Quiet on the M&A front, Mullen Group may eye U.S. market

Mullen Group may take a closer look at expanding in the U.S., as a stagnant Canadian economy and pricey valuations have tempered the company’s appetite to make a major deal here.

Murray Mullen, chairman, CEO and president of Mullen Group took plenty of questions about the company’s lack of acquisitions during an earnings call with analysts Feb. 11.

“We wouldn’t have looked at any of them,” he said of the bigger acquisitions that occurred in the Canadian market. “The ones we did look at, valuations have moved.”

Mullen has about $250 million available for acquisitions but has yet to find a substantial one that is priced right and offers the necessary synergies, instead focusing on smaller tuck-ins. That has Mullen considering taking a closer look at expansion in the U.S.

U.S. expansion?

“I think we’re going to be forced to look in the U.S.,” Mullen said. “The opportunities in Canada are slim to none and I don’t see the Canadian economy having a lot of growth potential.”

But a move into the U.S. would have to be aggressive, he added.

“The opportunities appear to be down south,” Mullen said. “If you’re going to do that, you have to have a strategy. You can’t just go play in that big shark tank. If you go in there, you have to be as aggressive as the American carriers are. You can’t dip your toe, you have to go in, fight hard and grow like crazy.”

He did, however, credit Kriska Transportation Group, of which Mullen owns 30%, with making some smart acquisitions already this year. And he had this to say about TFI International’s bold acquisition of UPS Freight: “Alain (Bedard, TFI International CEO) is just a star. If he pulls off this acquisition with UPS Freight and gets margins up, give him CEO of the Decade in Canada. If he pulls that off, he deserves every accolade.”

“When we find the right one we’re going to be very aggressive.”

Murray Mullen on M&A

As for Mullen itself, it looked at potential acquisitions in 2020 but mostly sat on the sidelines, and Mullen acknowledged he underestimated how the capital markets would reward growth.

“I might have out-thought it last year,” he said. “We’ll see how it plays out. Others have got their work cut out for them but I give them credit for being aggressive. We were not. We focused on margin.”

Mullen instead was a buyer of its own stock. But Mullen admitted acquisitions are necessary to fuel top line growth.

“When we find the right one we’re going to be very aggressive,” Mullen vowed, adding the company is especially interested in regional LTL carriers outside major centers.

Earnings

Mullen characterized the company’s 2020 financial performance as a “pretty darn good year,” with revenues sliding but margins improving. In the fourth quarter, revenue fell 5.4% to $297.7 million with net income increasing $1.7 million to $10.1 million.

LTL revenue climbed 1.8%, logistics and warehousing 5.3%, but the specialized and industrial services group saw a 15.2% decline.

For the full year, consolidated revenue slid 8.9% to $1.164 billion, with LTL revenue down 1.7%, logistics and warehousing down 10.6%, and specialized and industrial services off 15.1%. Net income totaled $64 million, a decrease of $8.2 million.

Consumers in the driver seat

Mullen is projecting a sluggish start to the year, with strengthening later on. The consumer continues to drive the economy, he noted, which benefits LTL and warehousing. But inefficiencies in the supply chain are hindering growth and perhaps painting a rosier picture of the economy than is warranted.

“The supply chain remains under stress,” Mullen said. “The evidence is clear. We see it in the shipyards, the rail yards, and our terminals that handle container freight. An increase in consumer demand layered on top of an inefficient supply chain creates the illusion the economy is busier than it really is.”

The reality, he said, is more delays, and bickering between carriers, shippers, receivers, rail providers and other players in the supply chain.

“Everybody is fighting with everybody these days because the supply chain is just not working on a just-in-time business model anymore,” Mullen cautioned. “This bears a lot of close attention.”

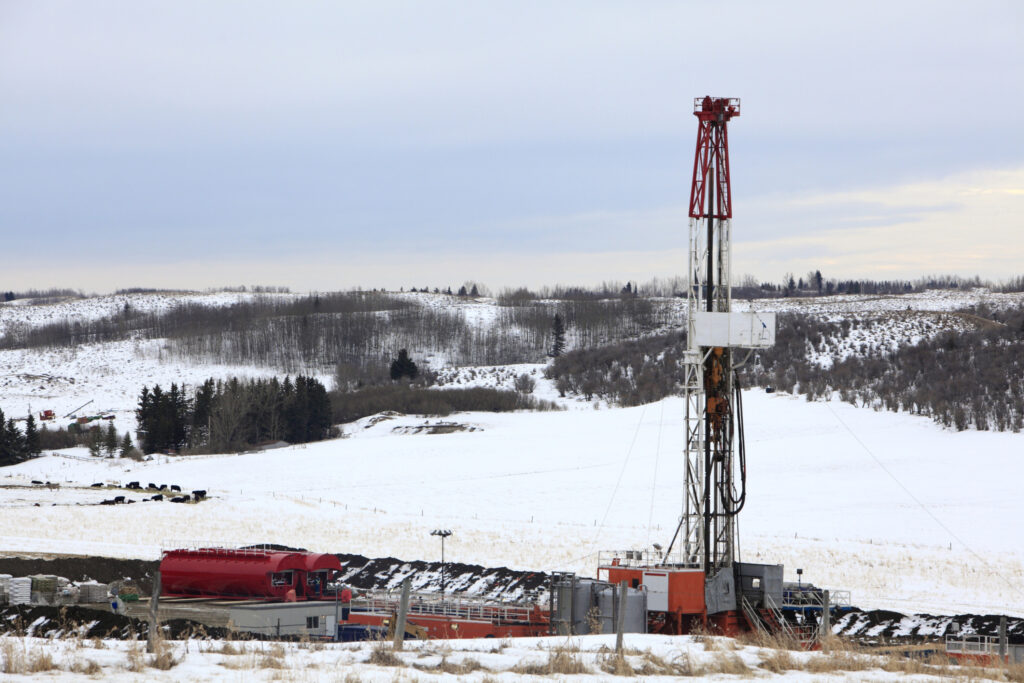

Oil and gas resurgence?

A sector of the economy that is positioned for future growth is oil and gas – one that would benefit Mullen’s specialized and industrial services division – but Mullen worries Canada has lost its desire to be a major player in this space.

“We see rising rig counts from last year, but still not to 2019 levels,” Mullen said. “The world wants what Canada has. That is pretty evident. The question is, will Canada participate?”

He warned that if the Canadian oil and gas industry is unwilling to invest, commodity prices will increase and “no one should complain when prices rise.” That means diesel prices will rise, along with fuel surcharges. He credited China’s booming economy with driving up commodity prices.

“China is making everything the consumer buys,” he said. “They are busy creating and building. Their factories are busy and we are busy consuming.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Good article with some excellent points about TFI being rewarded by the capital markets for its acquisition strategy, the supply chain challenges, and the mindset needed to enter the US market.