Predicting trucking’s evolution through 2050 and its impact on the aftermarket

By 2050, 30.6% of Class 8 trucks will be battery-electric and only 10% diesels, with 357,000 of the 6.3 million Classes 6-8 trucks on the road autonomous.

If that scenario plays out as predicted by Derek Kaufman, managing partner, Schwartz Advisors, who was speaking at the Heavy-Duty Aftermarket Dialogue this week, then the aftermarket parts industry will look vastly different than it does today.

By this time, Kaufman said, autonomous trucks will no longer have a cab, and aerodynamics will be built around the trailer itself. Battery-electric trucks will account for 46% of new truck sales, but batteries will be solid state, more powerful than today, more compact, and will offer better range.

The U.S. heavy-duty parts aftermarket will be worth about US$90 billion by then – about double its value today – and of that, battery-electric trucks will command about $31 billion of that while those autonomous trucks will represent an aftermarket parts value of about $9.1 billion – or 10% of the total market.

Dave Kalvelage, senior market analyst with MacKay & Company, added by this time, 53% of Class 8 trucks on the road will be fueled by new technologies while less than half are powered by internal combustion engines.

But Kaufman said the industry should push the EPA and California Air Resources Board (CARB) to give greater consideration to clean technologies beyond battery-electric.

“We believe the BET (battery-electric truck) solutions they are pushing are outstripping the infrastructure that supports them,” he said, noting renewable fuels should receive more consideration.

Diesel dominates

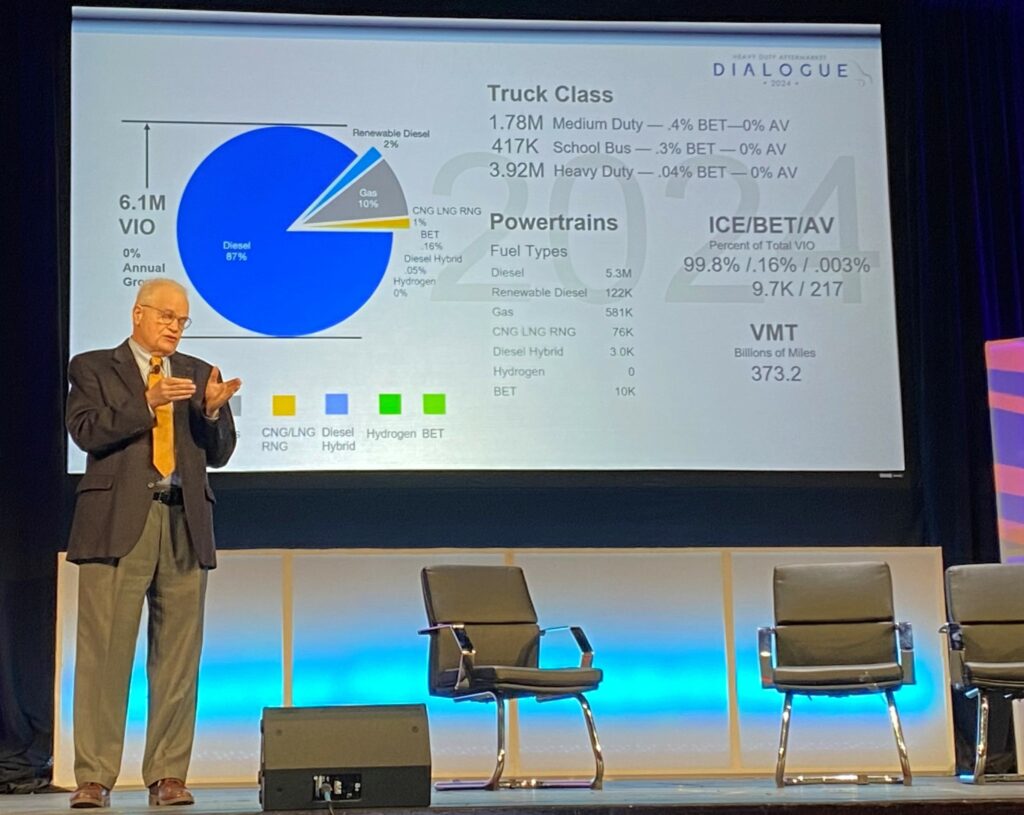

There are 6.1 million trucks on U.S. roads today, 87% of which are powered by diesel and 99.8% by internal combustion engines. Kaufman anticipates electric trucks to have a market penetration of less than 10% by 2030.

In order for battery-electric trucks to gain widespread adoption, Kaufman said 48-volt electrical architecture will be favored and that battery swapping will be the preferred method of recharging. He pointed to a joint venture by Daimler Truck, Accelera by Cummins and Paccar, and suggested they create a common battery platform so they can swap out battery packs between each other’s chassis.

He also predicts Asian OEMs – such as Hyundai – will be breaking into the North American market around this time.

In 2040, Kaufman said, there will be 6.7 million heavy vehicles on the road, 36% will be powered by diesel, 25% by renewable diesel and 14.8% by batteries. By this time hydrogen will begin appearing, representing about 4% of the heavy vehicle population, he added.

“We believe it takes a long time for hydrogen to become competitive, but by this time hydrogen infrastructure is steamrolling,” he said. Meanwhile, autonomous trucks will also be more prevalent by 2040 and Kaufman predicts manufacturers of those trucks will begin purchasing fleet customers around that time to offer Trucking-as-a-Service. A Deloitte survey of trucking executives found 60% felt autonomous truck OEMs would begin buying trucking firms, while another 32% said it will “probably” happen.

OEMs as truck fleets

“Ninety-two percent of trucking people said a Paccar, or Daimler, or Tesla will go out and start buying fleets making autonomous Transportation-as-a-Service out of them,” he said.

By 2040, Kaufman predicted 11.7% of new truck sales will be autonomous, but the uptake will be restrained by societal concerns or what he explained as WA-LTER (win alone, lose together). By this he means a fleet using an autonomous truck to make a delivery will be celebrated, but when an autonomous truck is involved in a crash, the entire industry will be condemned.

And he also expects blockchain to make a long awaited appearance in transportation, used to track every mineral that goes into a component, and every component that goes onto a truck – right through to its end of life.

By 2050, this will enable trucking to be “fully sustainable,” Kaufman concluded. “Every truck will have a climate change balance sheet associated with it.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

I think Derik is drinking to much UN coolaid