Truck makers brace for prolonged downturn as autonomy gains momentum and electrification cools

Demand for Class 8 trucks in North America is not likely to improve in the first half of 2026 and truck makers will have to seek out new revenue sources to support profitability.

That’s the assessment of McKinsey & Company, a global consulting firm that studies the commercial vehicle business. McKinsey partner Moritz Rittstieg spoke of market trends with truck press attending the House of Journalist event at CSE 2026 this week in Las Vegas.

“2025 was extremely challenging and 2026 is projected to at least start equally challenging,” Rittstieg said of the outlook for truck OEMs. “All the OEMs are hurting but not hurting to the same extent.”

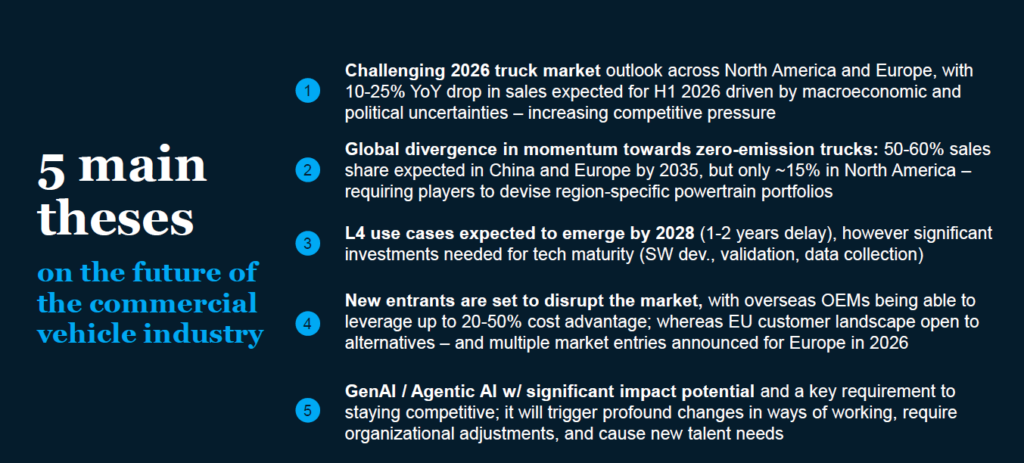

North American commercial vehicle production (GVW above 6 tons, including buses) are likely to drop 10-25% year over year in the first half of 2026, said Rittstieg. This is in part due to a 50% tariff on steel and aluminum, coupled with 25% tariffs on imported trucks and parts.

“The uncertainty is huge,” Rittstieg said, noting the historically long freight market downturn stems from the double-whammy of the COVID-19 pandemic and then changing trade policies including tariffs on equipment. Weak freight fundamentals have caused fleets to defer buying new trucks, which Rittstieg said they’ll likely continue to do at least until the back half of 2026, when they’ll be forced to begin replacing older units.

“When trucks age out, they may buy,” Rittstieg said of North American fleets. “There is some hope this is going to happen in the second half of this year. We haven’t heard of anything earlier, so that’s the scenario we’re looking at.”

Against a backdrop of weak freight demand and economic uncertainty coupled with rising costs of tariff-impacted new trucks, fleets are reticent to buy new vehicles. OEMs saw Class 8 order books fall 32% year over year between January and November 2025, a trend that’s continued since.

Macroeconomic growth, interest rates, and trade policies will help determine the timing of any recovery. Truck makers have been reluctant to pass on the entire cost of tariffs due to weakness in their order books, but Rittstieg believes “there needs to be a price reset in the market based on tariffs.”

Market share could shift as a result of the tariffs, he added, since they don’t affect all truck makers equally. As a result, OEMs need to seek additional revenue sources through new offerings such as bundling services and taking a larger percentage of the aftermarket spend.

“The OEM roughly captures $1 out of every $3 spent on the truck over its lifecycle. OEMs are looking at how to increase that,” Rittstieg said.

Electrification falls out of favor

The story is even worse when it comes to electric trucks. While in China, electric vehicle adoption is soaring but that’s not the case in the United States.

“In the U.S., all OEMs have pushed out timelines to the right. Order books have plummeted and it looks like electrification is going to be significantly slower than initially predicted,” Rittstieg said. “The general sentiment has cooled.”

Electric truck adoption still requires government incentives, which the Trump administration is loath to support. McKinsey has adjusted its forecasts for EV adoption and now its best-case scenario sees a 25% market penetration for electric trucks by 2035 in the United States with a worst-case scenario of just 6%.

The exception is in certain niche segments such as yard tractors which offer a better value case than on-highway trucks.

Bullish on autonomous

The one vehicle segment McKinsey remains bullish on is autonomous, which in contrast to electrification, is moving faster than initially expected. This is largely because investors are excited about automation and helping to fund the segment’s growth.

Investors also understand the potential of automation as it’s something many have personally experienced in the passenger car space thanks to companies such as Waymo, which has an eagerly awaited initial public offering looming.

But while there is an abundance of excitement about autonomous, Rittstieg added there are still many costly obstacles to overcome. Who will take on the financial risk in autonomous trucking deployment is a key question, he added.

“The real question is, can the economics be good enough for fleets to take the risk? Somebody has to put up the money.”

And it won’t be the incumbent OEMs alone, Rittstieg said, noting they have less appetite for risk than tech startups. The economic value proposition will have to be strong enough to satisfy the financial rewards that early adopting fleets, OEMs and technology providers will each want to enjoy.

“Is the pie big enough for this to really scale fast?” Rittstieg questioned.

He sees autonomous trucking rolling out in two phases: constrained autonomy from 2027 to 2040 in which driverless trucks operate on-highway only with transfer hubs where loads are handed off to human drivers at the beginning and end of a trip; and full autonomy from 2040 on, where driverless trucks can make deliveries from start to finish without the aid of transfer hubs.

Asked by trucknews.com if retrofit offerings or fully integrated OEM products will win, McKinsey partner Tobias Schneiderbauer is banking on the OEMs emerging as winners, largely because having an independent technology provider retrofitting existing trucks clouds the liability picture.

New entrants pose yet another risk

If all that isn’t enough to worry truck makers, Rittsieg said there’s also a growing threat of new entrants taking a piece of the North American market, especially with electric vehicles. Chinese manufacturers enjoy a 20-50% cost advantage over incumbent OEMs in North America.

Tesla is another threat with its promise of its mass-produced Semi, which has been repeatedly delayed but remains a significant part of the company’s vision. The company doesn’t anticipate new entrants in the diesel space since those trucks require more supporting infrastructure such as dealerships and shops to service the trucks than do the comparably simple EVs.

With so many headwinds facing commercial vehicle makers, the McKinsey reps were asked if there’s anything at all to be optimistic about. After a long pause, Rittstieg said “The United States is still the best truck market globally. I’m still bullish on the U.S. as a market.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Good, keep your over priced junk.

Just keep making parts for my old reliable truck.

Electrification has slowed because legacy truck makers can’t build a good EV truck and the massive new Tesla truck factory isn’t quite finished being built. But when is and Tesla starts making the best truck ever at 100,000 units per year, it will completely change the trucking industry. No other truck maker will be able to compete. Their cars are already the most efficient, cost saving and reliable vehicles ever. There’s no reason to think the trucks will be any different.

I have an Austria friend who has been driving cabover electric semi trucks for well over a year. We used to drive recycle trucks during ‘the winter’ in New Zealand about 20 years ago. Obviously different driving regs on Europe but he says trucks are awesome and keep improving.

I want to change to electric Isuzu type dump but the ones I tested here in BC didn’t have enough ground clearance and were a little shy of range. But I probably should have brought one anyway.

They want to make money and sell trucks. How about get rid of all emissions, make trucks easier to repair. Electical repairs are getting harder,when everything has go through a ecm. Go back to basic electrical , relay, wires and fuses. It’s wierd how a 60 Series engine was good on fuel and gave decent power and easy to repair. Now companies have emissions on truck and the cost of repairs are in the thousands and let’s not forget down time. Right now we have a mechanic shortage and that began 25 years ago, and we had easy things to fix. Doing engine jobs, clutches, tranny work and fixing basic electric work. Some people think the automatic transmission is the way to go, sure, maybe for fuel economy, but look at what drivers it attracts they have no idea how heavy the load is and how to control a truck. Drivers just hold on to the steering wheel and thier cell phone, they don’t have to worry about shifting gears