‘Stagnant’ trucking market expected in 2024: FTR

Steady consumer spending habits and falling diesel prices could prolong a capacity surplus affecting the trucking industry well into 2024.

Speaking during a State of Freight webinar by FTR, Avery Vise, vice-president of trucking for the industry forecaster, said there’s not much to be excited about in the current freight environment, but nor is a collapse in trucking demand anticipated.

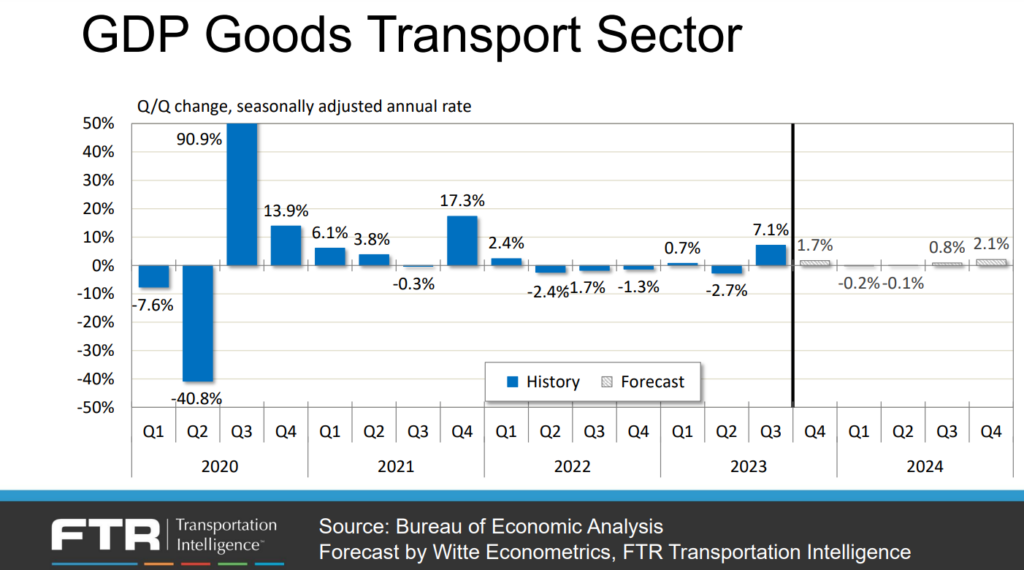

The goods transport segment of U.S. GDP was flat last year and forecast to grow just 1.2% in 2024. Vise said increases of 2% or more are needed to give trucking demand a noticeable lift. Still-strong employment numbers should support continued consumer spending, he added.

Truckers could get a near-term boost from the restocking of retail inventories, but don’t expect it to last, Vise warned.

“Overall, we are sort of lean,” Vise said of retail inventory levels, which have returned to pre-pandemic levels. “Any benefit we get from restocking is only going to be temporary and at best, will offset some of the near-term weakness.”

Inventory restocking

Eric Starks, FTR chairman, noted high interest rates will deter retailers from overstocking.

“The likelihood we see a bloating of inventory is probably very low because of interest rates,” he said. “Holding onto inventory costs money.”

Industrial production in the U.S., another freight driver, remains weak. Or as Vise said, “Just sluggish. Not horrible, but certainly not good.”

The year ended Dec. 31 saw U.S. GDP grow about 2.5% (with Q4 data yet to be released), and FTR is anticipating growth of just 2% this year. Stripping out the goods transport portion of GDP, Vise said 2023 was flat and will be down about 0.3% this year. Dry van loadings were up about 0.5% in 2023 and should climb about 1% this year, Vise predicted.

Capacity ‘elephant in the room’

But the “elephant in the room,” he added, is excess capacity and how quickly it will exit the market to bring freight demand back in line with trucking supply.

“Capacity is where things are going to change in the coming year,” he said. “We don’t see a lot of reason to expect big increases or decreases in freight volumes.”

The fourth quarter of 2023 saw the largest net decrease in the carrier population ever recorded in the U.S. However, there remain about 100,000 more FMCSA-registered carriers today than prior to the pandemic.

Payroll employment in the general freight truckload segment remains high, Vise noted, indicating many of the carrier exits have seen those drivers redistributed among large fleets.

Looking at active truck utilization, FTR said the industry is near pre-pandemic levels and forecast to remain steady.

“As we look ahead, the more important issue is that we are not really recovering very quickly,” Vise said of utilization, or the percentage of seated trucks engaged in hauling freight. “It is really going to be a very incremental increase in utilization as we progress through the year. Even by the end of the year we won’t be back to the 92% 10-year average based on where things are going.”

Rates outlook

Spot rates have bottomed, FTR says, after falling 16% in 2022 and another 19% last year from 2021 levels that were up 28%. Spot rates are now in line with 2019 levels, but operating costs have risen significantly since then.

Contract rates fell about 7% last year after rising 13% in 2021 and 7% in 2022, Vise said. They’re expected to fall about 3% this year with gradual increases appearing later in the year. But like those carriers operating in the spot market, those enjoying the benefit of steadier contract rates have also seen costs rise sharply.

FTR also notes intermodal has lost its edge compared to trucking thanks to the softening conditions facing truckers. With capacity tight and rates surging in 2021 and early 2022, FTR said more shippers turned to intermodal to control costs. Now, competitive conditions between the modes are closer to neutral.

Vise said carriers can expect a “pretty stagnant” year overall. Capacity is expected to continue leaving the market, but slowly as diesel prices have come down in 10 of the last 11 weeks giving struggling fleets a lifeline. And there’s little reason to expect freight demand to rise – or fall – sharply.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.