Economic Trucking Trends: Shippers pinched by fuel costs, vocational orders driving truck market

It’s another mixed picture for the trucking industry this week. We see shippers suffering alongside their trucking providers thanks to rising fuel costs — and facing the added challenge of the growing use of available truck capacity.

There’s reason to believe the freight market will take a turn for the better, but it may be slower coming than fleets hope, ACT Research reports. And Class 8 sleeper truck orders appear to be softening, while orders for vocational trucks and specialty trailers are picking up the slack.

No winners as shippers share the pain

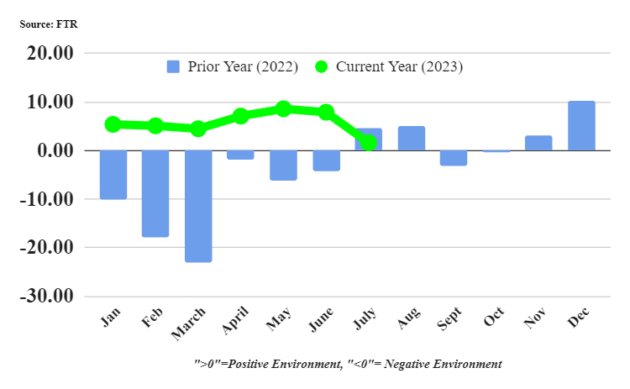

These are tough times for trucking providers, but for shippers they are…also tough times? Generally shippers are the benefactors of trying trucking conditions, but FTR’s Shippers Conditions Index (SCI) fell “precipitously” in July to 1.6, down from a 7.9 reading in June.

Blame higher capacity utilization by carriers and rising fuel costs. These were the worst conditions shippers have seen in nearly a year, though still in slightly positive territory. And FTR expects fuel costs to continue hitting shippers in August’s reading.

“Stronger fuel costs were a driver of the Shippers Conditions Index to its lowest level in nearly a year. With rising crude oil prices, it appears the stronger diesel prices are with the industry for the foreseeable future,” said Todd Tranausky, vice-president of rail and intermodal at FTR. “This will limit how positive the SCI can be in future months and put it on a trajectory to hold near neutral unless fuel prices make another jump higher, in which case they could turn more sharply negative.”

Turning point ahead?

The latest For-Hire Trucking Index from ACT Research suggests there could be a turning point in the freight cycle ahead, but cautions it will likely not come as quickly as fleets would hope. ACT’s Supply-Demand Balance jumped to 55.6 in August, up sharply from 42.2 in July, and achieving its first reading above neutral in 18 months.

The improved conditions were driven by improvements in both capacity utilization and demand. ACT says the jump is encouraging but it’s too soon to declare a recovery is underway.

“This is the highest result in 18 months, but our diffusion indexes measure the breadth of a signal, not the strength,” explained Tim Denoyer, ACT’s vice-president and senior analyst. “This month’s number indicates volumes picked up for a big number of fleets in our survey, but it wasn’t necessarily a large increase. So, we wouldn’t suggest this means the freight downturn is over, but it is a considerable ‘green shoot’ that suggests the retail inventory de-stock is playing out.”

Denoyer added, “New Class 8 tractor sales are still near record levels, so while we observe capital discipline among for-hire fleets, we also think private fleets continue to grow. Driver availability also remains extraordinarily good for the diverse group of for-hire fleets in our survey. In our view, this probably isn’t enough yet to turn the tide in the spot market, but the market rebalancing is progressing and this should be a good leading indicator of better times ahead.”

Vocational trucks driving demand

ACT Research is predicting a “fundamentally weak” U.S. tractor market in 2024, but sees strong vocational truck demand in the U.S. and Canada.

“Just as specialty trailer demand remains strong, the U.S. economy is likewise tilted to benefit specialty trucks. Presently, the longest Class 8 backlogs are for U.S. and Canadian vocational trucks,” explained Kenny Vieth, ACT’s vice-president and senior analyst.

While specialty vehicle markets and Mexican truckers are expected to provide support into 2024, domestic tractor market fundamentals are less bullish. Regarding carrier profits, Vieth added, “The all-star team of carriers that make up ACT’s carrier database saw Q2 incomes plummet. With spot freight rates still soft and contract rates remaining under pressure, the forecast for carrier profits is continued weakness before incomes begin to expand again in Q2 2024. If our forecast for higher profits into the end of 2024 is correct, support into 2025 is on the horizon.”

Incidentally, I was with Mack Trucks in Wisconsin this week, where North American president Jonathan Randall told us demand for “dirty trucks” (the Granite and Pinnacle vocational models) remains extremely strong, while over-the-road sleeper truck demand is softer. This is likely to remain true as construction projects related to the U.S. Inflation Reduction Act (IRA) – essentially an infrastructure bill – remain in the wings.

“While the tractor market appears under pressure heading into 2024 amid weak freight and falling carrier profits, vocational truck demand remains strong,” Vieth added. “August saw net orders up 3,900 units month over month to 19,500 units, with vocational trucks accounting for 42% of orders in August, well above the historical average around 29%.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.