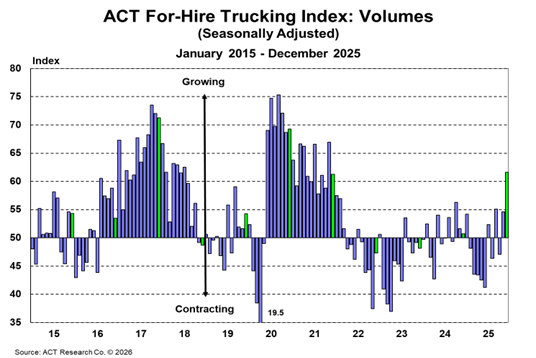

Freight volumes and capacity increased in December

ACT Research has reported a seven-point gain in its Volume Index for December, marking a four-year high thanks to consumer holiday spending and winter storms that tightened capacity.

“While the run-up during November and December is likely to pare some of the gains as weather warms, the sharp surge indicates the elasticity of supply is getting tighter,” Vieth said. “Additionally, inflation and volumes could be aided by the Supreme Court striking down IEEPA tariffs. However, whether the decision is made tomorrow, or mid-year, will have an impact on freight in 2026. Soft freight volumes across modes in December suggest weather was the main factor improving demand, and shippers may hesitate to restock until the [Supreme Court] decision.”

Capacity increased by 1.2 points in December, tiptoeing across the 50-mark for the first time since March, meaning it remains in neutral or flat territory, ACT Research reported.

“Capacity continues to contract as current levels of profitability remain a constraint on investment. Mid-November’s clarity regarding EPA27 may be helping to reduce the capacity contraction, but prebuying will likely be modest amid limited investment budgets. But as spot rates jumped in December, fleets tapped the brakes on the belt tightening,” Vieth said.

In general, volumes are improving and capacity is increasingly balanced, ACT indicated.

“While gains may relax as the weather improves, there are positives entering 2026,” said Vieth. “The economy continues to exceed expectations, and there are temporary aspects to both the increases in supply and demand this month. Capacity continues to exit the market, though a small prebuy ahead of EPA’27 will slow velocity of tightening, and the potential tailwind of IEEPA tariff reversals seems likelier than not.”

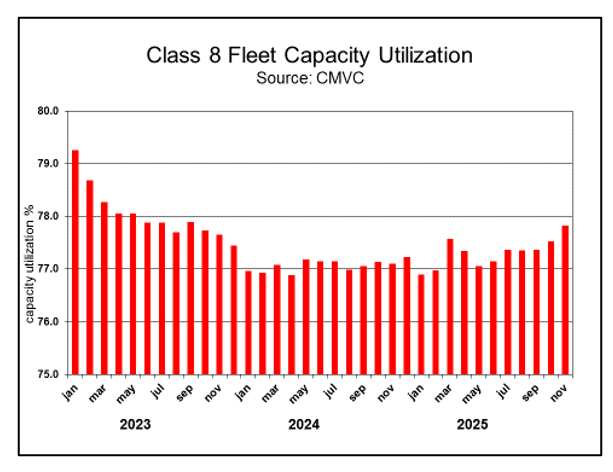

Class 8 truck sales to “remain subpar”

Despite positive signs for the Class 8 truck market in the most recent months, CMVC is forecasting another subpar year for sales.

“Carrier earnings so far in the fourth quarter indicate profitability in the for-hire trucking industry remains weak. For-hire carriers have largely brought capacity in equilibrium with the sluggish freight environment resulting in a neutral pricing environment, in which carriers nor shippers have pricing power,” CMVC said in an update this week.

“A neutral pricing environment coupled with an elevated inflationary environment results in higher operating costs squeezing carriers’ operating margin resulting in weak profitability. In the near term, carriers will remain focused on controlling expenses, streamlining operations and boosting productivity to increase profitability as they await for higher freight volumes to tighten capacity swinging the pricing pendulum towards carriers.”

The analyst indicated freight volumes will grow at “sluggish-to-moderate” rates in 2026, with U.S. trade policy weighing on freight growth.

“The wildcard to the 2026 Class 8 truck sales outlook is EPA27 emission standards, which the EPA is expected to more fully explain in March or April,” CMVC said.

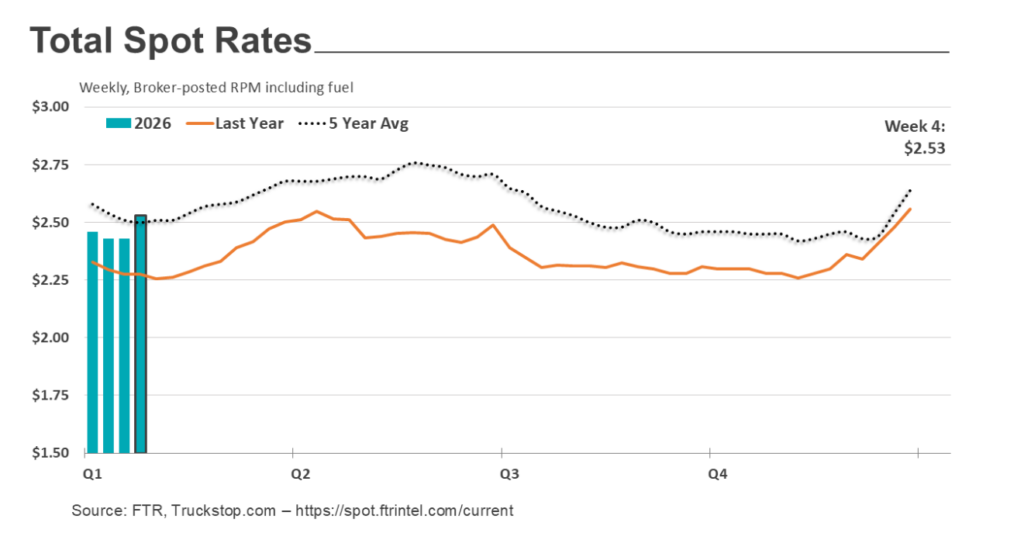

The weather outside is frightful, but the rates are quite delightful

Winter storms suck. Unless you’re hauling spot market freight, that is. Both refrigerated and dry van rates spiked the week ended Jan. 30, according to the latest data from truckstop.com and FTR.

Spot market rates rose the most for a single week since the end of 2023, with reefer rates spiking 45 cents/mile from the previous week. That’s the largest-ever seen week-over-week- increase, according to truckstop.com.

Dry van rates jumped 20 cents/mile, marking their third largest increase on record. The rate increases came during what is traditionally a post-holiday cooling-off period.

Flatbed rates rose fort he tenth time in the past 11 weeks, albeit more modestly than van and reefer rates. Truckstop.com predicts extreme cold will keep upward pressure on reefer rates and shippers shift some dry van freight into insulated trailers.

“A big increase in load postings and a sizable drop in truck postings produced a Market Demand Index of 143.6 – the strongest level since late March 2022,” it concluded.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.