Work truck shipments to ramp up as parts shortages alleviated

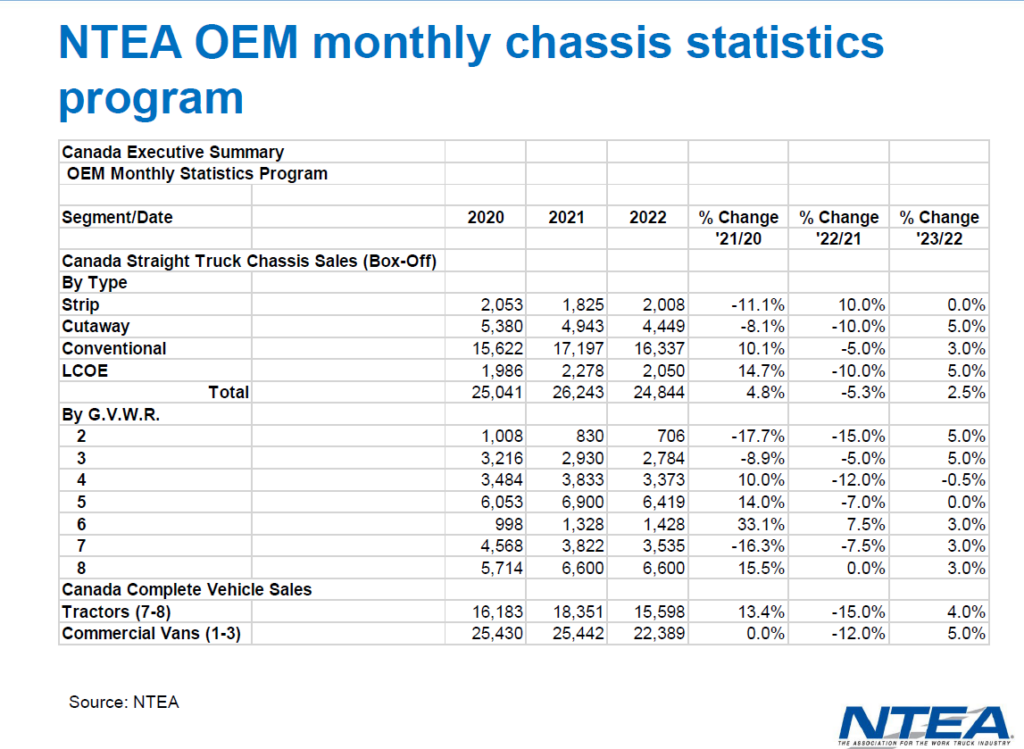

Classes 7 and 8 tractor sales in Canada are expected to end the year down about 15% at 15,598 units, according to a North American Commercial Vehicle Business Update from the NTEA, or Association for the Work Truck Industry.

Classes 2-8 straight truck chassis sales (box-off) in Canada will decrease 5.3%, at a projected 24,844 units.

Next year should be better however, with Classes 2-8 straight truck chassis gaining back 2.5%, while Classes 7 and 8 tractors improve 4%.

Shortfalls in sales can be blamed on the shortage of key components such as semiconductors. These began to appear in the Classes 2-7 work truck world in the second quarter of last year, and affecting Class 8 trucks early this year. As a result, shipments lagged sales while some trucks were delivered undrivable until those final parts could be installed.

“That may be slowly improving at this point,” Steve Latin-Kasper, NTEA’s senior director of market data and research said of the supply chain challenges and parts shortages. “Anecdotal evidence we have is that is the case, so we expect to see shipments continue to improve going forward.”

Looking at the macroeconomic picture facing the U.S., Latin-Kasper isn’t expecting a recession this year. But he acknowledged there’s an unusual lack of alignment between the consensus panels that predict such events.

Latin-Kasper pointed to a strong jobs market as reason for optimism. “How can you have a recession when everyone who wants a job, has one?” he asked.

The U.S. unemployment rate is back to pre-pandemic levels, but that brings its own challenges as companies struggle to find labor. The rest of the economy will normalize when supply chain issues are alleviated, he predicted.

Inflation is a concern, however, especially for work truck buyers who are seeing the costs of everything from steel to aluminum increase. And he believes there’ll be more pain at the pump and continuing fluctuations in oil prices.

“It’s extremely volatile and likely to stay extremely volatile,” he said of oil prices, noting the European Union is drawing down inventories and will have to restructure its storage infrastructure and supply chains. “We may yet see a point where oil prices once again rise swiftly as the European Union restructuring lags behind their ability to draw in storage and get increases in supply from more local sources.”

The U.S. has seen diesel prices rise faster than freight has grown, putting pressure on truck operators.

Leading indicators such as housing starts are slowing, but may level off at very slow growth, Latin-Kasper said. And interest rates will continue to rise.

On the positive side of the ledger are: credit availability; quoting activity; backlogs; fleet demand; and consumer and capital spending.

On the not-so-positive side are: lack of chassis availability; supply chain disruptions; inflation; rising interest rates; labor market imbalances; and political uncertainty.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Higher interest rates will solve the chassis shortage issue