Mixed bag for Canada’s spot market in March

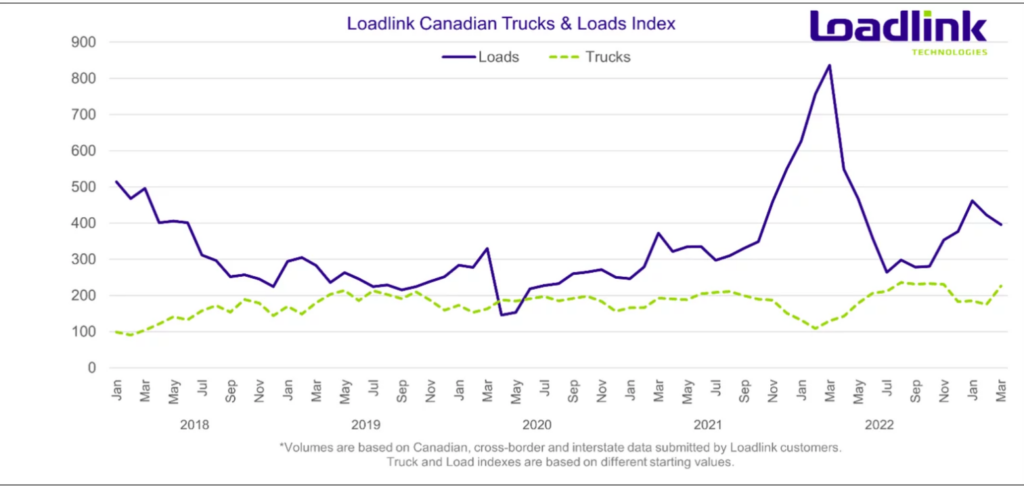

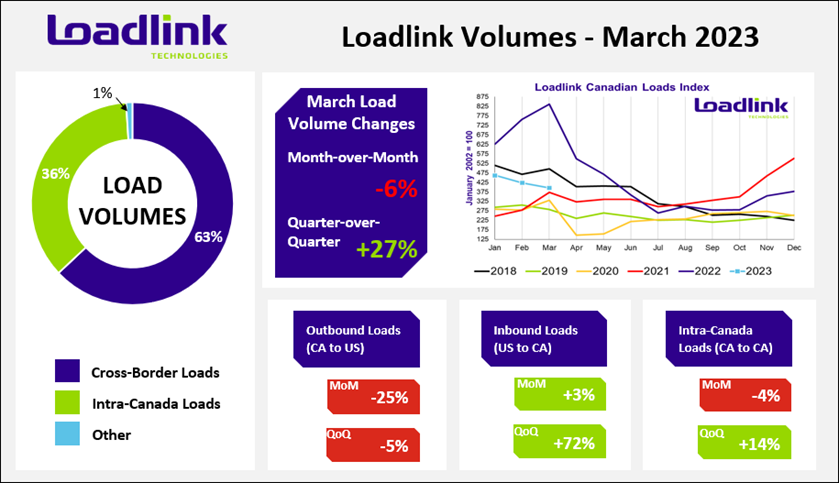

Canada’s spot market softened again in March, with load volumes down 6% from February levels and 53% year over year.

Meanwhile, truck postings surged 29% from February, with 2.51 trucks posted for each load on Loadlink’s load board.

But Q1 load volumes were up 27% from the fourth quarter of last year, with truck volumes down 9%. The best-performing segment came from a 72% jump in northbound cross-border loads. But Q1 volumes were still 42% off record highs in the first quarter of last year.

“Year-over-year comparisons look vastly exaggerated as load volumes in Q1 2022 were record highs for Loadlink’s history,” Loadlink Technologies said in a release. “Due to lifted Covid-19 pandemic restrictions and a reinvigorated economy, load volumes in February and March 2023 were almost double what they are currently. Despite that, Q1 2023 volumes still have been higher than all other months in 2022 since June onwards, so current freight market conditions should not be underestimated despite poor annual comparisons.”

The truck-to-load ratio of 2.51 was 38% higher than the 1.82 trucks per load posted in February, while the ratio surged 268% from the 0.68 trucks per load posted last March. The first quarter of this year saw an average of 2.03 trucks posted per load, 29% lower than the 2.88 posted in the fourth quarter.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

I don’t think I would, or the industry as a whole should, give too much credence to these numbers. The article appears to infer all loads, and all trucks, are posted on LoadLink which is patently false. Also, there is no mention of accounting for loads that are double-brokered, or for same loads that are posted by several different brokers, and/or carriers.

However, it is quite likely that, as carriers have witnessed themselves, the trend appears correct, in that at the current moment there are more trucks available than there are loads.

I would have expected the magazine, in its efforts to provide accurate, timely, and useful information, to make use of a more authoritative source of information.

In my opinion, publishing LoadLink’s numbers, without the appropriate disclaimers, is little more than sensationalist journalism. Something the industry does not need these days.

Just my humble two cents worth.