Trucking in ‘slow growth’ environment, not recession: FTR

The U.S. general economy and GDP Goods Transport numbers point to a “weak, status quo environment” that’s not great for truckers. Just don’t call it a recession.

FTR held a webinar Jan. 12 dubbed Cutting through the fog: Planning for transportation uncertainty, in which it acknowledged a very mild recession could occur later this year. However, for now, we remain in a slow growth environment, the industry forecaster said.

Todd Tranausky, vice-president – rail and intermodal with industry forecaster FTR, said imports are down but it’s not consistent across all ports. The West Coast U.S. ports have been hit hard by dropping volumes while other ports such as those in the Southeast U.S. have slowed less and those in the Gulf Coast have actually seen growth.

On the trucking side, Avery Vise, vice-president – trucking, said small trucing start-ups that formed during the pandemic to chase record spot market freight continue to close or reattach themselves to larger fleets.

Failing small carriers

“We have seen a very strong and long period of adding more carriers than we were losing, but that came to an end,” Vise said. “We have started losing a pretty substantial number.”

Preliminary December data indicates there were more U.S. carriers lost than in any other month on record, except for December 2005 in the wake of Hurricane Katrina. “That will likely continue for a period of time,” he said of the trucking failures.

So far, larger carriers have absorbed those small companies that had their authorities revoked, as seen through increased trucking payroll employment. But that’s beginning to flatten out, suggesting future authority revocations will pull capacity from the market as contract freight is expected to stay flat the rest of the year and large fleets will be less inclined to add capacity.

Those small carriers are failing due to higher diesel prices, falling spot market rates, and higher costs for truck payments, maintenance and insurance.

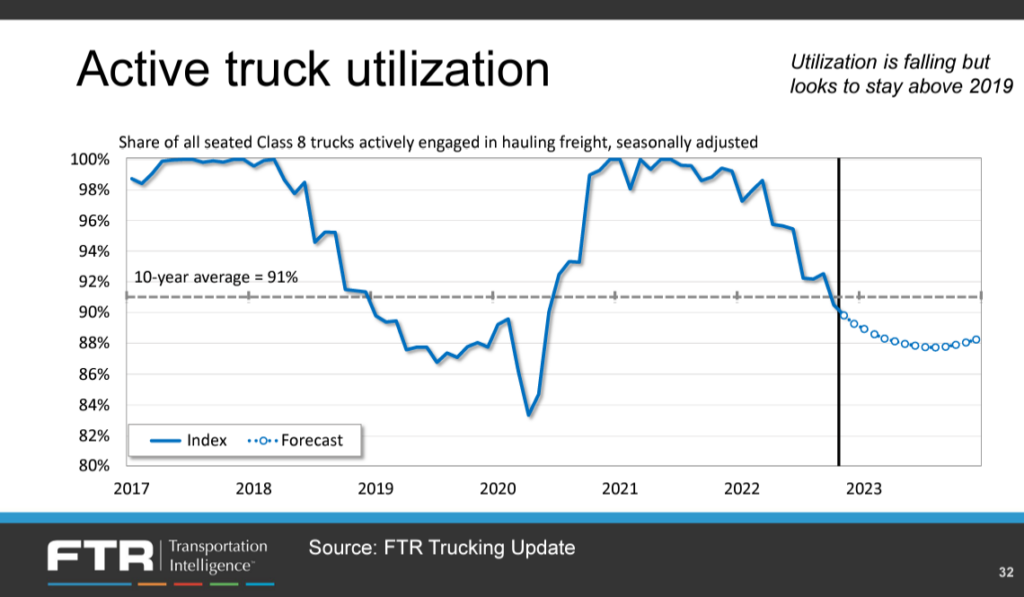

Active truck utilization, which serves as a capacity “tightness” barometer, was nearly maxed out in 2021 but has since fallen below the 10-year average and will continue easing over the next several months, FTR predicted.

How are trucking rates affected?

Rates may come down a little further but spot market rates are close to bottoming out while overall rates aren’t likely to change much this year, FTR said. Rates remain close to peak levels seen in 2018. That’s not indicative of profitability, however, as fleets have seen equipment, labor, maintenance and other operating costs surge.

“This is not a measurement of margin, it’s a measurement of the top line,” Vise said of rates. “We would be hard pressed to argue this shows carriers are doing better than prior to the pandemic.”

Tranausky said rail and intermodal volumes are weak, with weekly intermodal volumes down about 10% year over year so far in 2023. He sees an environment where intermodal will have difficulty competing with the truckload segment in terms of attracting volume.

While the trucking environment has returned to earth, Vise said we aren’t in recession.

“We are not in one now based on the data we’re looking at,” he stressed. “We are still seeing solid job growth.”

An economic recession could come later this year, Vise acknowledged, adding “I’d say we’re in a slow growth environment, not anything we’d consider recessionary for a couple quarters. Even then it’s unlikely to be anything more than mild.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.