Work truck suppliers face chassis, labor shortages

FARMINGTON MILLS, Mich. – Work truck suppliers are facing a shortage of available chassis and labor alike as they begin the slow recovery in the face of an economic downturn triggered by Covid-19.

“We were already anticipating a recession in the commercial truck industry,” said Steve Latin-Kasper, director of market data and research for NTEA, an association representing North America’s work truck suppliers. But the downturn clearly accelerated during business shutdowns associated with the pandemic.

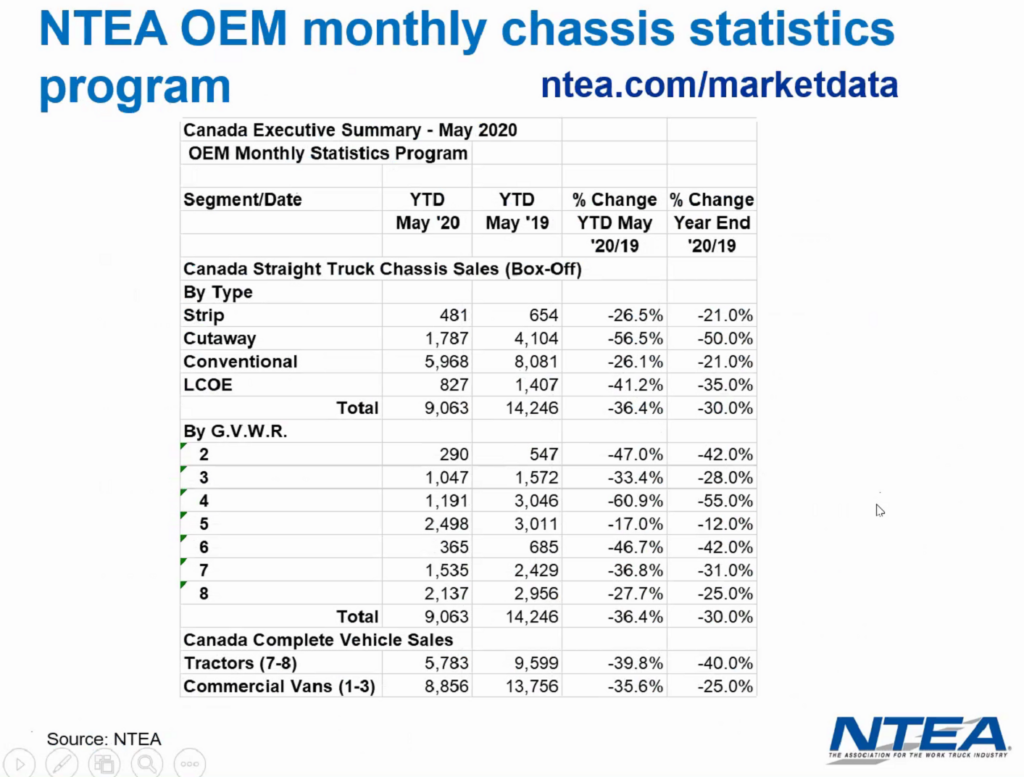

The association projects that Canada’s Class 7-8 tractor sales will be down 40% in 2020 when compared to 2019, he said during a webinar hosted on July 21. Class 1-3 commercial van sales, down 35.6% year to date as of May, are expected to improve only marginally to a 25% drop on a year-over-year basis.

The sales of box-off straight truck chassis are also projected to drop dramatically:

- The 5,968 conventional truck chassis sold in Canada as of May were down from 8,081 sold during the same period last year, representing a 26.1% drop. Totals are projected to be down 21% once 2020 comes to an end.

- Just 1,787 cutaways were sold as of May, down from 4,104 seen during the same period in 2019. That 56.5% drop is expected to improve only marginally, to a 50% drop for the year as a whole.

- The 827 low-cabover-engine (LCOE) year-to-date sales as of May were down 41.2% compared to the same period last year, although the downturn is expected to even out at a 35% drop on the year as a whole.

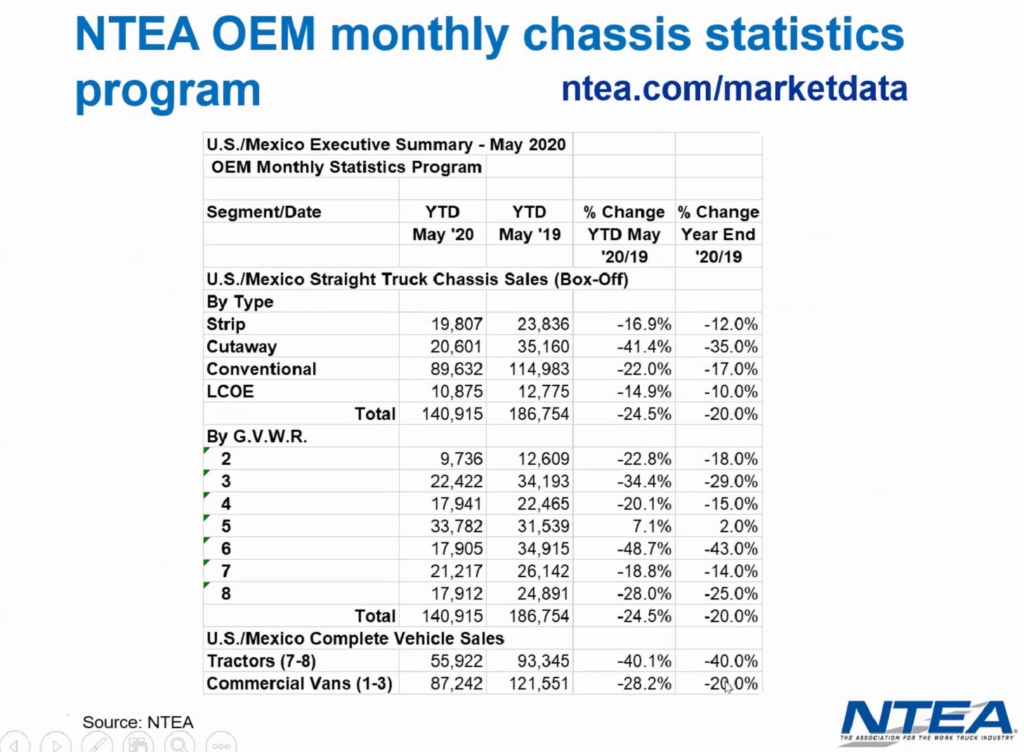

In the U.S. and Mexico, the association is projecting a 40% drop in Class 7-8 tractors and 20% drop in Class 1-3 commercial vans in 2020. Straight truck chassis sales are expected to be down 20% year over year.

“That’s probably as bad as it gets,” Latin-Kasper said of truck sales. He noted that credit is available, inflation is moderate, and interest rates are historically low. Construction industry is also recovering, while government spending is on the rise.

There are unique barriers to be overcome as manufacturers ramp up activities, however.

OEMs have restarted production, but continue to be affected by Covid-19 issues such as a different use of work space, he said. “There’s some body supply issues throughout the industry that are having at least a minor negative impact.”

“There’s very little in the pipeline for vans,” he added. “You can’t sell vans that weren’t shipped – so it’s very hard to see sales coming back here in the commercial van segment.”

The labor supply is also limiting the ability to move goods from plants to dealers, as some personnel decide not to return to work.

“In all likelihood the worst is behind us,” he said of the U.S. labor market.

But the recovery will be gradual, Latin-Kasper said. The 23 million Americans receiving unemployment insurance had dropped to 20 million in mid-May, and 17 million for the third week of July. “We expect it to keep going down like this,” he said. “We have a long way to go.”

Trailer production is expected to face a slow recovery as well, he added, noting how a second wave of Covid-19 will affect consumer spending.

In the midst of it all, however, there appears to be some relief in the form of commodity and oil prices.

“We are not expecting to see increases in aluminum or steel product prices this year,” Latin-Kasper said, referring to a drop in global demand. Aluminum prices were already declining before the economic downturn because of a drop in China’s construction activity.

Falling oil prices have also made it easier for fleets to deal with the drop in freight volumes, he said.

Referring to a poll by the National Association for Business Economics, Latin-Kasper said the biggest downside risk to the economy is a second wave of Covid-19 – something that he identified as already underway.

There is more bad news to come, too. States and local governments in the U.S. are not allowed to run deficits, and they’ll need to address lower sales tax and income tax revenues.

“We haven’t seen anything like the worst of this,” he said.

In a broader context, growth in Gross Domestic Product isn’t expected to return to pre-pandemic rates until 2022. Even if a full economic recovery isn’t realized before 2023, however, that will still be quicker than the 10 years it took to recover from the recession of 2007-09, he said.

“That’s still way better than it was the last time around.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.