Economic Trucking Trends: More capacity must leave before truckers feel relief

It was a busy couple weeks to be Bob Costello, chief economist of the American Trucking Associations (ATA), who we will lean on heavily in this week’s segment of Economic Trucking Trends.

He was front and center at the ATA’s own management conference in Austin a couple weeks ago, then visited Montreal for Isaac Instruments’ user conference to give an economic update. In between, he pushed out the latest ATA For-Hire Truck Tonnage Index results for September. Let’s dive into it…

Hope springs eternal

This week I attended Isaac Instruments’ Horizon User Conference, where ATA chief economist Bob Costello again visited to give attendees an overview of the economy and its impact on freight.

He painted a still grim outlook overview, characterized by a sluggish freight environment coupled with excess capacity. More capacity will have to leave before there is a rebalance of freight demand and trucking supply.

“The trucking market is not going to turn because of demand. It’s a supply side story all the way,” Costello said. “The data shows there is a significant amount of capacity leaving the industry. By spring of next year, I think things will feel better in the industry even if demand doesn’t pick up that much, because more supply is leaving.”

You can read the complete article on Costello’s presentation here.

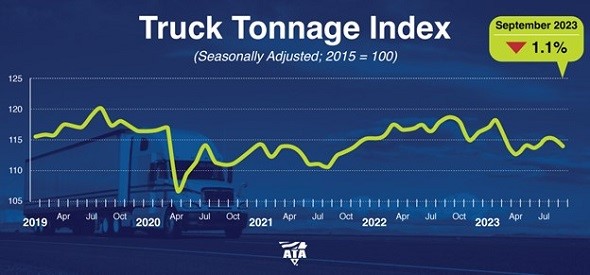

Tonnage loses steam

Costello’s visit to Montreal came on the heels of releasing the ATA’s September For-Hire Truck Tonnage Index, which pulled back 1.1% after a 0.2% bump in August.

“After hitting a bottom in April, tonnage increased in three of the previous four months, gaining a total of 2.2% before September’s drop,” Costello said. “However, this freight market remains in flux, and the index contracted by 1.1% in September, which erased half of those gains. Additionally, the year-over-year decrease was the largest drop since November 2020 on a very difficult comparison – September 2022 – which was the previous cycle high. While it is likely a bottom has been hit in truck freight tonnage, there could still be choppy waters ahead as the freight market remains volatile.”

Tonnage was down 4.1% versus last September, marking the seventh straight year-over-year-decrease and the largest from that period.

Gradually improving conditions

Better news from ACT Research, whose latest For-Hire Trucking Index shows continued but gradual improvements in freight volumes, pricing and driver availability.

While the Volume Index pulled back 4.9 points in September to 49.5, the reading still shows a gradually improving trend, ACT reported.

“Freight demand fundamentals are starting to improve after nearly two years of substitution, destocking, and inflation,” Tim Denoyer, vice-president and senior analyst at ACT Research said in a release. “Rising interest rates, declining savings, and private fleet growth are ongoing headwinds to for-hire volumes. However, with improving goods consumption trends, the end of destocking, and a resilient industrial sector, we expect the gradually improving trend to continue.”

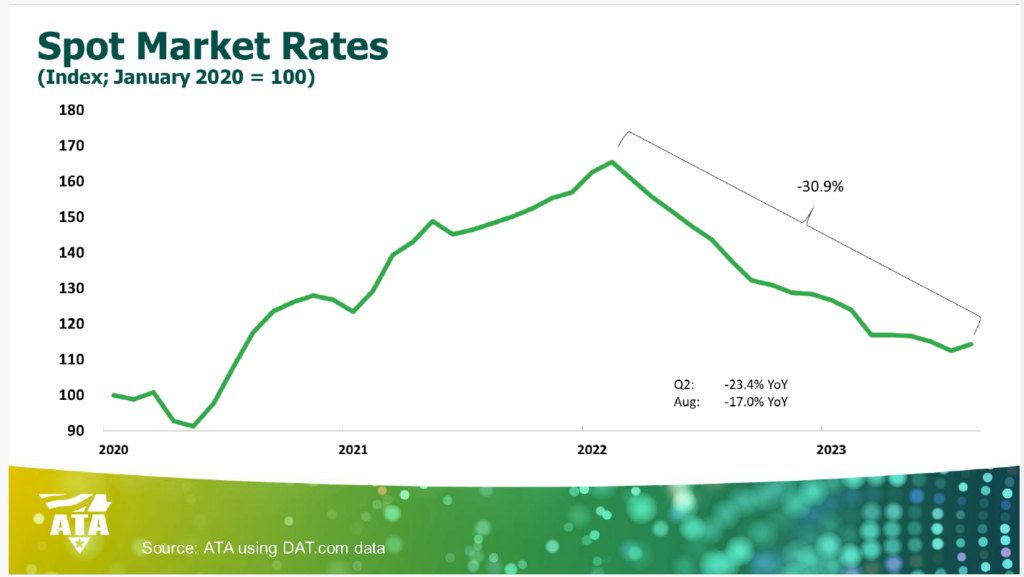

The Pricing Index jumped more significantly, up 9.2 points to 48.5, marking a stabilization in rates.

“The pricing environment is showing signs of starting to firm, but declines should persist in the near term as capacity additions and an elevated focus on labor retention persist,” Denoyer said. “Improvements in volumes and slowly decreasing for-hire capacity are positive signs for pricing. Spot rates have been steady for four months as the rebalancing rolls along.”

Meanwhile, driver availability hit an all-time high. ACT says fleets are seeing a large influx of drivers, unprecedented in survey history. Many of those drivers are coming from the challenged owner-operator market, ACT reasoned.

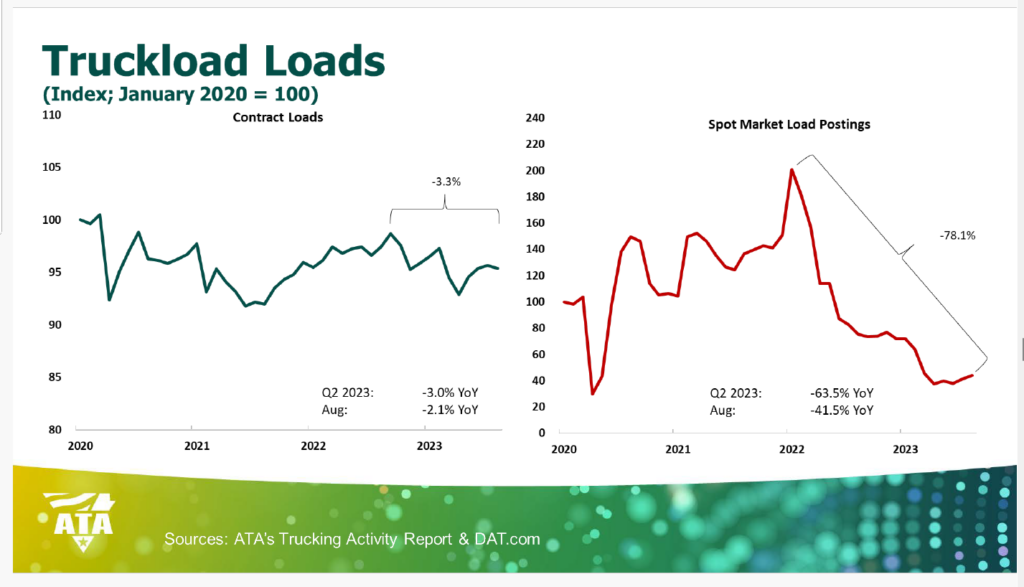

Spot market struggles continue

And why are those owner-operators fleeing for the safety of pulling contract freight in company equipment? The spot market remains challenging. Truckstop and FTR Intelligence report for the week ended Oct. 20, total broker-posted spot rates continued to ease slightly.

Refrigerated rates bucked the trend after six consecutive weeks of declines, rising modestly. But flatbed spot rates declined and van rates were unchanged. Dry van spot rates are about 10 cents higher than during the May lows, while refrigerated rates are a more comfortable 22 cents off the bottom.

Flatbed rates, meanwhile, continue to languish near their cycle low. Load postings declined, but so too did truck postings.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

In we know over 10,000 lease and owner ops and drivers of construction trucks and equipment that had jobs are now looking for work the local non profit I vol at is see these people often in ont less than 6 years with their children looking for food and unable to afford rent. I can show you church basements full of these people now . I live in a tent along with many other people often that came over as students and now have debt and unable to afford rent on a $20 hr job . The gov and the trucking industry needs. To provide for the people they brought into Canada in the past 5 years before anymore foreign drivers come to ont and B C