Frustration, confusion over tariffs on display during Heavy Duty Aftermarket Dialogue

It was the topic no one at Heavy Duty Aftermarket Dialogue wanted to talk about, but one that couldn’t be avoided.

And it wasn’t long into the day before it was being referred to as “the T word.”

Tariffs were a theme throughout the gathering of heavy-duty aftermarket suppliers, distributors and consumers. And it’s clear the full impact of U.S. President Donald Trump’s tariffs remains cloudy.

In her popular Talk from the Top roundup of survey responses from MEMA (The Vehicle Suppliers Association) members, senior director of programming and strategy Shannon O’Brien shared anonymous feedback from respondents.

“Overall, they were a real headache for our channel partners, especially early on when things were changing constantly, and there were a lot of unknowns,” she said during Heavy Duty Aftermarket Dialogue. “The frustration was the chaos around them and unclear guidance. Suppliers were handling the changes in completely different ways. Some called it extremely painful, while others said it was moderate and manageable.”

Fleets increasingly frustrated over lack of transparency

But for truck and parts buyers, the effect of tariffs was far from moderate and manageable. Later in the day, they shared frustration over the lack of transparency around tariffs and how they complicated planning in an already challenging market environment.

Fleets were being punished by tariffs in more ways than one. There was the added costs of trucks and parts, and then the effect on carriers’ customers themselves.

James Burg, president and CEO of James Burg Trucking, runs a Michigan-based flatdeck fleet hauling steel and aluminum for auto makers. He lost a large contract from a Canadian steel supplier that chose to no longer sell into the United States after 25% steel tariffs were imposed.

But the greatest frustration among fleets at the event was the uncertainty the tariffs cast on new truck prices.

“What has hurt the most is the uncertainty the tariffs have caused the OEMs to be able to provide accurate pricing to me as a fleet,” said Joeseph Richley, vice president of maintenance with bulk fleet Groendyke Transport. “I can’t get any of the OEMs to give me a clear answer on how this is going to affect me. One OEM says ‘This is the impact’ another says it’s baked into the price. I want to be able to see the detail. Real numbers. Not ‘It could be $3,000 to $4,500.’ That doesn’t help me.”

Dennis Meyer-Razon is manager of transportation for CHS Inc., a large U.S. farmer co-op that runs 6,000 power units and 8,000 trailers. He shared Richley’s frustration.

“I want to know what the tariff impact is per truck,” he said. “You know how much steel there is, where it’s coming from. Your parts. We can’t get anything at all from our suppliers. I know they have people that are doing this because they are charging us. Somehow, they are getting the number. How come they can’t give us that number? Our leadership is asking for it.”

Instead, Meyer-Razon said he’s had to lean on members of his own company’s government relations team to try to understand the full impact of tariffs on equipment prices.

“It took two months to get a day cab price from them and they didn’t know the tariff price,” Richley added of discussions with multiple OEMs. “Why can’t you just give me an answer? I don’t understand that.”

When budgeting, Meyer-Razon said “I just took my best guess based on the limited information I have.”

How parts suppliers are managing tariffs

Asked if suppliers are passing along the full cost of tariffs to customers, Marc-Philippe Beaudoin, vice president and product manager with UAP said, “It depends.”

Parts suppliers weigh what they can absorb themselves without collapsing their margins against what customers may be willing to pay. “So, there is no one-size-fits-all answer for that,” he said. “It’s ever evolving.”

Dave McLeave, Hendrickson’s director of aftermarket, added the full impact of the tariffs is still unclear. “It takes a long time for them to move through the market,” he said.

Volvo has not passed along the full cost of the tariffs, according to Rich Greenhill, vice president, aftermarket and solutions marketing with Volvo Group North America. The company explores all possible mitigation strategies before deciding “what the market can bear and what’s fair to pass through to the market. They definitely are not fully passed through.”

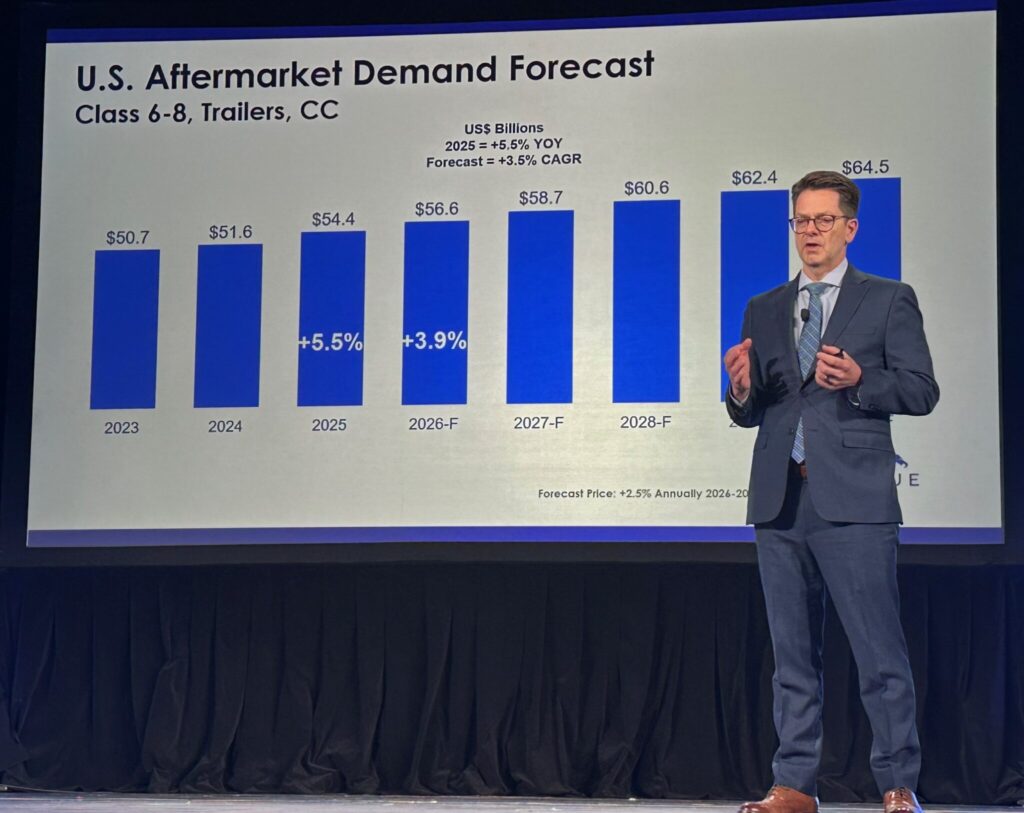

Dave Kalvelage, senior market analyst with MacKay & Company, brought some hard numbers to the discussion. A fleet survey found 21% of respondents indicated tariff-related price increases drove them to source non-genuine aftermarket parts.

Among dealers and distributors, 45% of respondents said tariffs have increased costs with only 25% saying the impact was minimal or non-existent. Just 68% of dealers and distributors are currently passing on the full costs of tariffs to their customers, he added.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.