ECONOMIC WATCH: Covid crisis to take toll on trucking

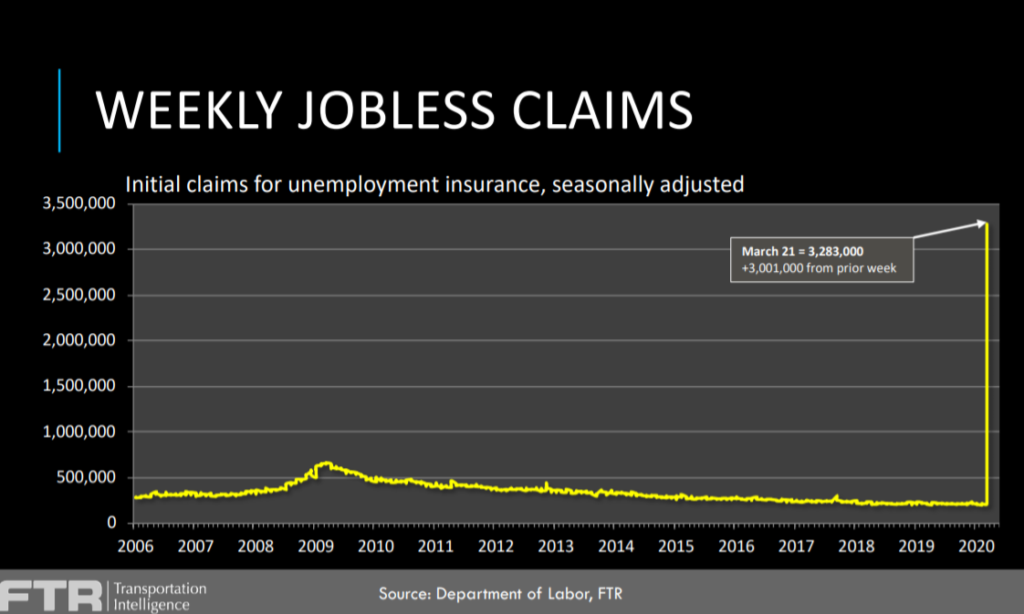

BLOOMINGTON, Ind. – The U.S. economy was rocked today by shocking numbers of 3.3 million people filing unemployment claims for the first time, but the worst is still to come for trucking.

“To put it in perspective, we were seeing somewhere in the neighborhood of 180,000 to 250,000 at any given point in time,” Eric Starks, CEO of industry forecaster FTR said on a webinar today, to discuss how the trucking industry will be impacted by the Covid-19 pandemic. “When we hit the peak in the Great Recession, we were north of 500,000, but we’ve never seen anything like this.”

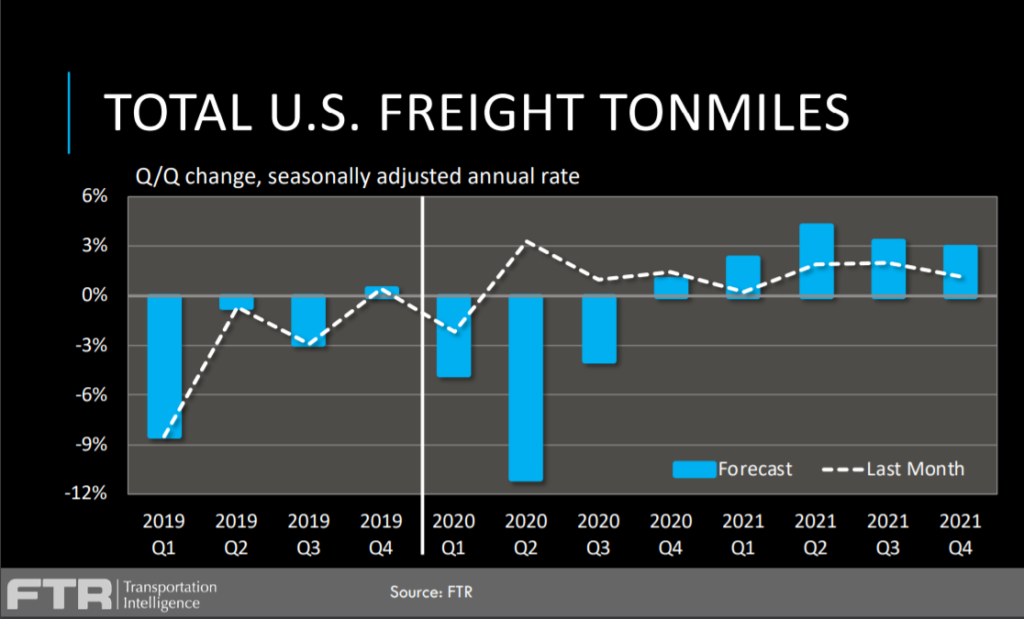

FTR has recently reduced its economic forecast, predicting U.S. real GDP will drop 11% in the second quarter.

“This has a huge impact on the marketplace and the transport system specifically,” Starks warned, adding the GDP goods transport sector – or freight in the system – could fall by 24% in the second quarter. “This is huge. There is no getting around this. There are significant impacts in the system as we move into the second quarter.”

Industrial output is also expected to take it on the chin, falling nearly 15% in the second quarter, as factories are temporarily locked up to deal with the virus.

Starks said FTR doesn’t expect to see a noticeable rebound until the fourth quarter, and freight won’t return to the peak levels seen in 2019 until mid-2021.

“We are talking somewhere between a year, to a year-and-a-half recovery just to get back to the levels we were at in the first quarter of 2019,” Starks warned. “We are going to be having a very difficult time as we move through the summer. What we don’t know is how long does the virus stick around? All indications we see right now say this is not a quick turn.”

What’s in store for trucking providers?

“Trucking is going through something it has never experienced before,” said Avery Vise, FTR’s vice-president of trucking, likening the situation to a catastrophic hurricane, but one that is nationwide in scope and with no set end date.

So far, there have been some benefits to trucking. Refrigerated load availability spiked, and spot market rates for dry van and reefer loads moved sharply higher over the past couple weeks. But non-essential freight has already felt an impact, with flatbed and specialized load availability on the decline.

Vise predicted the retail restocking efforts driving a spike in dry van and reefer freight “could go away quickly.”

“The spot market itself may stay elevated for a while, but clearly overall freight volumes are going to begin to fade,” Vise warned, calling for overall truck loadings to decrease 4% this year compared to a pre-crisis prediction of a modest 1.3% gain.

Flatbed, bulk, and dump segments will be hit hardest, with loadings expected to decrease from 6-9%, barring an infrastructure bill that would kickstart construction. Refrigerated loads, however, should finish the year up slightly compared to 2019, FTR predicts.

“There will be people who will make more money on unemployment than at their jobs, especially in the near-term.”

Avery Vise, FTR vice-president of trucking

Capacity utilization is likely to slide as drivers exit the industry. As available mileage dwindles and government supports workers with substantial payments, some drivers may opt to stay home, Vise noted.

“There will be people who will make more money on unemployment than at their jobs, especially in the near-term.”

Carrier bankruptcies are likely to continue, but “We think the loss of freight demand will outpace the loss of capacity,” Vise said.

Underlying issues driving an increase in carrier bankruptcies before the crisis – such as rising insurance costs – are not likely to abate, putting further pressure on weak performers. FTR doesn’t expect the U.S. government bailout to significantly impact the freight picture, though it could mean consumers are in better shape to resume spending when the crisis passes.

“This is a rescue plan, not a stimulus plan,” Vise pointed out.

FTR’s forecast assumes consumer spending will drop for a period of time.

“When we look at what happened with the latest data out this morning, and seeing over three million people applying for (unemployment) benefits, that suggests there is additional downside pressure on our numbers in the second quarter,” Starks said. If companies are able to keep their workforces in place, the economy should rebound more quickly when the virus is contained.

The effect on equipment demand

FTR has reduced its equipment demand forecast to recession levels. It’s anticipating North American Class 8 production of 150,000 units this year, and predicts the second quarter will kick off the worst three months of Class 8 production seen since the Great Recession.

Its trailer production forecast has similarly been cut to 155,000 units, explained Don Ake, FTR’s vice-president, commercial vehicles. The medium-duty market is not immune to the downturn, either.

Higher cancellations can make matters worse for truck manufacturers.

“We are looking for elevated cancellations in March, and we would expect order levels in the truck and trailer markets to be below 10,000 units at least for the next several months,” Ake said, noting fleets began showing “anxiety” about the impact of the virus through their ordering activity as early as late February.

OEMs may also struggle to get plants back up and running, following temporary closures over the past couple weeks, Ake cautioned.

“Two things are going to hurt them in the second quarter: a lack of orders to build, and also a disruption to society that’s going on,” Ake said, noting it may be difficult to get employees back on the job. “Another factor that comes into play is how well the supplier base can snap back. We’re not just talking about the U.S. supplier base, we’re talking worldwide. We have heard reports it’s been very difficult for a few weeks to get any supplies out of India.”

FTR has created a free online resource page for information on the Covid-19 virus and its impact on the transportation and freight markets. It can be visited at www.FTRintel.com/coronavirus.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

This shutting down the entire country over the COVID-19 virus is really hurting our country. The damned virus is going to spread anyway, so shutting down the entire economy is stupid to say the least.

Let’s get back to work!!!

Stay positive. At least we’re working. So many people have lost their jobs

I think it’s stupid and premature to put this type of things out specifically for trucking, if anything we won’t be able to keep up with the freight, more garbage will be produced by people staying at home etc etc etc, not to mention the internet orders are going to go up dramatically, so with all due respect your predictions are 100% inaccurate

This is a lie more. Fake news

I took two weeks off per doctor orders because of my age and a health issue. I’m going back to work on the 1st of April. Been driving for eight years now. We can’t just not keep driving, goods need delivered and we all should try and do our part. Wear a mask, wash your hands and stay vigilant. America will persevere.

Do we have enough food in the Warehouse to survive? If people aren’t working in the factories an the fields making the food an packaging it is there enough to go around. To carry us for two or three months simple question. I’ve traveled from Maine to Oregon an now in Texas. Why is there no toilet paper to be found. No one can hoard that much. What’s the true. We’re just out of it. Some folks have called around the answer they got was there is none any were…. Personally this is the beginning of the end. What’s next. People need to stop lying to the people of the US.

I would like to see more information regarding owner operators and how the industry is coping with lost work and if those with equipment loans defaulting or working with small businesses to weather the economic storm.

I’m Canadian, living/working in the US, mainly pulling food grade tankers. I feel for those impacted suddenly by this virus and have wondered how it would affect the various goods that would be transacted in an otherwise normal economy. Many priorities and buying patterns have been reevaluated and we’re now moving in strange times. As expected, much of the food related hauling is seeing an uptick. I’ve been running on recap hours for days now and my dispatcher just asked if I can run some more. I’ll help however I can.

Dropping in at our yard quickly, I see all these letters in our drivers mailboxes. These are documents stating the Presidential Policy Directives PPD-21.

Food and agricultural drivers are officially now deemed as critical for infrastructure with special responsibilities to maintain normal work commitments for the flow of those vital goods.

While I agree that major carriers will fail in the coming years(usx) demand has never been greater and freight pricing at an all time high. Whomever is feeding you this pessimistic view of the freight industry has obvious interests in pretending there is a downturn. Shippers are paying extravagant money to move their freight, just find a ligitimate freight bill of any load going anywhere.

I find the article very interesting, it gives the public a chance to look at what is really happening with the trucking industry. I hope many people will read this entire article, very informative, and true. It’s a shame that the majority of people I know nothing about the trucking industry, and how important it is for these trucks to be on the road.. without our people with a CDL license , is crucial to people’s everyday lives, and all they got to do is bitching about the stores being empty. Empty because of greed. let’s all get together and pray for our men who are taking a risk every day that they get into their truck and how crucial it is to get their loads delivered. What happened to gratefulness, all this really concerns me all I can do is my part of the job, and that’s where the good Lord comes into play. I’m trying very hard to be optimistic about this whole thing Palma I’ll tell you this much ungrateful but the men and women that deliver to the stores that choice. God bless our truckers.

I’m waiting to get my CDL from CRST in Denver Colorado. But all our DMVs are currently closed.

Regulations are not helping, When I was 20 years old, You could pay another driver $50 to teach you how to operate a Semi, now you have to jump through circus hoops, take out ridiculously high loans , and go to school for several weeks, where is the incentive?

Licensing, in any craft should be transferrable to any state in the country, but it doesn’t work that way ……why ? Are we the United States or not ?

Employers forcing drivers to do other low paying jobs to qualify for loan forgiveness package.

This will be a life changing event for everyone

It proves that we do not control anything