Industry could see 40,400 vacancies by 2030, THRC warns

Trucking HR Canada projects that 40,400 available jobs could be vacant in 2030 unless the ongoing efforts and support continue. Of those vacancies, nearly 10,800 are expected to be truck-driving jobs.

While current workforce investments and the HR best practices are working, driving the industry’s recruitment performance to new heights with significantly more women, youth and immigrants joining the sector, workforce demand continues to outpace supply, said Angela Splinter, CEO of Trucking HR Canada (THRC).

Even if all active job seekers in the sector were readily employable in 2030, employers would still have to recruit and train at least 10,300 new workers to meet their labor requirements, says THRC’s 2024-2030 labor market outlook report. It was compiled based on the 2023 surveys of 376 employers in Canada, that represent 48,385 drivers.

But recruitment and retention are not the only things on the employers’ minds.

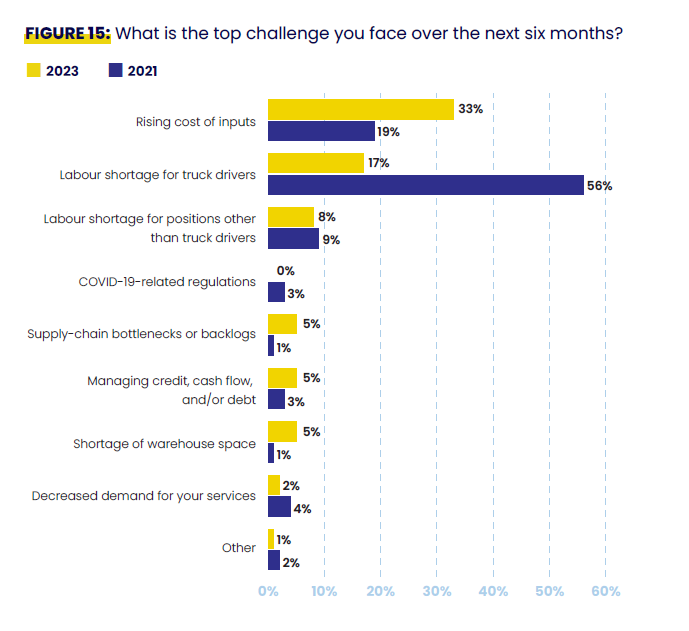

For the first time in a decade, increasing input costs replace driver shortage as the top concern for employers.

In 2021, 56% of companies said a shortage of drivers was their top concern, and only one in five said higher costs for fuel, equipment, insurance, labor, and other inputs were worrisome. Two years later, 33% of employers are worried about rising costs, while only 17% of employers identified the driver shortage as a top concern, pushing the issue to the second on the list.

Recruitment improved

However, employers are increasingly concerned about non-driving occupations, as recruiting drivers has become somewhat easier.

While 67% of companies said they could not recruit all the drivers they need in 2021, the number has dropped to 57% over the past year. Only 19% of employers reported lost sales or revenue because they were unable to hire drivers – a 40% decrease compared to 2019. However, one in four companies will likely have to delay plans to expand its business due to a lack of drivers.

Larger companies were less likely to fill all their vacancies.

“For example, 61% of those with more than $50 million in revenue could not fill all their positions, compared with only 48% of those with less than $5 million,” the report says.

“Employers said a lack of candidates with necessary experience (60%) was the main reason for not being able to fill positions, followed by too many departures in a short period (20%) and rapid company expansion (18%).”

To address the existing shortage of driving and non-driving jobs, 53% of employers use sponsoring professional truck drivers as a strategy, while other 40% turn to the Temporary Foreign Worker Program. Thirty-seven percent use THRC’s Career Expressway program, 35% use the provincial nomination program.

Retention and driver turnover

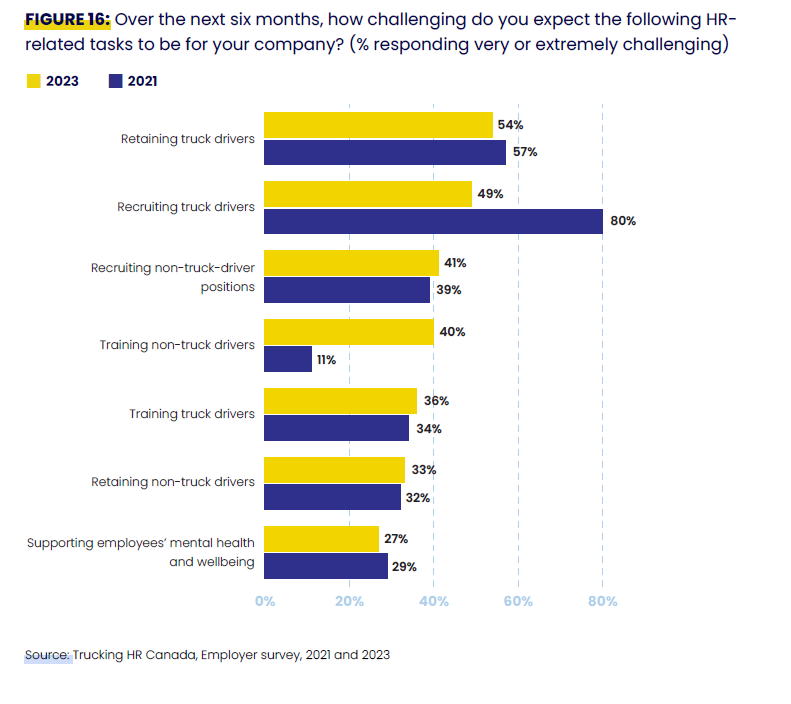

Two years ago,80% of employers anticipated that recruiting drivers would be ‘very’ or ‘extremely’ challenging. Now, only 49% think so.

However, retention continues to be an issue. Both, in 2021 and 2023, over half of the surveyed fleets said keeping drivers is difficult.

Employers find that higher wages are not enough anymore. Therefore, 66% of employers (up from only 38% two years ago) recognize the value of non-monetary incentives over a higher salary. These include providing employees with wellness programs, mental health support and awards programs.

Efforts pay dividends. These and other strategies led to the voluntary turnover rate for long-haul drivers decreasing from 19% in 2019 to 8% in 2023, while short-haul driver turnover dropped from 15% to 6%.

The industry should continue its efforts in recruitment, retention, and other aspects of supporting and developing the industry.

According to the report, if the sector implemented initiatives that boosted the attraction of new workers by 15% and reduced voluntary turnover of drivers by 10%, the number of vacancies in 2030 would drop by 39%, to 24,500 available jobs.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Mechanics and people to repair computers in all parts of the operations including reefer units are in the biggest shortage the dispatch and key safety personal are much harder to get and keep than truck drivers. The industry needs a program to train and import mechanics at the rate of at least 5000 per year at a cost of over $ 20 000 for each one and plan on spending $15 000 per driver that is trained for another 7000 drivers per year.And also a program to bring back injured truck drivers. The trucking industry in Canada needs to come up with about $350 million cd to pay for all these programs and limit the use of foreign work permit truck drivers to limited use in major cities and from April to the second week of December until Canada fixes the housing shortage