Economic Trucking Trends: A ‘meh’ week for trucking economic indicators

Economic news affecting the trucking industry was mostly unexciting in the most recent week, but ACT Research is sounding alarms for those in the trailer industry. Higher cancellations and a decline in orders are worth monitoring, the industry forecaster warns.

And truckers relying on the spot market faced more uncertainty, with signs the spot market may have bottomed.

Trucking conditions flat

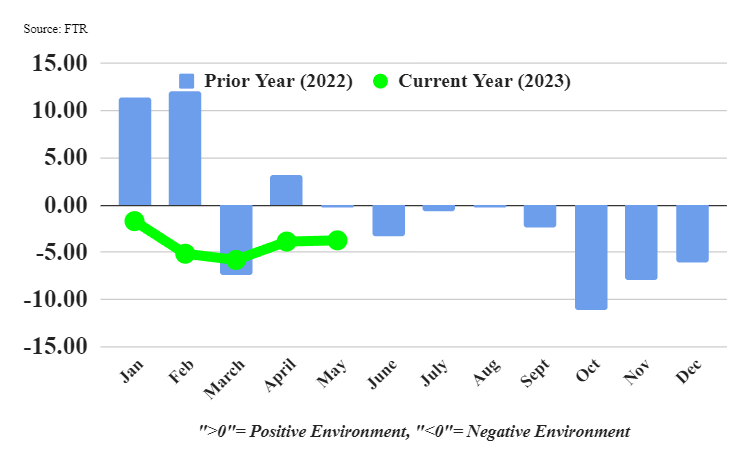

Trucking conditions were virtually unchanged in May, according to FTR’s Trucking Conditions Index (TCI). The -3.75 reading was slightly up from -3.88 in April, which FTR says is indicative of “mildly negative” conditions for carriers.

Lower fuel prices and “slightly less unfavorable rates” helped prop up the index, as conditions remained “weak but stable.” FTR predicts the index will remain negative through the middle of next year. While freight demand and utilization should improve, FTR notes weak rates and elevated financing costs will serve as headwinds.

“If there’s any good news for trucking companies, it’s that conditions are not really deteriorating,” Avery Vise, FTR’s vice-president of trucking, said in a release. “Freight volume is largely stable, and driver capacity appears to be falling steadily but slowly. However, this market climate could stick around well into 2024, resulting in weak freight rates and low margins. Solid financial management has never been more critical as trucking companies cannot count on a rising tide lifting all boats anytime soon.”

Tough times for trailer dealers?

ACT Research is sounding the alarms that trailer makers and dealers could be facing some challenges ahead.

“As expected, production outpaced orders again in June, dropping trailer backlogs 12% sequentially and 10% year over year,” said Jennifer McNealy, director – commercial vehicle market research and publications.

“Dry van, reefer, and flatbed backlogs were down month over month, while dumps were higher, as net orders slightly outpaced build in that segment. Despite the big sequential drop in trailer backlogs, the seasonally adjusted backlog-to-build ratio shed a modest 20 basis points, to 7.1 months in June from May’s 7.3-month level and 8.5 months from last June. While lower, the current backlog essentially commits the industry into the beginning of 2024.”

Regarding cancellations, McNealy added, “Fleet commitments remained mixed in June. Total cancels dropped to 2.8% of backlog, from May’s 4.2% rate. OEMs are still reporting that most cancellations are coming from the dealer network, although fleet and model-year cancellation-rebooks are being reported as the 2024 orderboards begin to open and slots get pushed. Conversations with industry stakeholders the past few weeks revealed that while they remain relatively optimistic about 2024, there was an acknowledgement of increasingly challenging conditions for customers and dealers.”

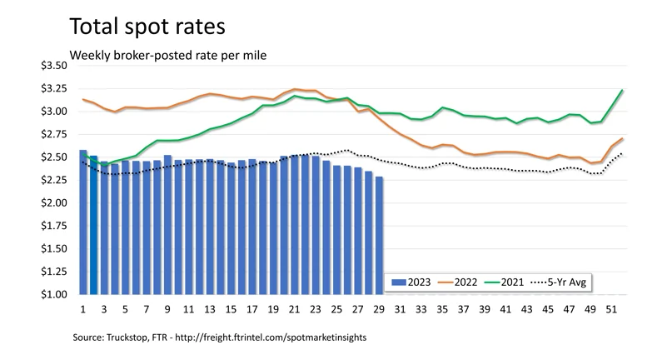

Spot market rates resume declines

Recent analyses suggested U.S. spot market rates had bottomed, but such rates resumed their declines across all equipment types in the week that ended July 21. Truckstop and FTR Transportation Intelligence reported that it’s not clear if the recent declines are something beyond typical seasonal easing.

“Historically, spot rates for dry van and refrigerated equipment flatten out by the end of July, so the next several weeks will be key in assessing the market’s strength,” the companies wrote in an analysis. “Dry van rates are about eight cents higher than the recent bottom, which was the week before mid-May’s International Roadcheck event. Refrigerated rates are still more than 18 cents above the recent bottom in mid-April. Flatbed rates, which also typically ease during July and August, were once again at their lowest level since August 2020 in the latest week.”

An uptick in truck postings coupled with a decline in loads resulted in an overall Market Demand Index reading of 48.6, which they say is the lowest level since the week of last U.S. Thanksgiving.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Good article James.

How are you doing these days?

Cheers,

Roy