Economic Trucking Trends: U.S. debt ceiling default aside, trucking has its own worries

As U.S. lawmakers scrambled to reach an eleventh hour deal to resolve the debt ceiling crisis – a failure to do so potentially causing broad economic repercussions – the trucking industry itself had plenty of economic news to digest over the past week.

Unfortunately, even without a debt ceiling default or credit downgrade to our most important trading partner, the news isn’t all positive for freight haulers.

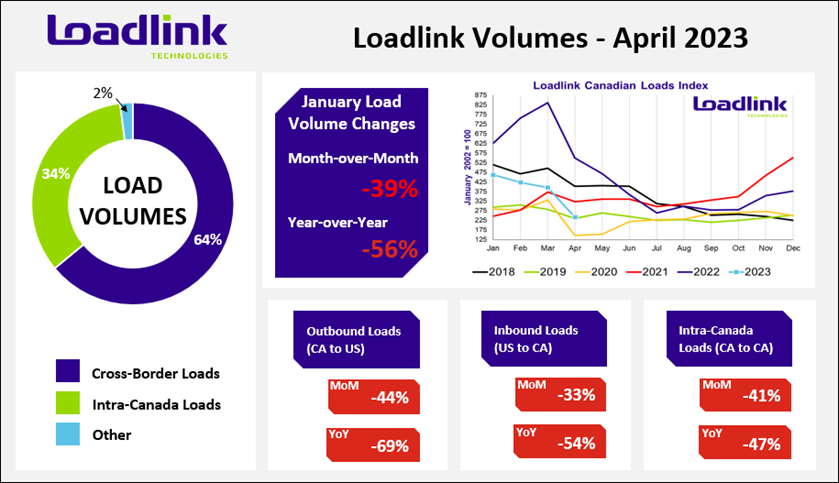

Canadian spot market weakens

More trucks, fewer loads. That was the story on Canada’s spot market in April, according to the latest data from Loadlink Technologies. The load board operator points out volumes appear especially weak due to tough year-over-year comparisons against record highs at this time last year.

Volumes fell 39% from March, however, and were down 56% year over year. Truck volumes, meanwhile, rose 2% from March and were up 61% year over year. If you’re looking for a bright spot, volumes on inbound cross-border loads from Texas and Florida were where to look.

Outbound loads to the U.S. dropped 44% from last month and 69% year over year. Domestic spot market freight fell 41% from March and 47% year over year. Loadlink repots there were 4.18 trucks posted for every load on its board, a 67% increase form the 2.51 available trucks per load seen in March. The year-over-year truck-to-load ratio surged an eyebrow-raising 266%.

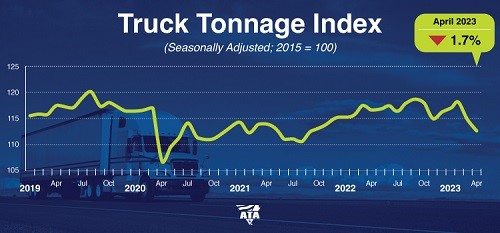

Contract freight also contracting

Hauling contract freight offers some reprieve from the volatility of the spot market, but the American Trucking Associations (ATA) truck tonnage index paints an ugly picture as well. For-hire truck tonnage in the U.S. dropped 1.7% in April on the heels of a 2.8% decline in March.

“While the broader economy continues to surprise and thus far stave off an expected recession, the freight economy is starkly different,” said ATA chief economist Bob Costello. “The goods portion of the economy is soft, and as a result, even contract truck freight is now falling, albeit not nearly as much as the spot market. The tonnage index hit the lowest level since September 2021 in April and has now fallen on a year-over-year basis for two straight months.”

Tonnage was down 3.4% from last April – the biggest year-over-year decrease since February 2021.

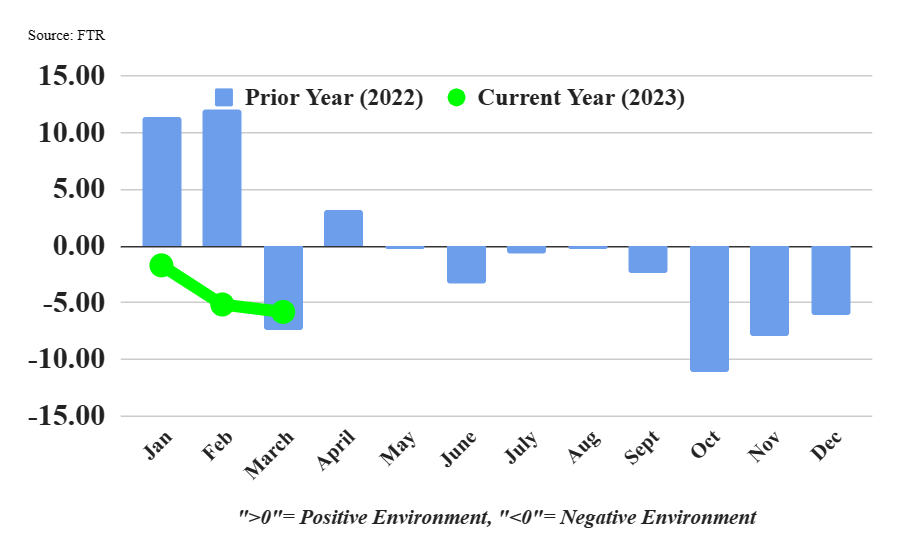

Bad news for truckers, good news for shippers

Industry forecaster FTR reported trucking conditions deteriorated in March, bringing its Trucking Conditions Index down to -5.83 from -5.17 the previous month. Lower fuel costs and better utilization were offset by a more negative rate environment. Financing costs continue to weigh on fleets.

FTR anticipates “modestly unfavorable” conditions to persist into 2024.

“The data that drives our forecasting model still suggests that market conditions for trucking companies are at or near bottom, but the recovery looks fairly shallow – certainly compared to recent markets,” said Avery Vise, FTR’s vice-president of trucking. “We have yet to see clear indications that enough drivers are exiting the market to set the stage for a capacity-driven rebound. Although many very small carriers are failing, so far larger carriers have absorbed that driver capacity. Freight demand appears just strong enough to keep most drivers employed but not strong enough to keep them fully utilized.”

Bad news for truckers generally means improving conditions for shippers, but FTR’s Shippers Conditions Index in March dipped to a positive reading of 4.5, from 5.1 in February. All four freight metrics considered by the SCI – freight demand, capacity utilization, rates, and fuel costs – were up in March, the third time that has occurred since May 2020.

“Despite the small decline, the overall story of positive shipper conditions and a stable outlook remains in place this month and are expected to hold firm for the balance of 2023. All four components of the index were positive for the first time since 2020 this month, signaling the lack of pressure in the system at the present time,” said Todd Tranausky, vice-president of rail and intermodal at FTR.

Equipment outlook remains bright

ACT Research reported this week that trailer manufacturers and major suppliers are seeing stable business conditions, but softer demand can be expected next year. Build rates were up in April as supply chain snags came undone.

“OEMs are reporting that their order boards for 2023 are fully open, with most booked through the end of the year, and we are hearing that some trailer makers are taking orders into 2024,” said Jennifer McNealy, director, commercial vehicle market research and publications. “That said, several concerns are weighing on their minds, including the labor market, slowing demand into 2024, [U.S. Federal Reserve] hikes, business investment providing continued pressure on carrier profitability, recession risk, material supply availability and cost, and how all these factors are likely to impact dealer confidence.”

I caught up with Jonathan Randall, president of Mack Trucks North America at ExpoCam. He said the truck maker isn’t seeing any cancellations and demand for both highway and vocational trucks appears strong through the end of the year, even into next year.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

@James Menzies … why do you do this to yourself ???

One would assume that as a professional reporter, a trusted industry voice if you will, you would at least verify your sources, and the validity of the information with some sort of corroboration.

You can’t quote LoadLink numbers. There is no possible way they can be accurate, or even quantifiable in any sense.

First of all LoadLink numbers do not account for the repeat postings where there are numerous entities flogging the same load. That 4.18 trucks per load could really be 16.72. It could also be 1.045.

Their volume numbers are just as fallible, as they have no way of accounting for, or even ferreting out, the rampant double brokering that goes on on their load board. i.e. “carriers” looking for loads could be double brokers, and “brokers” flogging loads could be carriers double brokering freight.

One can’t even say that even though their numerology is flawed that their trends are accurate as the amount of loads that hit the spot board, and the proliferation of double brokering ebbs and flows with the economy.

Any numbers produced by LoadLink, that pertain to the state of the industry, must be taken with several grains of salt.

On the plus side, you quoted ATA’s chief economist, Bob Costello. If one looks at Mr. Costello’s track record, one can discern, with ease, that Mr. Costello is not very often wrong.

FWIW, BMO puts out a quarterly Trucking Industry Update that is quite informative.