Economic Trucking Trends: Tough times for flatdeckers, used truck prices normalizing

As we head into the long weekend, it’s better to be a shipper than a carrier. At least if you’re relying on the spot market to find or move freight. Shipper conditions improved according to the latest data, while rates remained tough on the spot market – especially if you’re seeking flatbed loads.

Used truck sales are still strong in the U.S., but prices are coming down for highly elevated levels last year. The good news for buyers is there’s more inventory and at more reasonable prices.

Good news for spot market van haulers…flatbed, not so much

The week ended June 23 showed strength in the U.S. spot market for van and reefer haulers, and weakness for those looking for flatbed loads.

Loadboard Truckstop noted dry van and refrigerated loads saw pricing strength during the week, while flatbed rates fell sharply. For flatbeds, it was the largest price decrease seen since March. But van rates were the strongest since mid-May, Truckstop reported.

“The real test of van rates’ strength will be the current week, however,” the company noted. “Spot rates during the final week of June typically are the strongest of the year for refrigerated and dry van except for rates during the December holiday period. This week will need to produce large rate gains for both equipment types if they are to match seasonal expectations, but that result is not out of the question.”

Check back in this space a week from now to find out.

How are shippers faring?

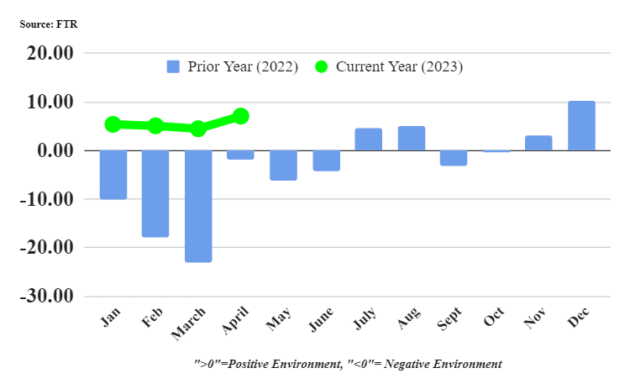

Conditions for shippers improved in April, according to FTR’s Shippers Conditions Index (SCI), which climbed to 7.1 from a 4.5 reading in March.

The improvement in shipper conditions resulted from a weaker freight rate environment and reduced carrier utilization, which more than offset stronger freight demand and slowing fuel costs decreases in April.

Shippers are expected to remain in a positive environment through mid-2024, predicts industry forecaster FTR.

“Shippers conditions improved in April as weaker rates and carrier utilization helped support shippers,” said FTR vice-president of rail and intermodal Todd Tranausky. “The outlook is for a firmly positive outlook for shippers in the economic balance of power between themselves and carriers for at least another 12 months. Economic uncertainty or a higher-than-expected amount of economic weakness could bump that time frame further out into the future and extend the good ride shippers have had over the last few months.”

Used truck prices coming back to Earth

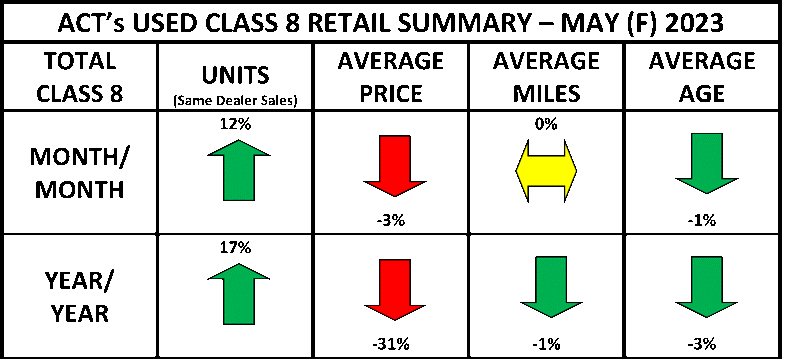

Retail sales of used Class 8 trucks in the U.S. indicate pricing is coming back down to Earth, while demand for used equipment remains high. ACT Research indicated same-dealer sales grew 12% in May from April levels, but the prices were down about 3% on the month and 31% compared to this time last year.

“Sales usually slow 4-5% in May, so the increase was not only uncharacteristic, but also presents a bit of a conundrum in the context of the current economic and freight environments,” said Steve Tam, vice-president at ACT Research. “As owner-operators and smaller fleets in particular exit the industry, inventory continues to increase. This is providing remaining fleets with more options than they have had in a long time.”

Auction sales were up 32% in May, ACT reports.

Tam concluded: “Despite the current anemic economic and soft freight conditions, the comparison highlights just how tough conditions were in 2022 with respect to scarce inventory. As the year progresses, the year-to-date scenario also continues to diverge from last year.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.