Solid-state lidar opens door to industrial ADAS, MicroVision CEO says

MicroVision is positioning its latest solid-state lidar technology as an enabler of improved industrial site safety — from forklifts in crowded warehouses to commercial trucks operating in complex environments — by driving down costs and expanding safety applications beyond automotive.

Speaking to trucking and automotive press at a House of Journalists gathering ahead of CES in Las Vegas on Jan. 4, CEO Glen DeVos said the company’s short-range, wide field-of-view, solid-state lidar sensor marks a critical step toward bringing advanced driver assistance systems (ADAS) into industrial settings where safety technology has historically been limited by cost.

The sensor, introduced publicly last year, delivers a 30- to 50-meter range with a 180-degree horizontal and 135-degree vertical field of view, providing high-definition “near-field” perception around a vehicle. Unlike legacy electro-mechanical lidar units, the new design is fully solid state — a shift DeVos compared to radar’s evolution from bulky, expensive hardware to compact, low-cost sensors, following the trajectory seen in traditional radar.

“Solid state is the first and most important step to driving cost down,” DeVos said, noting early radar systems once cost thousands of dollars and were the size of a shoebox, while today’s versions are software-defined devices costing well less than $50.

Industrial safety an opportunity for growth

While automotive market penetration remains a long road due to multi-year vehicle development cycles, DeVos said industrial markets offer a faster path to revenue — and potentially a bigger safety payoff.

Lidar has long been used in automated guided vehicles (AGVs) and robots, but primarily as a safety scanner. Those electro-mechanical sensors often sell for $4,000 to $6,000 each, limiting their use to fully automated systems rather than manually operated equipment.

“That cost has been a major barrier,” DeVos said. “If I want to put one of those sensors on a manually driven forklift, I’m adding five or six thousand dollars just for the Lidar.”

Offering a further breakdown of the potential cost savings, DeVos said an autonomous forklift today would require traditional sensors and related software costs totaling about $20,000. DeVos said MicroVision’s solid-state units will cost about $1,000 each, with software capabilities included, bringing the total package with four solid-state sensors to about $4,000-$6,000.

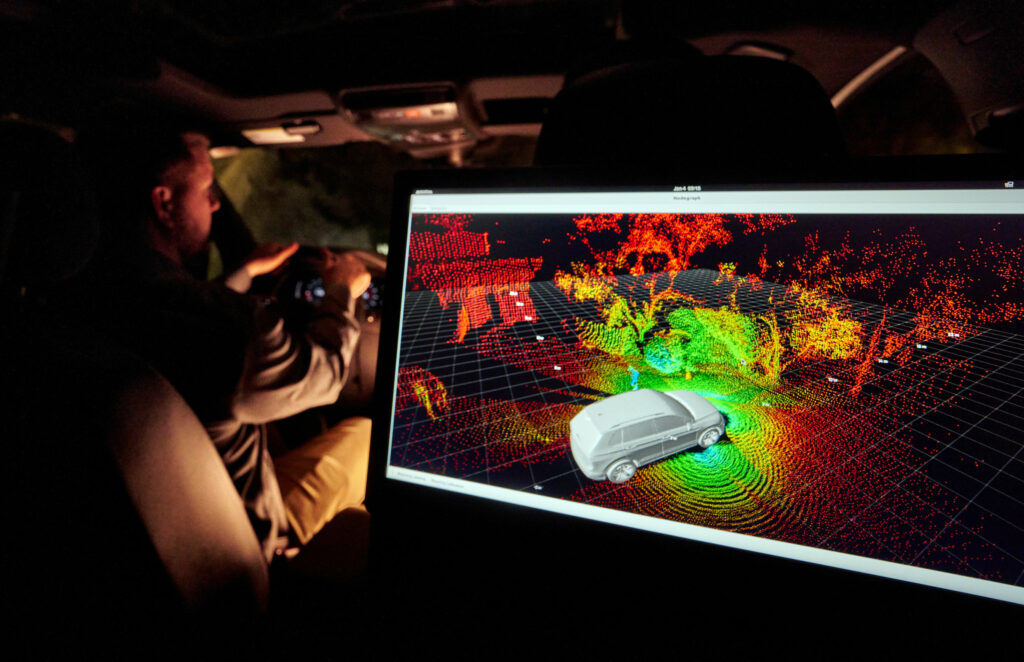

By deploying multiple short-range sensors — still costing less than a single traditional lidar — operators can build a detailed 3D point cloud of an entire warehouse environment. That opens the door to industrial ADAS features that are common in on-road vehicles but largely absent in factories and distribution centers, such as collision warnings, object detection, localization, and even automatic braking.

The need is significant. DeVos cited OSHA data showing more than 30,000 forklift accidents annually in the United States, with an average cost of roughly $110,000 per incident — an accident rate far higher than in automotive applications.

“Industrial ADAS really doesn’t exist today,” he said. “And yet the safety problem is worse.”

From forklifts to commercial vehicles

The same architecture extends to commercial vehicles, where MicroVision advocates a “satellite” sensor approach. Instead of relying on a single, expensive long-range lidar mounted high on a vehicle, perception is broken into roles: short-range sensors handle near-field awareness, while a simpler long-range unit focuses down the road.

For highway-oriented commercial trucks, DeVos said that means narrower fields of view and longer forward scanning distances, reflecting straighter roads and fewer tight maneuvers seen by Class 8 trucks in linehaul, hub-to-hub applications.

By tailoring each sensor to a specific job, costs can be reduced while improving overall perception — a model already proven with radar and camera systems, DeVos said. MicroVision plans to enter the commercial vehicle market in the future.

Open software architecture

Another differentiator, DeVos said, is MicroVision’s open software framework. Each sensor includes an integrated system-on-chip capable of processing raw data, generating point clouds, or running full ADAS features.

OEMs are given access to the software stack, allowing them to deploy their own code directly on the sensor. This gives OEMs greater customization opportunities and the ability to differentiate their systems in the market. Industrial users, however, are more likely to lean on MicroVision to develop the software capabilities as well, as they often lack the engineering know-how to write their own software.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

“MicroVision plans to enter the commercial vehicle market in the future.”

Ibeo which was bought by Microvision and actually makes up a big portion of MicroVision employees, has sold multiple lidar sensors into the market. Valeo Scala 1 and 2 were developed by Ibeo, and are in Mercedes and Honda vehicles. They were licensed and co-developed by Valeo, but still Ibeo’s product. That product has evolved into the Movia S short range sensor that Devos was describing.