Economic Trucking Trends: Lots to digest in busy week for economic news in trucking

It’s been a busy week on the economic front, with mixed signals for the trucking industry. We saw signs that for-hire tonnage has bottomed out, fleets are being disciplined in their equipment purchases, and overall trucking conditions are nudging upward but tempered by a halt in spot market pricing improvements.

Parts and labor costs have begun to return to Earth, and the most recent trailer order numbers provide little clarity about where that market is going.

Let’s get into the details.

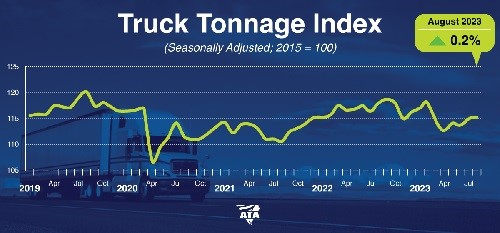

More signs of the truck tonnage bottom

U.S. for-hire truck tonnage edged up 0.2% in August, on the heels of a 1.1% gain in July. It’s a welcomed sign that the market has bottomed.

“The evidence is growing that tonnage hit bottom in April and continues its slow climb upwards,” said American Trucking Associations (ATA) chief economist Bob Costello. “However, year-over-year comparisons remain difficult as tonnage peaked in September of last year. As a result, it is unlikely that tonnage turns positive compared with a year earlier for at least a month or two longer. Most recently, freight continues to be mixed, with consumer spending and factory output flat to down.”

Year over year, tonnage was down 2.3% — the sixth straight year-over-year-decrease.

For-hire fleets exercise discipline as private fleets ramp up

ACT Research has come upon an interesting trend in the market, suggesting private fleets are leading the way with Class 8 truck purchases while for-hire fleets exercise discipline. This could improve market conditions if the trend continues.

“We’ve created a proxy for private fleet activity that suggests mid-single-digit growth in freight volumes, helping to explain the difference between the accelerating U.S. economy and declining for-hire volumes,” revealed Tim Denoyer, ACT Research’s vice-president and senior analyst. “Private fleet growth is evident as Class 8 tractor retail sales are on pace to set a record this year, yet for-hire fleets are by and large demonstrating capital discipline.”

“Though the freight market is still near the bottom of the cycle, in our view, new truck orders in the next few months will be pivotal to setting the market tone for 2024,” he added. “The capacity contraction in the for-hire sector is beginning to coil the proverbial spring for better market conditions, but this improving outlook could be spoiled if fleet expansion continues ahead of industry need.”

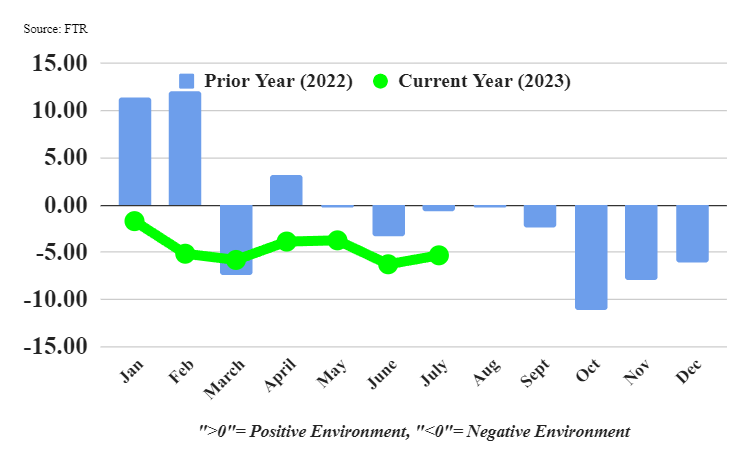

Trucking conditions improve slightly…for now

FTR’s Trucking Conditions Index (TCI) improved slightly in July, with a still-negative reading of -5.34. That’s better than June’s -6.29 reading, due to improving freight volumes and capacity utilization, which offset weaker rates and higher fuel costs.

But don’t get too excited. FTR says continued increases in fuel costs in August and September are likely to send trucking conditions down further in the near term, with only gradual improvement in store until Q3 2024.

“The overall truck freight market remains unfavorable for trucking companies, but the financial situation for smaller carriers in particular is tightening due to surging diesel prices,” said Avery Vise, FTR’s vice-president – trucking.

“Large numbers of small operations are exiting the market, and that exodus could accelerate if diesel prices continue to rise sharply. So far, the data suggests that larger carriers have absorbed much of that driver capacity, but truckload carriers are approaching a saturation point due to sluggish freight demand. Declining driver capacity could tighten the market modestly, but significant improvement for carriers will require stronger volume as well.”

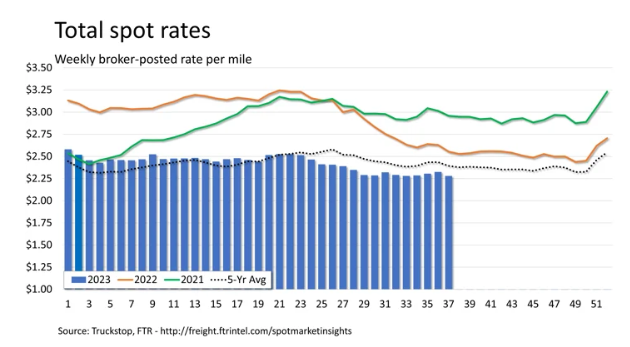

Spot rate improvements hit the brakes

Improvements in U.S. spot market rates came to an abrupt halt in the week ended Sept. 15, Truckstop and FTR Transportation Intelligence report.

All equipment types saw a “most cooling” in broker-posed spot rates, with the decrease led by refrigerated rates.

Hopefully it’s just a temporary chilling, as reefer rates had gained US 29 cents a mile over the previous seven weeks. But the decline in total spot rates was the largest since mid-July.

Total rates on the spot market are down about 4-5% year over year.

Trailer order numbers leave questions

Preliminary net trailer orders rose in August to 11,500 units but were lower than longer-term comparisons, ACT Research reported.

“With still high backlogs, 2024 orderboards only minimally open, and August as a traditionally weak order month, it remains too soon for robust expectations,” Jennifer McNealy, director of commercial vehicle research and publications at ACT Research concluded.

“Additionally, the data continue to provide mixed messages, with cancellations remaining elevated, driven primarily by the dry van and flatbed segments, even as backlogs remain at healthy levels. In July, the backlog-to-build ratio was north of six months in aggregate, with some specialty segments having no available build slots until the beginning of 2025. Demand may be softening, but it’s not gone. The next few months should provide more illumination on the 2024 outlook, as orders move from the current negotiation stage into booked business.”

Parts and labor costs coming down

We’ll wrap up this week’s report on a positive note for fleets. Parts and labor costs dropped during the second quarter, according to the latest Decisiv/TMC North American Service Event Benchmark Report.

“With rising build rates for new equipment and less mileage reducing the need to operate aging trucks, fleets are finally seeing a definite improvement in parts and labor costs,” said Decisiv president and CEO Dick Hyatt. “The data that Decisiv collects and analyzes for TMC on Vehicle Maintenance Reporting Standard [VMRS] system-level codes points to a return to normalized trade cycles and more predictable service and repair costs.”

After an extended period of cost increases, the combined parts and labor costs for the top 25 VMRS codes fell 1.3% in the second quarter compared to the first quarter. Labor costs decreased for the first time in the past year, and parts costs were down for the second quarter in a row. On a year-over-year basis, combined parts and labor costs rose only 5.57% in the second quarter of this year compared with the same period last year – which is far slower than the 15% increase in costs seen 2022.

“After many months of rapidly increasing parts and labor costs, we are pleased to see this positive trend in the maintenance expense data,” added TMC executive director Robert Braswell. “The council’s fleet membership will benefit from this important parts and labor cost analysis and plan accordingly going forward.”

The full report is shared with TMC members.

FTR conference a hit

Last week I attended the info-jammed FTR Transportation Conference in Indianapolis. This is a great conference for those who really want a deep dive into economic factors driving freight and insights into the future of the business.

I still have some equipment numbers to sort through. Look for them in this space next week. But if you’d like a recap on other news from the conference, check out the links below.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.