ECONOMIC TRUCKING TRENDS: Peak shipping season ‘virtually non-existent’, but trailer orders get a lift

Trailer orders sprung to life in October, and cancellations fell. However, demand remains historically weak.

ACT Research lists the headwinds facing Class 8 truck demand – and there are a lot of them. And the spot market remains sluggish, suggesting peak shipping season may be a letdown.

Trailer orders show some life

Trailer orders jumped 77% in October, according to preliminary data from FTR, but remained 5% below year-ago levels at 15,916 units.

The spike pointed to renewed fleet engagement and reduced cancellations, FTR reported; however, the 10-year October average of 37,116 units is more than twice the strength as seen this year.

A slowing of cancellation rates to just more than 5% suggests some stabilization, FTR added.

“The U.S. trailer market continues to experience meaningful pressure from volatile trade policy, elevated material costs, and weakening fleet sentiment. Although a Supreme Court ruling could eliminate country-specific tariffs depending on the outcome, the main tariff cost for the trailer industry comes from the 50% Section 232 tariffs on steel, aluminum, and copper that will be unaffected,” said Dan Moyer, FTR’s senior analyst, commercial vehicles.

“OEMs and suppliers are adjusting to higher costs and softer demand through selective price increases, tighter cost controls, and sourcing shifts. Fleets are extending equipment life cycles, prioritizing maintenance, and limiting new capital commitments as elevated costs and policy uncertainty continue to weigh on near-term trailer demand.”

ACT Research reported orders of 17,100 units.

“Sequentially, October’s higher net order intake was expected, as it is usually one of the strongest order months in the annual cycle initiated at the end of Q3 when the industry begins opening next year’s order boards,” said Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research.

“October’s tally brings the year-to-date net order total to 138.3k units, or 17% more net orders than were accepted through year-to-date October 2024. Looking forward, concern continues that moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous governmental policy — especially around the EPA low-NOx rule — remain as challenges to stronger trailer demand. However, pent-up demand is building, and fleets eventually will need to divert capex to trailing equipment purchases deferred over the past few years.”

Class 8 outlook continues to face headwinds

ACT Research’s latest North American Commercial Vehicle Outlook paints a grim picture for Class 8 truck makers and dealers.

Ken Vieth, ACT president and senior analyst, noted the initial rollout of tariffs in April sparked a “mini pre-buy” at the retail level.

“On top of the IEEPA tariffs, the trucking industry is contending with the new §232 tariffs, a 25% levy on the value of foreign content in imported medium- and heavy-duty trucks and buses. Seeing as we are nearing Year 4 of generationally low carrier profits, and freight rates remain sluggish, the sudden and onerous cost increase will reduce already weak new U.S. vehicle demand, at a time when backlog cushions should be accumulating,” Vieth said.

The list of 2026 demand headwinds includes:

- Freight rates and for-hire carrier profits remain mired at recessionary levels;

- A freight air-pocket happening now that follows an extended tariff-avoiding freight pull-forward;

- Accelerating tariff-driven goods inflation that will weigh on freight volumes;

- A pullback by private fleets after significant fleet expansion in 2023-2024;

- Specific uncertainty surrounding EPA27;

- Macro-level uncertainty around U.S. economic policy.

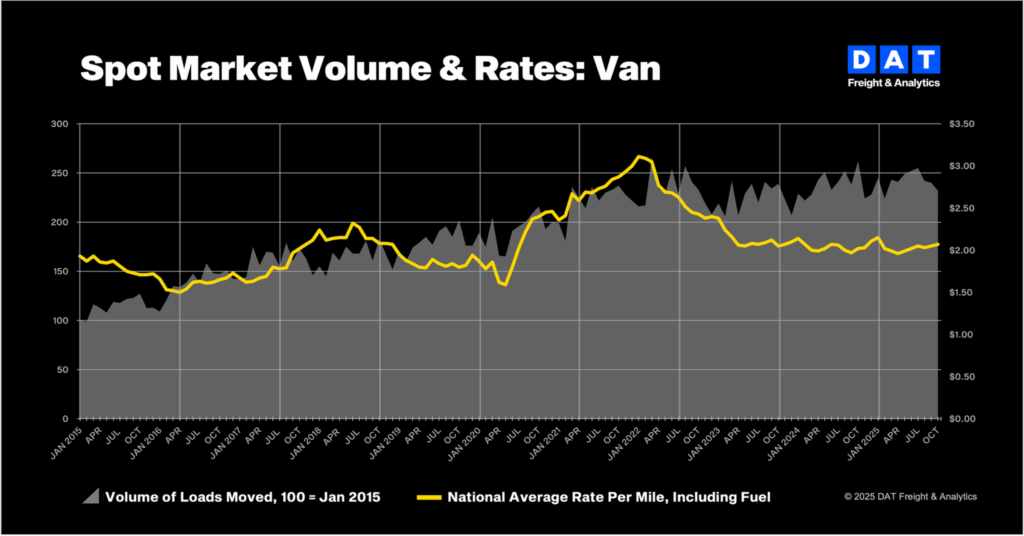

U.S. spot market volumes fell for fourth straight month in October

DAT Freight & Analytics reported that October marked the fourth consecutive month of declining truckload freight volumes. That doesn’t bode well for peak shipping season.

October marked the first month of the year in which the DAT Truckload Volume Index for all three equipment types – van, reefer and flatbed – declined both month over month and year over year.

- Van TVI: 232, down 3% compared to September and 11% year over year;

- Refrigerated TVI: 184, down 2% month over month and 7% year over year;

- Flatbed TVI: 305, down 4% month over month and 3% year over year.

“Freight volumes in the third quarter and October reflect what we’re seeing in the broader goods economy, with shippers drawing on inventory built up earlier in the year to reduce their exposure to tariffs and weak consumer demand,” said Ken Adamo, DAT chief of analytics. “As a result, the traditional peak holiday shipping season looks virtually non-existent this year.”

Rates edged higher thanks to tightening capacity. Spot van rates climbed 2 cents/mile to $2.07, reefer rates were up 4 cents to $2.48 and flatbed rates edged up a penny to $2.51/mile.

Contract rates were flat at $2.42/mile for van, up 2 cents/mile to $2.78 for reefer and up 3 cents to $3.09/mile for flatbed.

“While it’s a buyer’s market for truckload transportation, it’s also buyer beware,” said DAT chief scientist Chris Caplice. “Polling of shippers in our DAT iQ Benchmark consortium shows they’re prioritizing reliable capacity over securing minor cost savings on new contracts. Carrier survivability and overall viability are becoming growing concerns.”

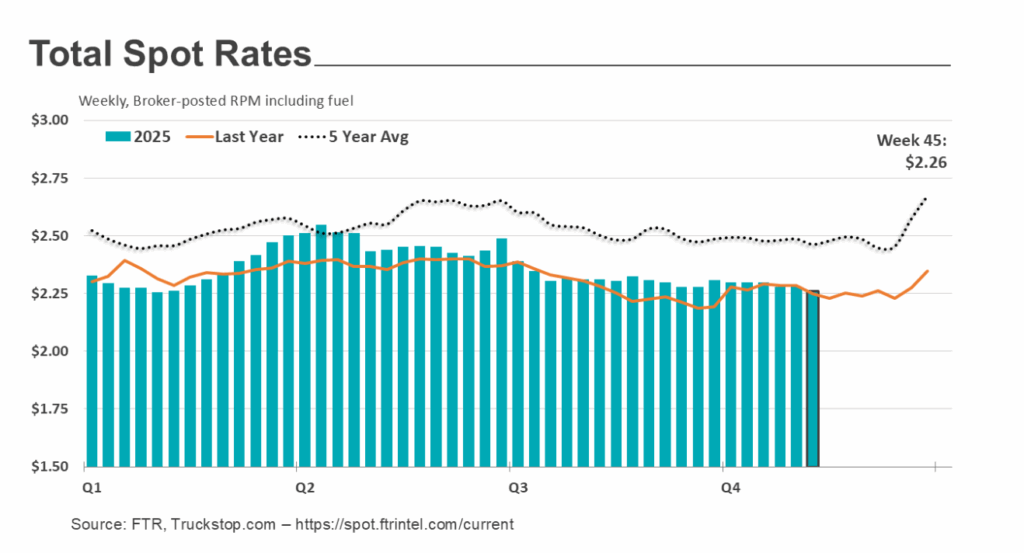

Spot market flat in most recent week

For the week ended Nov. 14, truckstop.com and FTR report no meaningful shift in ongoing seasonal trends. Reefer rates were up modestly, as is typical for the week before U.S. Thanksgiving.

Van rates were mostly unchanged, and flatbed rates declined.

A drop in load activity and an increase in truck postings resulted in a Market Demand Index of 72.0, the weakest level since the end of June and the softest since late January.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.