Canadian shops led in revenue growth, lagged in parts markups in 2023: Fullbay

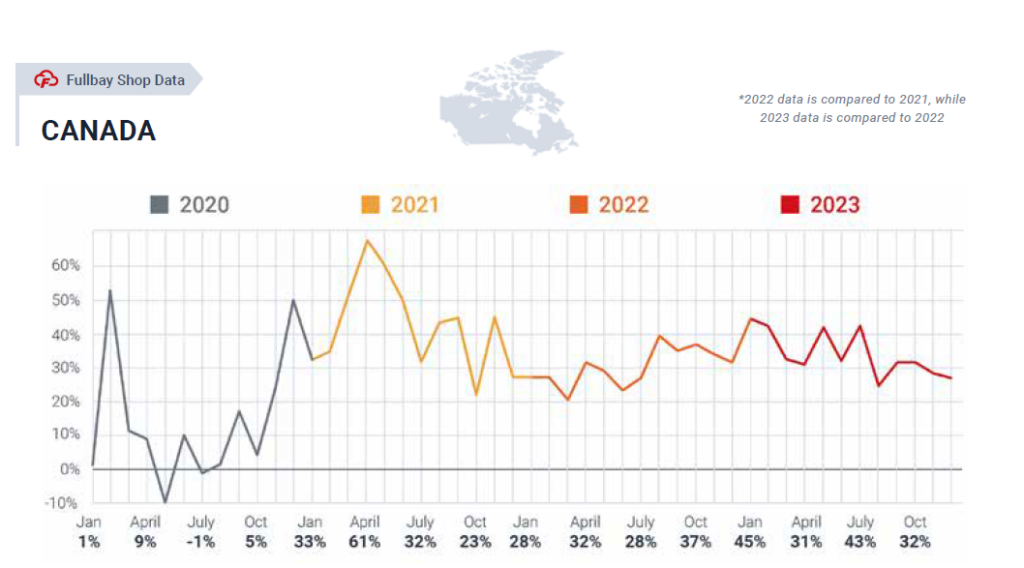

Canadian shops led other regions in growing revenue 35% in 2023, according to the latest Fullbay report, The State of Heavy-Duty Repair.

Meanwhile, Canadian shops that responded to the survey (about 120 of them), indicated their median labor rate grew from $125 an hour in 2022, to $133/hr in 2023, a 6% increase (Canadian shop figures are reported in Canadian dollars). This lagged the overall North American labor rate increase of 9%.

Technicians in Canada earned a median rate of $40 an hour, or an average of $32/hr. But the efficiency of Canadian technicians (how fast a tech completes a job) was the lowest of all regions contained in the report at 72%.

Canadian heavy-duty repair shops had the lowest parts markups and margins, at 26% and 20%, respectively. Those increased just 1% and 0.6%, respectively, from 2022.

These were some of the findings in Fullbay’s jam-packed annual report on the state of heavy-duty repair.

The report also found the industry continues to struggle to attract young talent. Only 23% of technicians are under the age of 31, while 47% are 31-45 years old. The good news is the majority are experienced, with 65% having more than 10 years of experience. That said, only 17% have less than five years of experience, reflecting the lack of new entrants to the trade.

Turnover continues to be a problem as well. Just 28% of respondents had been with their current employer for more than two years.

“There is massive turnover in the industry right now,” Peter Cooper, director of operations for Absolute Repair, Merx Truck & Trailer, said in the report. “Your stats show that 61% of employees have only worked at three or fewer shops, yet 35% have been at their job less than two years. That shows that our industry needs to focus more and more on keeping techs and stopping turnover. I feel that too many shop owners have all their focus on fixing trucks and not fixing their business.”

One way to address turnover is through benefits. The main benefit given to technicians is uniforms, at 71%, followed by health insurance (60%), paid vacation (55%) and flex time (44%).

Benefits important

“Benefits are very important to people,” said Jimmy Wall, general manager, Donahue Truck Centers. “I feel benefits are not a choice, but a mandatory investment any shop owner should have.”

The report noted technicians increasingly value flexible scheduling.

Most responding fleets (84%) don’t yet have a plan to service electric vehicles, while 45% of responding shop owners admitted to being “not at all familiar” with EVs.

Canadian shops were able to increase their invoiced work by 44%, leading all regions and resulting in a 12% revenue boost. Average invoices in Canada totaled $1,337. It took the average Canadian shop 2.4 days to begin a repair, up slightly from 2.2 days in 2022.

Mobile techs paid more

Of shops offering mobile service, 33% pay the technicians performing that work a premium.

“Mobile service sets your shop apart,” said Wall in the report. “It brings the shop to your customer. It is also a way to service customers quicker but also allow for a higher rate to do so.”

Canadian shops charged an average of $115 for DoT inspections. About 6% of respondents charged less than US$50 for that service.

“Offering DoT inspections free is an investment in highway safety and an opportunity to build lasting relationships,” offered Chris O’Brien, chief operating officer with Fullbay.

The full report can be downloaded here.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.