Truckers, OEMs struggling to keep pace with demand: FTR

Freight demand is outpacing the trucking industry’s ability to attract drivers and acquire new equipment, which bodes well for rates going forward.

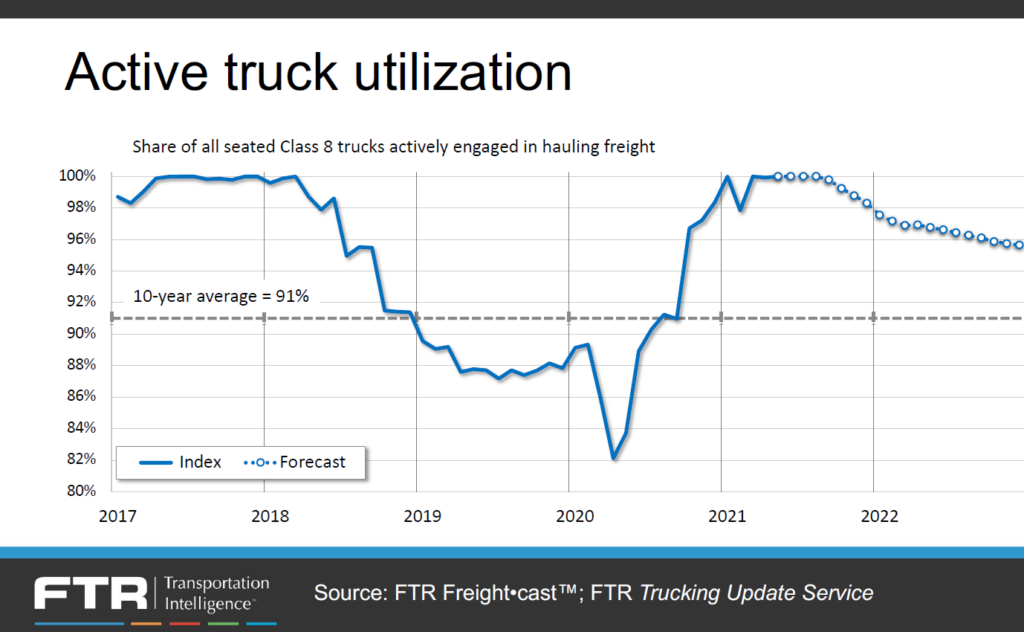

Industry forecaster FTR gave a market update July 8, which painted a bright immediate future for trucking. Avery Vise, FTR’s vice-president – trucking, noted capacity utilization is near 100%, well above the 10-year average of 91%.

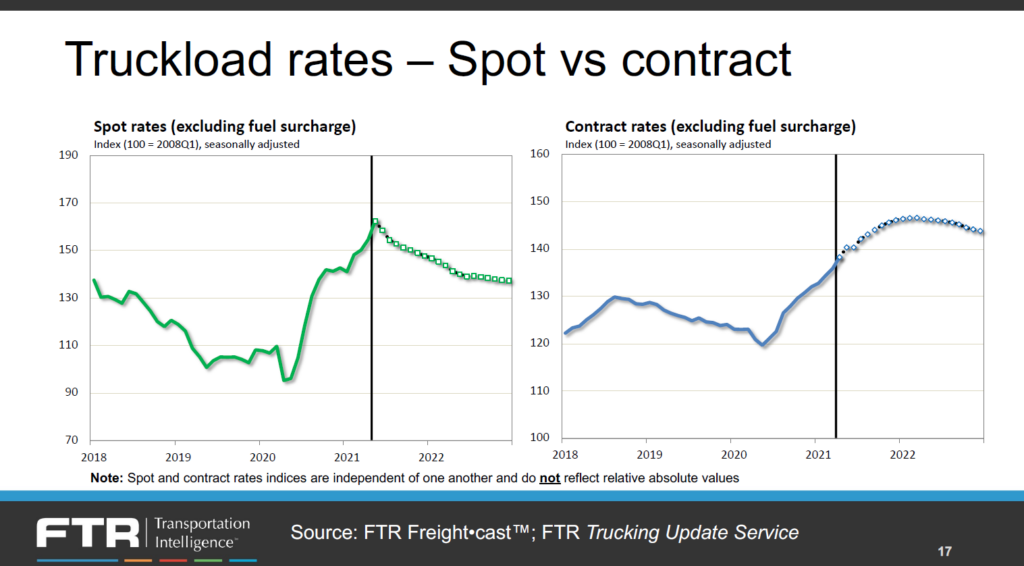

Spot market rates remain near record highs and contract rates are strengthening, Vise noted, pointing out the spot market provides real-time insights into rates but accounts for only about 30% of the freight hauled.

“Rates are close to record levels and are showing no clear signs of turning,” he said of the spot market.

The dry van and refrigerated segments are enjoying the strongest conditions, while flatbed has stabilized. Vise said FTR is projecting truck loadings, which have already returned to pre-pandemic levels, to grow about 7% this year. Meanwhile, he added, the industry will be challenged to increase the driver pool by 7%, which means truck utilization is expected to remain high.

“We see a strong rate environment for quite a while,” said Vise. “There is not much good news for shippers based on our current forecast.”

Conditions that are limiting the industry’s ability to add capacity include: a backlog of new entrants due to Covid-related closures of state licensing agencies and training centers; a plunge in the U.S. labor force participation rate due to generous unemployment benefits and early retirements; increased job opportunities in other industries; and the drug and alcohol clearinghouse that has sidelined more than 60,000 drivers so far this year.

The U.S. trucking industry is down about 38,000 drivers, or 2.5% seasonally adjusted, compared to February 2020.

Meanwhile, new trucking start-ups are surging to record levels in the U.S.

“Most of these [new] carriers are very small,” Vise said. However, they represent about 157,000 drivers over the past year.

Equipment scarcity

Normally, such lucrative conditions for carriers would see them adding capacity. However, supply chain issues are limiting truck and trailer makers’ ability to keep pace with demand.

Don Ake, FTR’s vice-president – commercial vehicles, said truck and trailer demand this year is similar to 2019, but build rates are much lower. On the truck side, he said this can be chalked up to a shortage of semi-conductors – there are 15-35 in each Class 8 truck – while trailer makers are experiencing shortages of other materials and labor.

Ake noted media and analyst reports on the semiconductor shortage are inconsistent, with some saying the backlog should ease in August and other saying they’ll last much longer.

“If you can’t get enough semiconductors, you can’t build enough trucks,” Ake reasoned.

Comparing 2019 Class 8 demand and build rates to this year, Ake noted there’s about a 40,000-unit gap in production, or 26%, which highlights the impact of the supply chain issues manufacturers are facing this year.

“There is no clear progress being made to catch up,” he said.

Economic outlook

The general economy in the U.S. continues to perform well, Vise noted, and the elements of GDP tied to goods transport are outperforming overall GDP growth.

Vise noted this could level out as consumers begin spending more money on services rather than goods, as consumer spending habits return to pre-Covid norms. But then again, noted Vise, increased spending on services improves employment and puts more money into consumers’ pockets.

“We are already seeing spending on services growing faster than on goods,” Vise said. “Will it mean a collapse in goods spending? We think that’s very unlikely.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

In 2019 too many new tractors and trucks were sold caused very low rates so many small transport companies lost money between Oct of 2019 to July of 2020. I am very glad that trucking is limited on many more units can be in operation. We need minimum freight and wage rates.

If nobody hires new drivers, why would people bother to get a CDL?

New drivers get used to the smell of urine as you will be smelling it everywhere you park. Drivers often dump full jugs of urine on the parking spot where they park as they are too lazy to dump in a field.

What a great job !

Canada needs more rest areas for truckers, four lane hwy’s , way better pay and much much more. Governments need to bench mark the US model, but there’s no political will at all levels. The many problems that all industries have been aware of for decades and still absolutely nothing has been done. Who in their right mind would ever consider truck driving as a career when stake holders are ignoring the bad working conditions of a trucker. I’ve been trucking for nearly 40 yrs and it’s the same old topics that I have been reading and there has been zero improvements. My suggestions as many professionals drivers tabled has fallen on deaf ears. And, that’s a shame.

A lot off drivers still collecting the dole so why would they come back before it’s time. They bring money in illegally from their country when they come as refugees pleading they have no money but they have enough to but down on a 1 million dollar home. There are lots of drivers in Canada you just have to pay them for the market no pay them peanuts and hope they can afford to stay. Cost of living went up 22% but o/o rates and drivers wages have not even come close.

Now eld lingering in the background the drivers will still make the same money even if they get a raise.

Before they were get 50cents and running 3000 miles now with eld get 70cents and only be able to run 2500 miles. The CTA and all the other trucking associations are creating a ticking time bomb for drivers leave all responsibility on the driver and pay them less well the corporate companies rake in millions.

And here we thought slave labor was over.