Economic Trucking Trends: Fuel prices pinching shippers and truckers, flatdeck continues to weigh on rate recovery

There are no winners in transportation when fuel prices rise, as evidenced by recent readings from both FTR’s Trucking Conditions Index and Shippers Conditions Index. Both trucking conditions, reported last week, and now shippers’ conditions are feeling the pinch of rising fuel costs.

There’s good news on the spot market front with demand increasing and rates following the upward trajectory. As long as you aren’t hauling flatbed freight, that is. That segment continues to lag the recovery.

And the used truck market is normalizing, but ACT Research is monitoring whether there’ll be a coming glut of used equipment thanks to the bankruptcy of Yellow Corp.

Shippers feel pinch of higher fuel prices

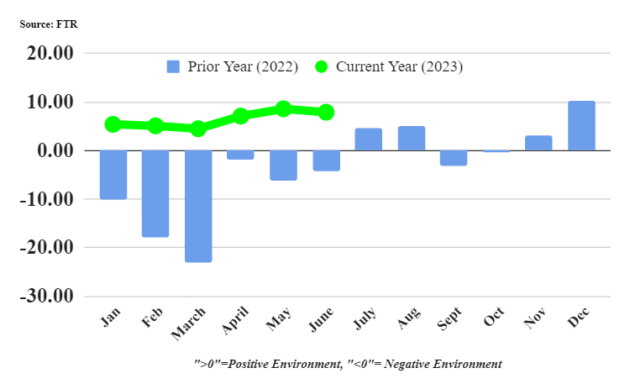

When do conditions deteriorate for both truckers and shippers? When fuel prices rise. Last week we reported data from FTR indicating trucking conditions were deteriorating and this week, the industry forecaster reports the same is true for shippers.

But conditions remain favorable overall for shippers, with the Shippers Conditions Index (SCI) reading 7.9 in June, slipping from May’s 8.6 reading. Blame fuel prices, FTR reports.

“Fuel is one of the most volatile components that can impact shipper conditions through its ability to move fuel surcharges and capacity around,” said Todd Tranausky, vice-president of rail and intermodal at FTR. “It weakened overall shipper conditions in the latest month, but the SCI remained at a fairly positive level overall. If fuel prices continue to increase, it will push less positive readings in the SCI in the months ahead.”

Spot market rates edge higher – except for flatdeckers

U.S. spot market rates for the week ended Aug. 25 were up slightly for only the second time in the past 13 weeks, Truckstop and FTR Transportation Intelligence reported. Flatbed rates have dragged down overall spot market rates, having decreased in 11 of the past 13 weeks.

But dry van rates have made the slow move upward and refrigerated rates have seen “notable gains,” the company reported.

“The year over year comparisons for dry van and refrigerated rates are still negative, but they have narrowed significantly as the spot market had essentially normalized from extreme levels by this time last year,” Truckstop and FTR Transportation Intelligence reported. “Even flatbed volume was its least negative year over year since July 2022, but flatbed loads were still 29% below the prior-year week.”

Load postings were the strongest since February, excluding weeks with a post-holiday rebound or the International Roadcheck inspection blitz. The Market Demand Index reflected the reduced truck postings with its highest reading (53.9) seen in the past four weeks.

Used truck sales slowing

ACT Research has noted retail sales of used Class 8 trucks in the U.S. faltered for the first time in three months in July, falling 7.8% from June. Prices dropped 5% from the month before.

“Sales usually dip a percentage point or two in July, so the decrease was in line with – but greater than – expectations,” said Steve Tam, vice-president at ACT Research. “Including auctions and wholesales, the total market volume fell 28% month over month in July. Compared to July 2022, the retail market was 19% larger.”

ACT is monitoring what becomes of bankrupt Yellow Corp.’s 14,000 trucks (mostly Class 8 day cabs) and nearly 45,000 trailers. The industry analyst says the bankruptcy proceedings appear to be proceeding in a disciplined and methodical manner.

“Were all that equipment dumped into inventory at one time, the result conjures up images of a piranha feeding frenzy,” said Tam. “While it is still very early in the process and there are no guarantees, this [current disciplined] approach should help to minimize the negative impact on used equipment values.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.