Economic Trucking Trends: Ongoing evidence of a freight market recovery

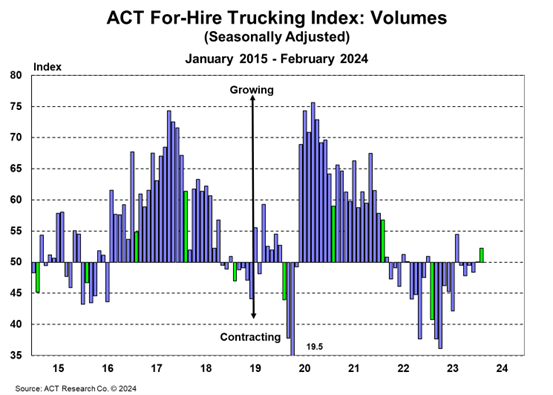

The latest data to come across our desks indicate a slow freight recovery continues. ACT Research has noted improving volumes and better balance in the market, as capacity continues to decrease.

The latest week saw spot market rates climb, led by dry van. And freight brokers, too, are seeing glimpses of recovery. Shippers, however, are seeing deteriorating conditions, partly due to winter weather in January that briefly drove up rates.

Freight market recovery continues

Industry analyst ACT Research continues to see signs of a freight market recovery. In its latest For-Hire Trucking Index, its Volume Index nudged upward 2.3 points in February to 52.3.

“The U.S. economy continues to surpass expectations, and with goods prices now declining, retail sales are likely to recover in the coming months,” said Carter Vieth, research analyst at ACT. “Supporting the retail recovery is solid real income growth, a strong job market, and the end of the post-pandemic services boom. And after an 18-month destock, signs point to a restock beginning.”

Capacity, meanwhile, decreased 1.1 points, marking eight months of for-hire capacity contractions. Vieth said many fleets are reducing their capex budgets in 2024 and delaying equipment additions.

The Supply-Demand Balance increased 3.3 points in February – more good news for truckers.

“This marks the seventh consecutive month in which the Supply-Demand Balance has turned positive mainly on capacity contraction, but improving volumes have also contributed, which should continue,” Vieth said.

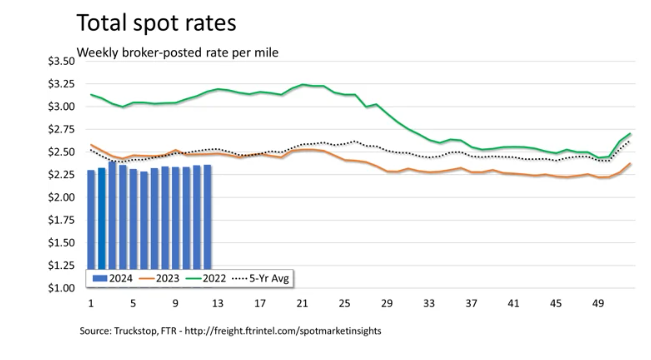

Spot market rates move higher

Truckstop and FTR Transportation Intelligence report that spot market rates in the U.S. continued to improve for the week ended March 22. Dry van rates had their largest gain since mid-January, helping to drive up overall spot market rates for the week.

It was the third consecutive week of rising overall spot market rates, the companies report, but the overall gain over those three weeks was less than 3 cents/mile.

Load postings jumped 9% versus the same week a year ago, which was the largest year over year comparison since February 2022. Load postings are outpacing truck postings, pushing up the Market Demand Index to 73.3, the highest level since the first week of 2023.

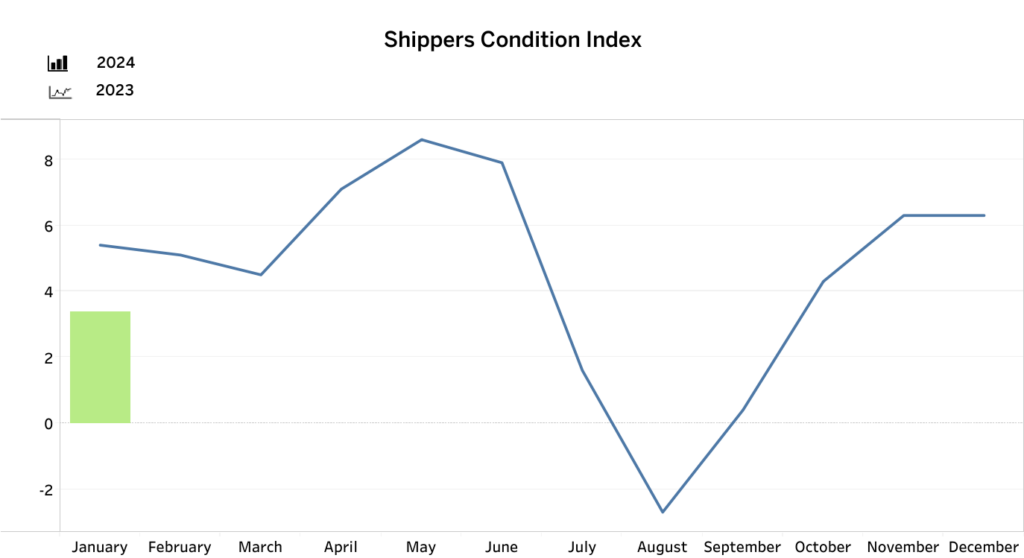

Shipper conditions declined in January

Conditions for shippers declined 3 points in January to a barely positive 3.4, according to the latest FTR Shippers Conditions Index. This was the weakest it has been since September, thanks to less favorable freight rates and slowing diesel price decreases.

But the index may have been influenced by winter weather in mid-January that drove up rates. FTR expects the index to remain close to neutral in the coming months.

“Until recently, market conditions for shippers were reliably favorable except at times when diesel prices soared in relatively short periods,” said FTR’s vice-president of trucking, Avery Vise. “Core freight market dynamics – freight rates, utilization, and volume – have been consistent positives for shippers. That situation is changing, albeit gradually. We expect more muted conditions through 2024, and shippers should anticipate modestly more challenging market conditions by early 2025.”

Good news for truckers, less so for shippers.

Brokers see ‘glimpse of recovery’

Freight brokers are also seeing improving freight conditions, according to the Transportation Intermediaries Association’s 3PL Market Report for the fourth quarter of 2023.

“While 2023 has been a challenging year for the 3PL sector, with the fourth quarter being particularly tough, there are emerging signs of a turnaround,” said Mark Christos, TIA chairman of the board. “The industry’s ability to remain flexible and responsive to changing market conditions will be crucial in overcoming current challenges and seizing future opportunities.”

The report outlined declines in shipments, invoice amounts per shipment, and total revenue. Total shipments were down 4.7% from Q3 2023, and 8.9% year over year.

The association has seen “a noteworthy improvement” in the invoice amount per load for truckload and LTL segments, hinting at a possible recovery.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.