Zero-emission truck models surge, orders hold steady during Covid-19

TORONTO, Ont. – The market for zero-emission truck models is hardly a zero-sum game. In fact, the number of electric vehicles available in Canada and the U.S. continues to surge.

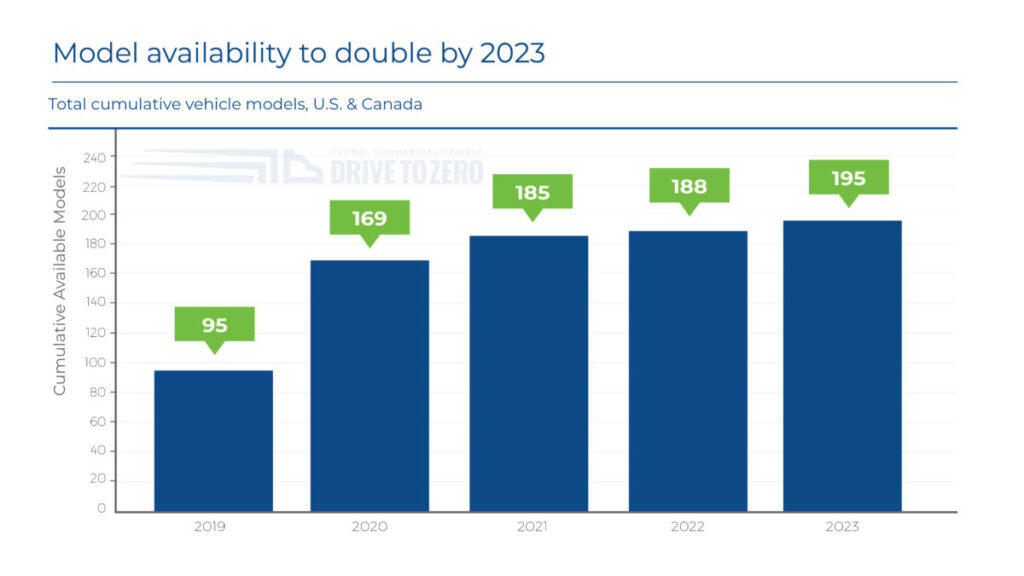

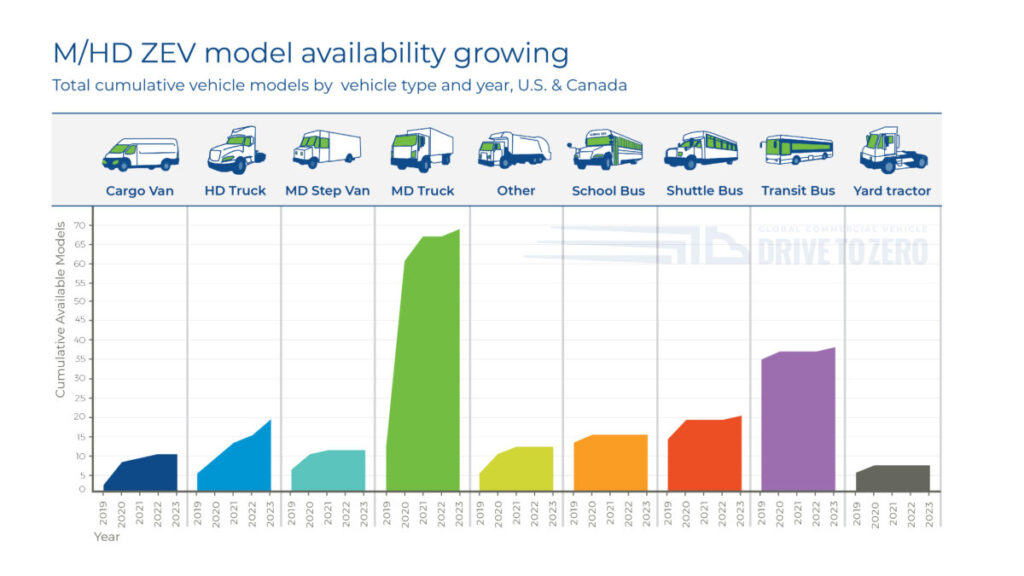

Calstart’s Zero-Emission Technology Inventory shows that the number of zero-emission trucks, buses and off-road equipment models will rise 78% this year, and double by 2023. By the end of 2020 there will be 169 medium- and heavy-duty models in production, compared to 95 offerings in 2019. Within three years, there are expected to be 195 such vehicles.

“Zero-emission trucks and buses are on the verge of a major surge in the U.S. and Canada,” said Calstart northeast regional director Ben Mandel, during a Tuesday media briefing. “The growth we’re seeing is happening really across the board.”

A key market is clearly in the form of medium-duty vehicles like box trucks and other straight trucks, thanks in large part to up-fitters that provide battery-electric conversion kits that can be offered with different body types and vehicle chassis, Mandel said.

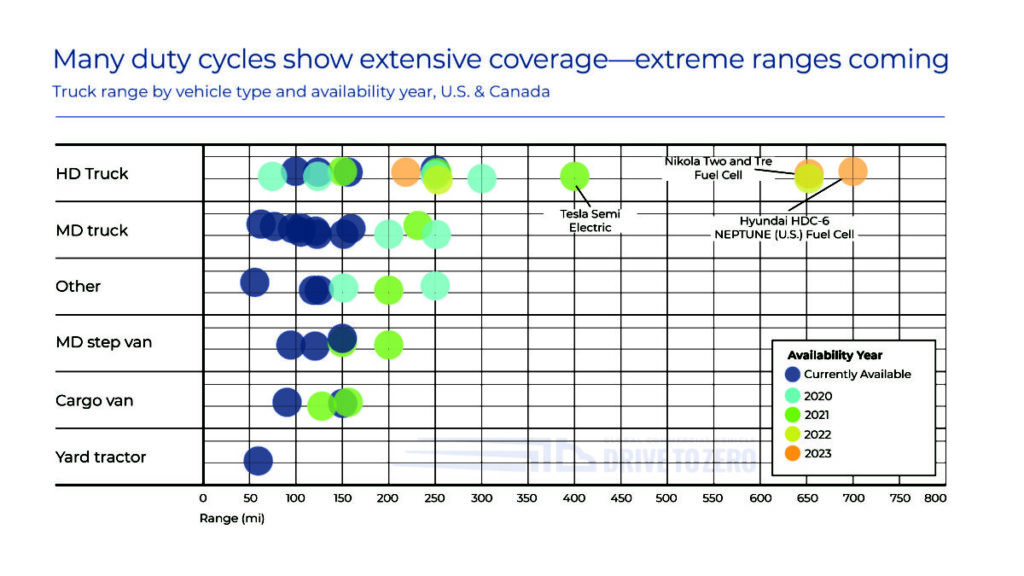

“It might take a few more years for this market in heavy-duty trucks – especially on the longer-range end of the spectrum – to present themselves and make themselves a fully developed market,” he added.

Even here gains are being realized, with the promise of models offering ranges of more than 950 km by 2023. Cited examples of those include the Nikola Two and Tre, and Hyundai HDC-6 Neptune, all of which are to run on hydrogen fuel cells.

Factors behind the growth in zero-emission vehicles include corporate commitments, policy drivers, and increasingly attractive business cases alike. Companies such as UPS, FedEx, Amazon and Ikea are actively investing in the technologies, too.

UPS has invested in Arrival, and has ordered about 10,000 battery-electric delivery vans for North America and Europe. About 1,000 electric and hybrid-electric vehicles are already in the field. FedEx, meanwhile, has ordered 1,000 electric vans from Chanje. Amazon has ordered 100,000 electric delivery vans from upstart Rivian.

Ikea is committed to offering zero-emission deliveries around the world by 2025, said Steven Moelk, the retailer’s project implementation manager – zero-emission home delivery.

“We believe that the technology, both on the vehicle side and the infrastructure side and the software, all that technology exists today to meet our goal. So we’re pressing forward with electrification,” he said. “The distance of the routes tends to be smaller and the dwell times tend to be longer. And they’re taking place, quite frankly, in urban areas, in densely populated areas.”

The investments in zero-emission final-mile deliveries also offer a tangible way to showcase the company’s commitment to sustainable mobility, he said.

The challenges that remain are more financial in nature, and how favorable lease and rental options can be offered to independent contractor drivers, he added.

Government policies offer support in the form of initiatives like California’s advanced clean truck rule, along with incentives like Quebec’s Ecocamionnage program. Low-carbon fuel standards offer accelerated payback periods, while utility companies are have programs to support charging infrastructure.

“Zero-emission trucks and buses are on the verge of a major surge in the U.S. and Canada.”

– Ben Mandel, Calstart

Aaron Gillmore, vice-president BYD Electric Trucks – North America, says the rest of the world is outpacing North America when it comes to deploying zero-emission vehicles. But he describes the market as being “on the cusp of change”.

His company is focused on opportunities such as ports and rail hubs, which use Class 8 yard tractors to move containers but stay close to home. There are regional drayage shuttles taking those containers to nearby warehouses. Distribution centers and refuse vehicles round out the OEM’s key market segments.

“The will is there. The technology is there,” he said. “ Some of the challenges are making sure that the economic models work, that there’s policy support. You’re always trying to balance range and payload and cost when you’re trying to put these things together.”

Mandel says the interest in zero-emission vehicles is also holding strong in the face of other plunging vehicle orders, Mandel said.

Recovery and stimulus plans in the wake of Covid-19 could view zero-emission vehicles as an economic growth strategy, he added. China, for example, has extended incentives beyond when they were to be retired. Europe’s Green Deal will also offer support.

“When you look at particularly final mile, there are more deliveries than ever before as everybody shops online. And the e-commerce boom that’s been happening for a decade seems to have accelerated even more during the crisis,” said Moelk, referring to growth in a business segment that will rely on urban delivery vehicles. “As people get used to it, they’ll probably continue to shop online.”

“As we see commitments from governments in the U.S., particularly in California, in Europe, in China, investing in urban delivery electrification can really result in less air pollution, noise and climate impacts, and at the same time create new clean technology jobs,” said Cristiano Façanha, global director of Calstart’s Drive to Zero program.

“Despite everything that is happening, the commitments from manufacturers, from governments, they’re still holding true.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.