Economic Trucking Trends: What are equipment orders saying about trucking conditions?

There has been lots of doom and gloom surrounding North American trucking conditions in recent months, but what are truck and trailer orders telling us about fleets’ appetite for new equipment? Let’s take a look.

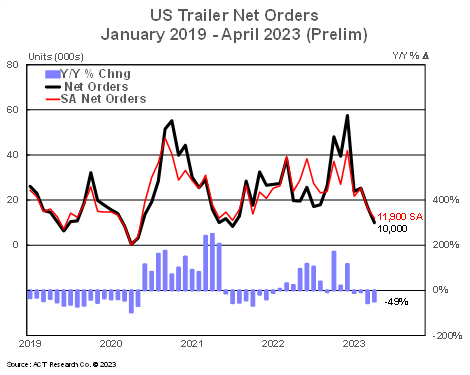

Trailer demand plunges

ACT Research reported preliminary data this week showing net trailer orders totaled 10,000 units in April, marking a substantial decline from March numbers.

“Preliminary net orders were 41% lower compared to March’s intake, and down 49% versus the same month last year,” said Jennifer McNealy, director commercial vehicle market research and publications at ACT Research. “Seasonal expectations called for orders to pull back in April, particularly given the near record-level order backlogs and supply chain challenges being experienced by the industry.”

McNealy added: “Demand appears to be softening, albeit against strong comparisons. That said, backlogs remain robust. For the time being, the industry is still wrestling with lingering supply chain challenges, although signs of improvement are seen monthly, and fleets needing trailers remain in queue for orders already placed, with backlogs for most trailer categories still near the top of their target ranges.”

Weaker orders are helping to shrink the trailer backlog to about 213,000 units, ACT reports, down about 16,500 units in April if its projections hold true.

What about trucks?

Truck OEMs are eating into backlogs as orders are weakening, 2024 order boards have yet to be opened, and easing supply chain challenges are allowing build rates to increase. ACT Research reports that like trailers, Class 8 truck backlogs should decrease by about 15,100 units in April.

“As supply conditions have improved, so has output. Evidencing this trend, heavy-duty and medium-duty production each exceeded build plans (again) in April,” said Eric Crawford, ACT’s vice-president and senior analyst. “The Class 8 build rate in April was 1,384 units per day, 6% above industry build plan. The industry produced 26,302 Class 8 units across April’s 19 production days. Classes 5-7 build averaged 1,192 units per day, 13% above build plan. April’s build rate was the highest in nearly four years (since August 2019). The industry produced 22,650 units across April’s 19 build days.”

Retail sales remain “robust,” ACT reported, rising double digits in April for both heavy- and medium-duty categories.

“We expect positive momentum to slow in second half 2023, as the impact of prior Fed rate increases takes hold [and additional rate increases may still be yet to come], and the cumulative impact of depressed freight rates over an extended period weighs on pent-up demand,” Crawford concluded.

How’s that spot market holding up?

Loadboard Truckstop and industry forecaster FTR reported this week that the week ending May 12 saw a continued softening of broker-posted spot rates in the dry van and refrigerated segments, giving back about half the gains the spot market saw the prior two weeks.

Dry van rates have declined in nine of the past 10 weeks, though the rate of decreases is slowing, Truckstop reports. Flatbed is also weakening, seeing its second straight week of declining rates, something that hasn’t happened since January.

We should have better news next week, but it may be a mirage caused by the capacity disruption resulting from the Roadcheck enforcement blitz.

Light at the end of the tunnel?

While trucking conditions have been tough, ACT Research says there’s a light at the end of the tunnel, with demand fundamentals improving and capacity beginning to tighten.

“With produce season arriving late this year and the freight market likely passing the peak of the destock, freight demand is near the bottom,” said Tim Denoyer, ACT Research’s vice-president and senior analyst. “With inflation easing, improving real income trends will allow for a bit more holiday spending this year, when even less destocking will mean more freight volume.”

Regarding fleet capacity, Denoyer added, “Interstate operating authorities are contracting at a record rate, with about 11,000 net revocations since last October, including about 1,600 net revocations in April. Total revocations were about 10,800 in April, near record levels, though grants and reinstatements are also elevated. This is beginning to tighten capacity, which will also help spot rates find the bottom and begin to rise.”

Denoyer concluded, “The intersection of additional volume and tightening capacity underpins our forecast for a near-term bottom in spot truckload rates. We’ve been expecting the bottom roughly around this month since we introduced 2023 spot rate forecasts 16 months ago, and we still think Roadcheck this week will help usher in a new freight cycle.”

The final word

Amid these challenging economic conditions, Titanium reported earnings this week grinding out a $3.6 million profit in the first quarter, albeit a decline of 40%. Still, industry leaders don’t cower in the face of tough conditions, they seek out opportunities to improve and grow their business.

Titanium CEO Ted Daniel was unfazed by industry conditions and opportunistic about the possibility to make an accretive acquisition.

“It’s likely the North American economy will continue to face strong headwinds, which will undoubtedly cause turmoil within the transportation industry as well,” he acknowledged. “We are poised to not only navigate our core business through these challenges but also to capitalize on potential accretive [acquisition] opportunities.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.