Economic Trucking Trends: Freight recession lingers, but economic growth to improve

It was a busy week for trucking-related economic data, which painted a mixed picture. Canadian spot market volumes were steady, but spot market rates in the U.S. remained weak – especially for flat-deckers.

For-hire truck tonnage, reflecting contract freight, was up for the second straight month but still in freight recession territory.

Trailer orders slowed, as expected, with cancellations on the rise. But ACT Research suggests this can be attributed to dealer inventory management more than declining fleet demand.

And on the macro-economic side, the Canadian Federation of Independent Business (CFIB) released its economic update that projects improving economic growth in Canada and declares there’s “no recession in sight.”

Let’s take a deeper look…

Tonnage growth improves

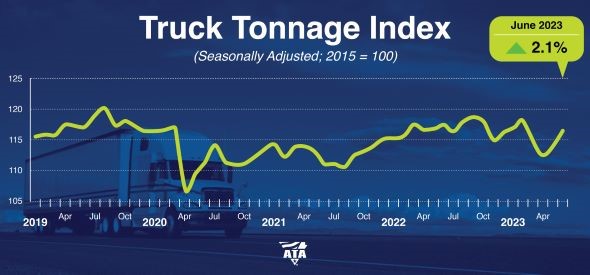

U.S. for-hire truck tonnage ticked up 2.1% in June, according to the American Trucking Associations (ATA), on the heels of a 1.2% increase in May.

The increase is welcomed, but still nothing to get overly excited about.

“While the tonnage index increased in both May and June, it remains in recession territory,” said ATA chief economist Bob Costello.

“The index continues to fall from a year earlier and is off 1.9% from its recent peak in September 2022. A multitude of factors have caused a recession in freight, including stagnant consumer spending on goods, lower home construction, falling factory output, and shippers consolidating freight into fewer shipments compared with the frenzy during the goods-buying spree at the height of the pandemic. However, the magnitude of the year-over-year declines is improving, perhaps pointing to a bottom in the freight market.”

Despite the month-over-month rise, seasonally adjusted tonnage was still down 0.8% year-over-year (YoY), marking the fourth straight YoY decrease.

Tonnage: The longer view

The ATA has issued its annual Trucking Trends report, which highlights trucking’s contribution to the U.S. economy. The industry moved more than 11.4 billion tons of freight in 2022, generating more than US$940 billion.

“While 2022 was a challenging year for trucking in many respects, the industry still posted growth in revenue, tonnage, employment and several other measures,” said Costello. “In addition, by share of freight revenue and tonnage, trucking remained by far the dominant mode of transportation in the country.”

Trucks moved 61.9% of the value of surface trade between the U.S. and Canada.

Spot market steady, but rates still weak

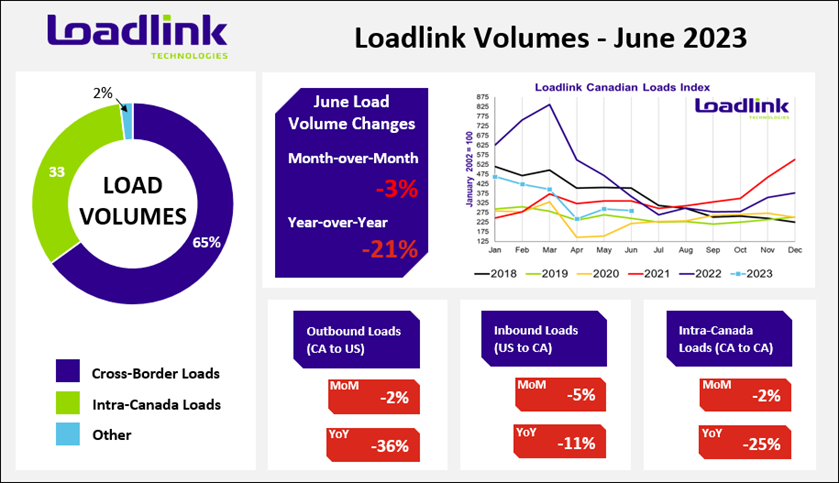

Canada’s spot market saw little change in June, with truck and load postings both stable, according to the latest data from Loadlink Technologies.

“While equipment availability continues at new highs, load postings show consistent, stable performance entering the summer season,” the company said in a release.

The truck-to-load ratio was 4.01, up just slightly from the 4:1 ratio posted seen in May. But it was up 59% from last June’s ratio of just 2.53 trucks per load.

In the U.S., spot market rates fell in the week ending July 14 for the seventh straight week, to the lowest levels seen since August 2020, according to Truckstop and FTR. Dry van rates fell the most since the third week of this year, and are now at their lowest levels since the week before May’s international Roadcheck inspection blitz, the companies report.

Falling flatbed rates have been pushing down the average, and they too were down further in the week ending July 14, reaching their lowest levels since January 2021.

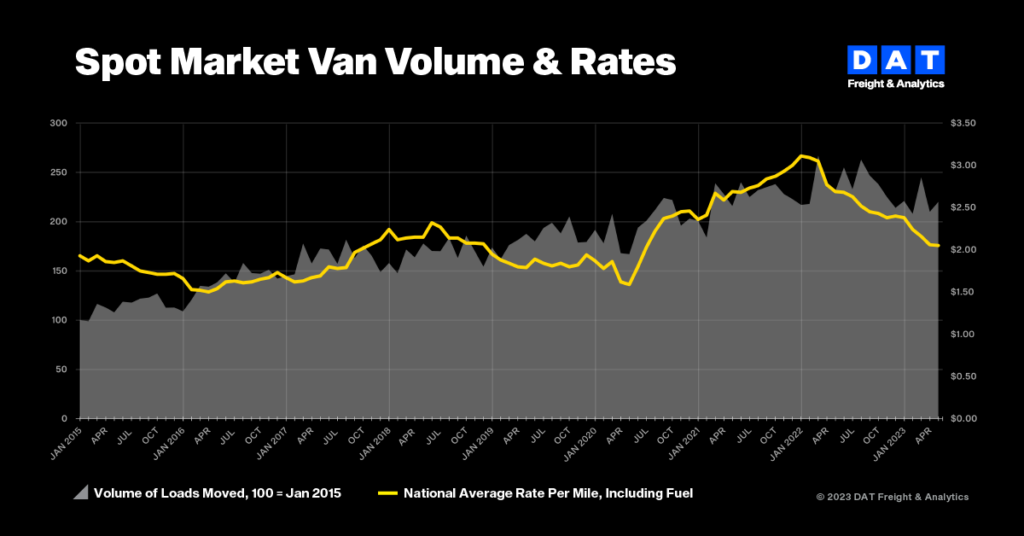

But if you’re looking at the moth of June as a whole, DAT Freight & Analytics has some more encouraging news to report.

“The gap between spot and contract rates was the narrowest since April 2022,” said Ken Adamo, DAT chief of analytics. “Spot rates for van and refrigerated freight increased for the third straight month, and volumes were almost unchanged from May. These are signs that spot truckload prices have reached the bottom of the current freight cycle.”

Here’s a segment breakdown compared to May rates (all U.S. dollars):

- Spot van rate: $2.08 per mile, up three cents (the first increase in five months)

- Spot reefer rate: $2.47 a mile, up three cents

- Spot flatbed rate: $2.61 a mile, down four cents

“Demand for truckload services typically slows at this time of year, but this could change quickly given the threat of strikes in the parcel and less-than-truckload sectors,” Adamo said. “Shippers are putting contingency plans in place and would look to freight brokers and carriers on the spot market to keep their line haul operations moving. Demand for trucks would jump, especially around Louisville, Memphis, Indianapolis, Dallas and other major parcel hubs.”

Trailer orders down, cancellations up

Preliminary data from ACT Research shows trailer orders fell to 6,300 units in June.

“Preliminary net orders were 34% lower compared to May’s intake, and down 75% versus the same month last year,” said Jennifer McNealy, director – commercial vehicle market research and publications at ACT Research. “Seasonal expectations suggest orders are likely to remain soft the coming few months, particularly given near record-level order backlogs. Trailer manufacturers normally spend mid-year working down the backlog ahead of the next year’s full-order-board opening.”

She added, “Albeit against strong comparisons, demand is softening, but with 2024 orderboards just beginning to open, it is no surprise that net orders in June were the lowest they’ve been so far this year. That is simply part of the cycle. However, we’re seeing increased and broad-based cancellations, but we’re hearing that much of this is a dealer stocking issue, rather than a general decline in fleets’ appetite for equipment. Since backlogs remain relatively healthy, most fleets needing trailers remain in queue.”

‘No recession in sight’

A new quarterly economic report from the CFIB paints a more encouraging picture of the broad-based Canadian economy. It expects economic growth to slowly rebound to 1.4% in the third quarter, with “no recession in sight” for Q3.

The report also sees CPI inflation continuing its downward trend.

“Key macroeconomic indicators, such as GDP, retail sales and inflation, appear to be moderating. We forecast that Q3 inflation, both total and core, will be within or likely very close to the Bank of Canada’s inflation-control target range of 1-3%,” said Simon Gaudreault, CFIB’s chief economist and vice-president of research. You can read the full Main Street Quarterly report here.

The last word

We’ll turn it over to Murray Mullen, chairman of Mullen Group, for the final word in this installment. He discussed Q2 results with analysts Thursday and had this to say about what’s happening in the Canadian economy and why the industry is still mired in a freight recession:

“[Businesses] realized late last year they miscalculated their supply chain requirements, and began to right-size inventory levels after ordering way too much in 2021-2022. This led to lower freight volumes and more competitive pricing in 2023, which is the exact opposite of last year,” Mullen explained. “We went from a freight boom in 2022 to a freight recession in 2023, all within a few quarters.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.