Economic Trucking Trends: Class 8 orders remain strong, potentially prolonging trucking’s pain

Conditions for truckers continue to be tough, but shippers aren’t throwing any parties, either. Rising fuel prices are hurting both truckers and shippers, with FTR’s Shippers Conditions Index plunging into negative territory for the first time in nearly a year.

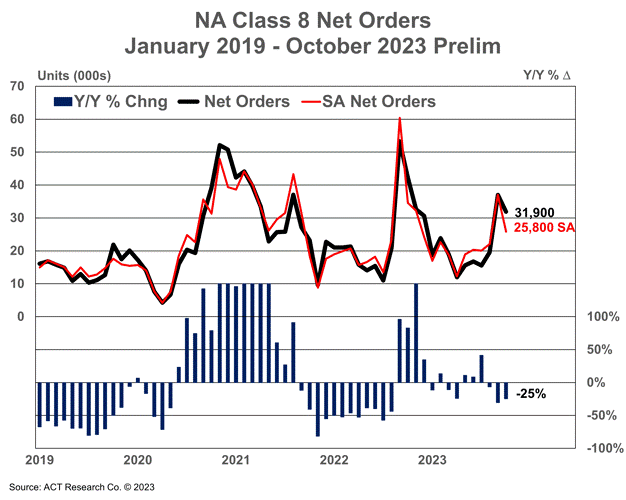

Meanwhile, fleets continue to have a healthy appetite for new equipment in 2024. While this may represent replacement demand, continued strength in Class 8 truck orders could prolong current freight market conditions that are characterized by excess capacity, according to ACT Research.

Class 8 orders reflect different ‘vibe’

Preliminary Class 8 truck orders totaled 31,900 units in October, which when seasonally adjusted would amount to a still-above-trend 25,800, according to ACT Research. It’s good enough to grow order backlogs, but OEMs have less buffer than they’ve been accustomed to over the past two years.

“A strong seasonal factor presses down on ‘real’ orders this month, with seasonal adjustment dropping October’s intake to 25,800 units, still good for the third-best order month in the past 12 months,” said Kenny Vieth, ACT’s president and senior analyst.

“The Class 8 backlog should rise by around 3,400 units when full October data are released in mid-November. If those numbers hold, Class 8 backlogs will have ended October at around 165,000 units. Even though backlogs, in seasonal fashion, are rising, they continue to point to a different market vibe heading into 2024. As we head into 2024, the absence of the large backlog cushion the industry has enjoyed the past two years underscores the importance of seasonal order activity in the coming months.”

Strong equipment orders could prolong freight market downturn

ACT Research, citing the Cass Freight Index and Cass Truckload Linehaul Index, indicates the freight cycle is starting to flatten, with smaller year-over-year declines. That’s the good news. But as new equipment production continues at a steady rate with still-lengthy backlogs, the trucking market may stay oversupplied.

“We continue to expect the freight cycle to turn once capacity tightens, but early signs of 2024 equipment production suggest that may be a while,” said Tim Denoyer, ACT Research’s vice-president and senior analyst.

“Even as the freight demand cycle should improve in 2024, the demand outlook remains soft for this winter as the industry continues to add equipment capacity into an oversupplied market. Class 8 orders over the next few months will be pivotal in setting the tone for capacity and rates in 2024.”

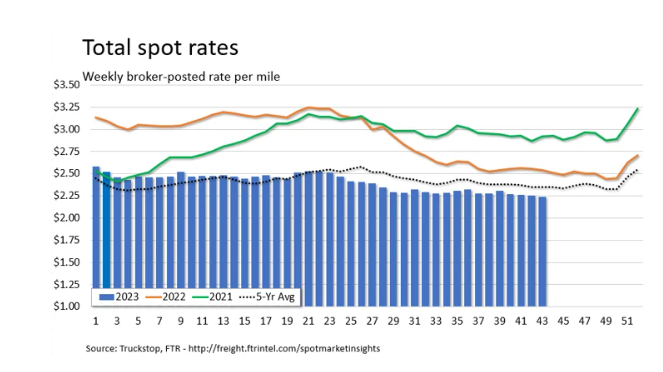

Spot market closed October with a whimper

Spot market rates continued to be weak in the week ended Oct. 27, but are at least stabilizing. Truckstop and FTR Transportation Intelligence analyzed the latest spot market data and indicate a traditionally weak month of October closed out, well, weak.

“The month of October traditionally is weak for rates, so the next few weeks leading into (U.S.) Thanksgiving will be a test of the market’s strength, especially for dry van and refrigerated equipment,” the companies suggest.

“In the latest week, total market rates were down for the fourth straight week. Refrigerated spot rates returned to their downward trend after a one-week increase. Dry van and flatbed saw slight increases in spot rates.”

A tepid spot market was worsened by a “notable increase” in truck postings, softening the Market Demand Index to 48.3, its lowest reading since August.

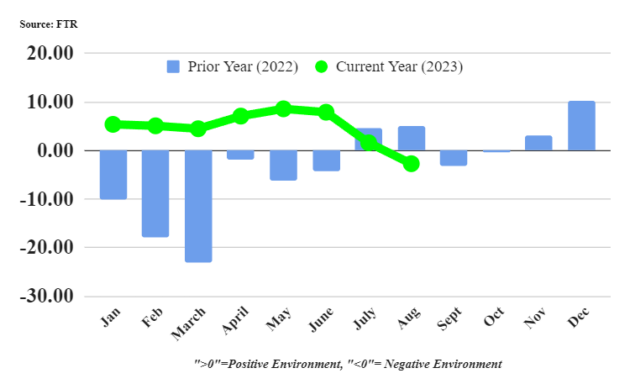

Shippers pinched by rising fuel costs

Freight market conditions aren’t binary, and yes, it’s possible for truckers and shippers to suffer together. FTR’s August Shippers Conditions Index (SCI) plummeted to its first negative reading (-2.7) since October 2022 on rising fuel costs.

For comparison, FTR’s Trucking Conditions Index also plunged in August to a -12.54 reading due to the double-whammy of rising fuel prices and lower freight volumes.

Speaking to the SCI, FTR’s vice-president of rail and intermodal Todd Tranausky said: “The decline was almost entirely the result of higher diesel prices as overall capacity remains abundant across modes. But diesel prices pushed up rates and fuel surcharges leading to a less favorable environment for shippers. It is possible that diesel prices stay elevated for an extended period of time.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.