ECONOMIC TRUCKING TRENDS: Trailer order strength sustained in January, spot market rates show resilience

Trailer orders saw December momentum carried into January, though total order season activity was lackluster.

Shippers saw some fuel price relief translate into a positive environment in December, but expect conditions to deteriorate, FTR warns.

And spot market pricing shows resilience even after the effects of severe winter weather have dissipated.

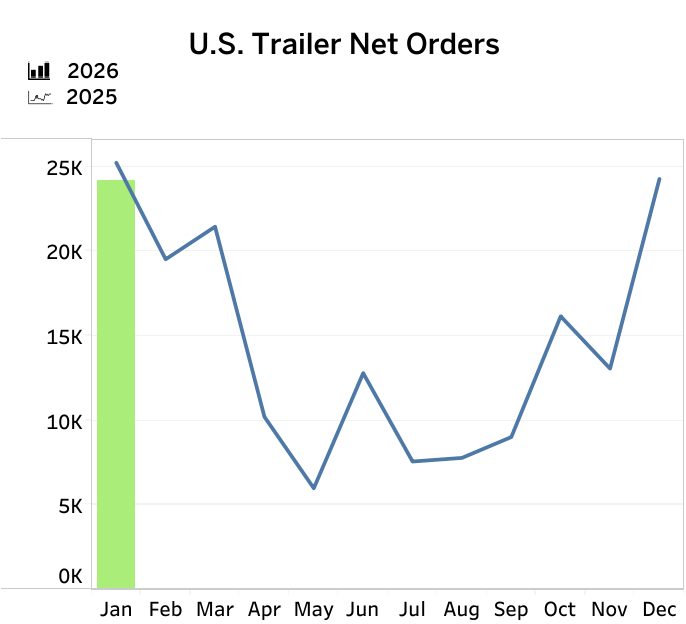

Trailer orders steady in January

Trailer orders remained steady in January at 24,206 units, according to preliminary data from FTR. The tally was down 4% year over year and well off the 10-year January average of 26,340 units.

And, FTR reports, the 2026 order season (from September 2025 to January 2026) was down 16% year over year. Still, the stabilization of orders at higher levels over the past two months is encouraging and according to FTR, could result from:

- The ongoing release of deferred orders from September through November

- Improved carrier fundamentals as reflected in FTR’s Trucking Conditions Index reaching its strongest level since February 2022 in December

- Firmer freight rates and tighter capacity utilization

- Outsized spot rate increases in December and then, sparked by weather, again in January

- Fleets advancing purchases ahead of further tariff-related cost pass-throughs

- Improved capital planning visibility amid greater Class 8 regulatory clarity

“Positive indicators from the truck freight market and improved regulatory clarity are much-needed boosts to the U.S. trailer market, but manufacturers and fleet purchasers still must deal with cost inflation and trade uncertainty that continue to shape pricing and demand,” said Dan Moyer, senior analyst, commercial vehicles.

He also noted an antidumping and countervailing duty proceeding against Canadian and Mexican trailer builders is also having an effect on purchasing decisions.

“Even though potential changes resulting from that investigation would be months away, it is likely already influencing sourcing strategies and pricing decisions. Overall, existing metals tariffs and the advancing van investigation likely will keep costs elevated and demand selective,” Moyer said.

ACT Research reported 23,300 orders in January.

“Sequentially, a drop in net orders was expected, as December is usually the second strongest order month of the annual cycle,” said Jennifer McNealy, director commercial vehicle market research and publications.

“January is usually the month when trailer makers begin to take fewer orders and start to work down the backlog that grew during the peak of order season, October through December. That said, fleet decision-making hesitance into late 2025 seems to have delayed the cycle a bit, causing January orders to follow the traditional pattern but still surprising on the high side, as December’s weather-induced spike in freight rates, increasingly aged fleets, and some level of tariff-related clarity are in play for trailing equipment demand.”

McNealy added: “The questions now become how sustainable are 20,000-plus-unit order intake months, and how quickly will trailer OEMs build down the still-thin backlog, particularly given concerns about the level of activity in the key freight generating economic sectors that drives transportation demand, still-weak, although improving, for-hire carrier profitability, and uncertainty about future government policies that remain as challenges to stronger trailer demand in the near term.”

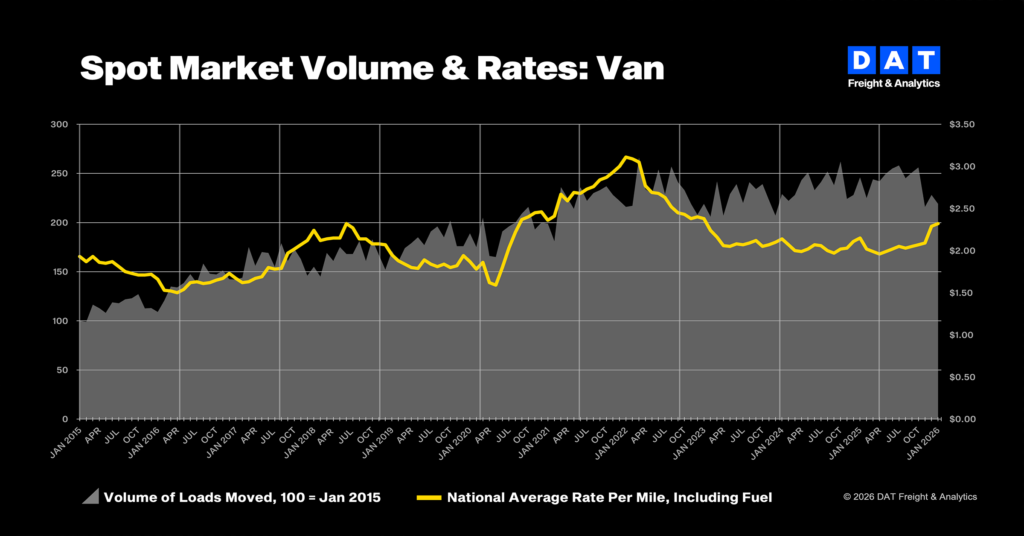

January freight rates showed resilience

Truckload freight volumes slid in January following the holiday shipping season, but spot market rates continued to improve, according to data from DAT Freight & Analytics.

Its Truckload Volume Index fell 4% for dry van and reefer loads while flatbed freight ticked up 2%.

But overall pricing improved, by 3 cents/mile for van at $2.32, 12 cents for reefer to $2.81/mile, and 22 cents for flatdeckers to $2.85. Winter Storm Fern no doubt contributed to the spike in spot market pricing, affecting supply chain productivity across 24 states, DAT reported.

The average spot van rate was up 17 cents from January 2025, while the reefer rate was up 27 cents. Spot flatbed rates increased 41 cents year over year.

Contract rates were stable at $2.48/mile for van loads, $2.81/mile for reefer and $3.04/mile for flatbed.

“Not every spike or dip warrants a response,” said Ken Adamo, DAT chief of analytics. “What matters is whether the data signals a temporary disruption or a real shift in market fundamentals. January’s numbers didn’t mark a change in loads moved, but they did show how shipper urgency and carrier pricing discipline can push rates up despite softer volumes.”

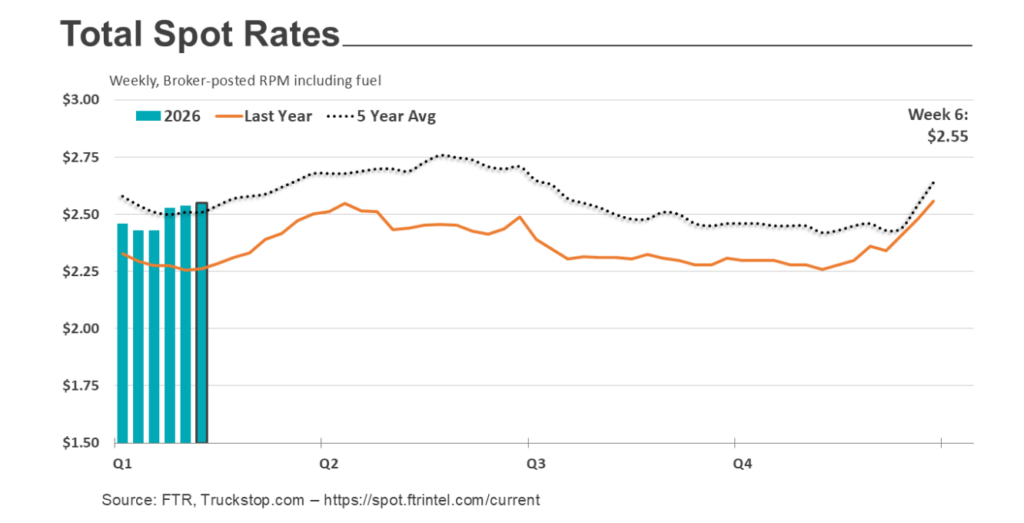

Spot rates resilient as winter storm effect dissipates

For its part, Truckstop.com reported rate resilience for the week ended Feb. 13. While rates for dry van and refrigerated equipment fell from the previous week, they remained well above levels from the same week last year.

“In both cases, rates are either at or very close to their strongest year-over-year levels in four years,” Truckstop.com said in an update. “Flatbed spot rates are not running as strongly year over year as van rates. Still, they are the highest since May 2022 and have risen in 12 of the past 13 weeks. Van spot rates usually fall during the current week, but even if they do, they likely will still be significantly higher than they were in the same 2025 week.”

Shippers likely to see tougher conditions ahead

FTR’s Shippers Conditions Index (SCI) jumped into positive territory in December with a reading of 1, up from -2.9 in November. This was largely due to a sharp drop in diesel prices that more than offset tightening capacity utilization.

However, the industry forecaster warns of increasingly tough conditions ahead for shippers.

“We already were forecasting somewhat unfavorable market conditions for shippers, and that outlook is tougher still in our latest analysis,” said Avery Vise, FTR’s vice president, trucking.

“Much of that deterioration is based on our expectations for stronger freight volume placing greater demand on freight capacity, but the road ahead is rocky for shippers even if our modestly stronger freight demand projections are too rosy. The excess capacity that had favored shippers for a couple of years or more is history, and stresses – even if brief – will cause hiccups that result in higher costs.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.