Mapping the future of autonomous trucks

If you want to gauge the recent interest in developing autonomous trucks, follow the money.

Tech startups and established OEMs alike have since early 2019 announced billions of dollars of funding for autonomous vehicle initiatives. This March, even the Canada Pension Plan (CPP) Investment Board was part of a $2.25-billion investment round in Waymo, the former Google self-driving car project that has expanded into trucking.

In other words, some of your retirement savings are banking that a future truck will perform selected driving tasks as well as you can. Maybe better.

“We’re aggressively ramping up our investment in the trucking application,” says Waymo’s product manager for trucking, Matt Carroll, a native of London, Ont. “We will likely see fully driverless trucks across the industry begin to hit the road within the coming years.”

Truck drivers are not expected to be replaced by such trucks anytime soon. Tests on some of today’s most sophisticated autonomous prototypes are focusing on clearly defined routes and tasks. But some of the required technical capabilities are already emerging in trucks on the market.

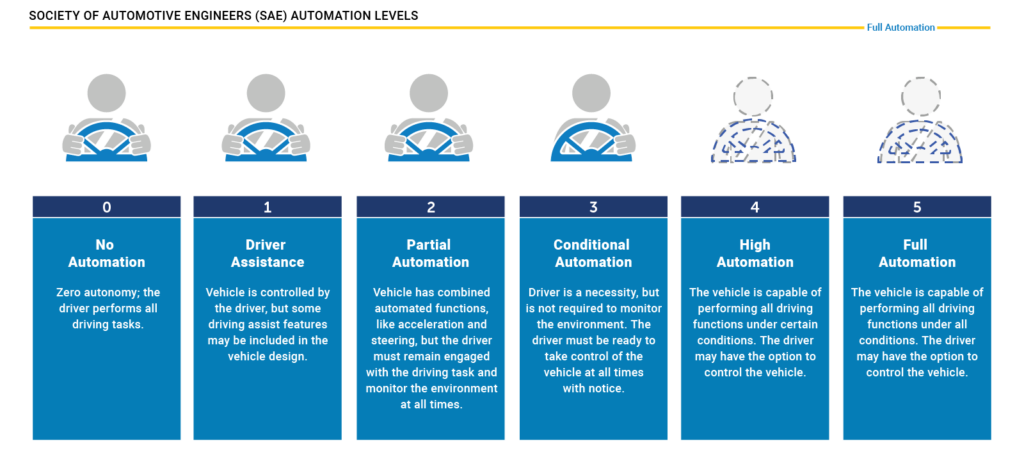

Freightliner Cascadia models with Detroit Assurance 5.0 can apply their own brakes, shift, and hold paths between highway markings. It’s admittedly more co-pilot than pilot. Warnings sound when drivers lift their hands off the wheel for too long. But it’s a quantum leap over traditional cruise control – and an interim step to the Level 4 autonomous trucks that will perform every driving function under specific conditions.

Daimler and Volvo have in recent months also unveiled dedicated business units to explore autonomous vehicle technologies. And Europe’s ZF, which has already demonstrated an autonomous shunt truck and container-hauling configuration, has been named a manufacturing partner for TuSimple, one of the largest tech startups focused on the vision.

“We have experienced a significant increase in inquiries from customers,” said Volvo president and CEO Martin Lundstedt, during the launch of Volvo Autonomous Solutions. “It is a logical next step for us to gather expertise and resources in a new business area with profit and loss responsibility to take autonomous transport solutions to the next level.”

Autonomous vehicle tests

For some companies, that next level involves taking test vehicles onto tracks and even the open highway. TuSimple’s fleet of 41 autonomous-capable trucks are pulling 13 loads per day between Arizona and Texas. It’s teamed up with UPS, Penske Truck Leasing, U.S. Xpress and McLane to launch an Autonomous Freight Network by 2024, consisting of autonomous trucks, digitally mapped routes, strategic terminal locations, and a proprietary monitoring system.

“The potential for automating driving is just amazing,” said Daimler AG truck and bus leader Martin Daum, when recently announcing the OEM was taking a majority stake in Torc Robotics – a business developing the artificial intelligence (AI) needed to read the road and make driving decisions.

“It’s a giant leap in terms of technology advancement.”

– Suman Narayanan, Daimler Trucks North America

Suman Narayanan, DTNA’s director of engineering – autonomous technology group, refers to Torc’s primary contribution as a “software stack” that draws on data collected through radar, lidar and cameras. Related successes were some of the keys to developing the Asimov system for self-driving cars, and supported Caterpillar’s retrofit of autonomous mining trucks.

“It’s a giant leap in terms of technology advancement,” Narayanan says of the shift from Level 2 to Level 4.

The limits of technology

But even those who develop autonomous vehicle systems stress the limits to the technologies. The need to focus on defined operating areas tops them all.

“Our focus is not on urban traffic,” Narayanan said as an example, noting that the early applications will be specific highways. “We want to start where we can maximize value.”

“No one will lose their job with this technology,” agrees TuSimple head of government and public affairs Robert Brown. He’s confident that someone starting a career as a truck driver today would still retire behind the wheel, with emerging systems focusing on routes like those between distribution centers. “We’re not talking dense urban downtown Vancouver or something like that.”

“We’re not removing brake pedals and steering wheels from the vehicles,” he adds.

One high-profile prototype did remove the cab, though. Volvo’s Vera is better described as a self-directed chassis rather than a truck.

Sasko Cuklev, director – autonomous solutions at Volvo Trucks, says its first assignments will involve shuttling containers a “short distance” from a Swedish logistics center to a port. It’s the type of work that he envisions as an early adopter of autonomous technologies: “Hub-to-hub applications with shorter distances, repetitive flows, high volumes of goods, lower speed, typically A-to-B transport. For example, from a port to a distribution center, port to a manufacturing plant, or in between distribution centers.”

The port settings align with a term Brown uses to describe the role of autonomous trucks: “Intermodal 2.0”. Truck drivers would still interact with equipment at both ends of any trip, supporting things like pickup and delivery applications. People would still be needed for support, oversight, inspections, deployment, and arrival.

In the process, the technologies would offer an extra level of safety systems, combining the unblinking eyes of things like cameras and lidar, and introducing responses that are faster than human reflexes. Throughout a conversation, Narayanan repeatedly refers to the technology as a layer of safety, comparing it to things like hours of service rules and other driver assistance systems.

“We also see the need to addressing the monotony that some of the highway driving can bring,” he says.

Platooning promise or limits

Other potential gains have been a matter of debate. The higher level of autonomous controls would be central to platooning, which involves tucking tractor-trailers from nose to tail, closing gaps in the name of aerodynamics.

Daimler abandoned that concept, arguing that the fuel economy gains are lost in real-world settings, as platoons break apart and re-establish themselves in traffic. Volvo has tested platoons with FedEx, but Cuklev declined to comment on early lessons.

In the midst of it all, some other autonomous vehicle initiatives have stopped dead in their test tracks.

Uber paid US $600 million to acquire Otto, which made headlines with a hands-free shipment of Budweiser beer in 2016. But it dropped the idea of autonomous trucks shortly after inking a legal settlement with Waymo, which had accused former employee and Otto founder Anthony Levandowski of stealing information.

Meanwhile, Starsky Robotics shut down earlier this year, only months after sending a truck 15 kilometers down a Florida expressway without a driver in the cab. Driving at both ends of the trip was accomplished remotely, with an operator working controls in an office setting. In the wake of the closure, company founder Stefan Seltz-Axmacher openly questioned factors that attract investors, and highlighted the slow advance of artificial intelligence.

“The space was too overwhelmed with the unmet promise of [artificial intelligence] to focus on a practical solution,” he wrote in a blog for Medium. “As those breakthroughs failed to appear, the downpour of investor interest became a drizzle. It also didn’t help that last year’s tech IPOs took a lot of energy out of the tech industry, and that trucking has been in a recession for 18 or so months.”

“The systems cannot have faults that require the human to intervene,” he said. “The reliability of the vehicle needs to be second to none.”

Like a ‘phenomenal’ truck driver

The goal is for autonomous vehicle systems that do everything a “phenomenal” human driver does today, Narayanan says, referring to the need for redundant systems.

“Right now, the failsafe we have in our truck is a human driver,” he continues. They know how to respond to an ABS warning lamp in the dash, for example. “We must have a brake system or steering system that is built in such a way that they can monitor their health constantly.”

There’s no room for error. Any failures could be disastrous.

While autonomous truck test have been spared high-profile accidents, the same can’t be said for autonomous cars. Elaine Herzberg was struck and killed by an Uber test vehicle in Arizona. A Tesla traveling in its “autopilot” mode failed to identify the side of a white trailer. Such collisions also seem to combine technical failures and operator error. The drivers behind the wheel tended to be engaged in other activities, like watching movies.

Ongoing barriers are not limited to technology alone.

“We can handle pretty wild weather,” Brown insists, referring to successful tests that have ranged from high winds to night driving. The one notable exception is finding a way to track vehicle positions in snow. “It’s definitely on our road map.” It’s just not there yet.

“Surface streets are a much more challenging domain compared to freeways since they tend to be more unstructured, the differences between one and another tend to vary more — while highways are pretty similar to one another — and there are more long-tail events to consider,” says Waymo’s Carroll.

The practical considerations don’t end there. Who would a CVSA inspector or law enforcement officer interact with when a Level 4 truck controls itself, Brown asks. Issues like that would likely leave any autonomous trucks in the hands of specialized users.

‘A very sticky relationship’

“It’ll be a very sticky relationship, so with won’t be like you can buy a truck and just run it,” he says of TuSimple’s model. “There’s data infrastructure. There’s a lot that goes into this, the mapping, so it can’t just be, ‘buy a truck off the shelf.’”

The rules that govern such trucks need to evolve as well, even though they are expected to share routes traveled by human drivers. But there has been movement. The U.S. Federal Motor Vehicle Safety Administration has already unveiled some of the guidance that vehicle developers need to follow.

“We are seeing significant investments in more advanced Automated Driving Systems (ADS) that might one day allow vehicles to drive themselves and thereby have the potential to greatly reduce the number of fatal crashes involving human error or poor choices,” NHTSA acting administrator James Owens said in November, in testimony before the U.S. Senate Committee on Commerce, Science and Transportation.

“But as with any revolution, these developments also carry uncertainty. Advanced technologies may not always work as designed or advertised… If the history of other vehicle technologies is any guide, some versions of these technologies will work better than others.”

Early in 2018, Canada’s Senate Committee on Transport and Communications expressed concerns that Canada is ill-prepared for the arrival of autonomous vehicles, too.

“It is not a matter of if,” the Senate report concluded, “but when more sophisticate automated and connected vehicles will arrive on Canadian roads.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

I worked as DPO (dynamic positioning officer) on board ships. The technology uses multiple redundancies, 3 Gyros, wind sensors, 3 computers and many many more apart from all sophisticated software, fail safe solutions. And guess what there needed to be min. 2 DPOs (one senior one assistant) all the time on the bridge as all possible impossible happen. I cannot imagine fully automated trucks on the road unless there are seperate highways away from other traffic. First of all GPS system may give problems, equipment can give problem, there can be wrong doing, sensor fault and you name it. One mistake can lead to possible several fatalities with 40 ton truck. One accident with fully automated truck will set the whole industry decades backwards with public acceptance. This technology cannot work parallely with other traffic.