Economic Trucking Trends: Truck orders fall, signs of a spot market turnaround

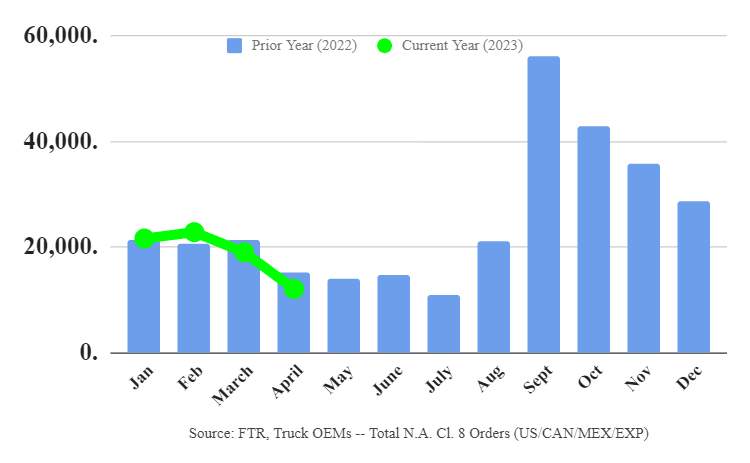

Class 8 orders continued to fall in April, with FTR reporting preliminary orders of 12,050 units. That’s down 37% from March and marks the sixth decline in the last seven months.

Orders were down 20% from year-ago levels. Not big surprise, FTR chairman Eric Starks said in a press release. Demand remains strong but build slots are filled for the year.

“When 2024 order boards open later this year, we anticipate some modest additional strength in order activity. There still are indications that fleets are requesting equipment, and there has been no notable uptick in cancellations,” Starks said.

“With build strong over the last several months, backlogs will have come down during April. The incoming order rate for March was 145,000 annualized, which is on par with the weak order levels during the summer of 2022. Despite the weakness, we do not anticipate much, if any, negative impact on production levels over the next few quarters.”

ACT Research’s take

ACT Research reported 11,600 Class 8 orders for the month, with Classes 5-7 orders down 6% to 18,000 units.

“Given robust Class 8 orders into year end, ensuing backlog support, and normal seasonal order patterns, orders were expected to moderate into Q2; we expected seasonally adjusted orders in a range of 15,000 to 20,000 units per month into mid-Q3 2023,” said Eric Crawford, ACT’s vice-president and senior analyst.

“The recent turmoil in the banking sector likely tightened credit conditions for some industry participants and may have played a factor in exacerbating April’s weakness. Thus, while we expect orders to remain at subdued levels into mid-Q3 2023, we are not inclined to think April’s order activity represents the likely run rate going forward.”

The decline in medium-duty orders was smaller than the double-digit declines seen the past two months.

Spot market turning the corner?

We turn to the spot market and see…glimmers of hope? A new survey from Truckstop and Bloomberg Intelligence suggests things are looking up for those relying on the spot market, for the first time in weeks.

The survey of small fleets and owner-operators in the U.S. suggested there are some signs of optimism.

“While we don’t believe we’re out of the woods yet, the shift in sentiment is encouraging,” said Lee Klaskow, senior freight transportation and logistics analyst at Bloomberg Intelligence. “Conditions should improve due to seasonal trends, coupled with higher-cost capacity being forced out of the market. Rates may get additional support as inventory levels return to more normal levels.”

Responding carriers said their demand expectations for the next three to six months have improved, though remain below historical Q1 averages. The rate outlook also is improving, thanks to seasonal trends and capacity leaving the market.

While about 48% of respondents experienced weaker demand last quarter, 60% expect volumes to rise over the next 3-6 months — about 20% higher than the Q4 2022 survey. Still, improved sentiment isn’t motivating carriers to buy additional or replacement tractors, with only 29% of respondents saying they might make a purchase over the next six months. Soft demand was cited by 42% as the main reason for not buying equipment, followed by higher costs (32%).

Spot market volumes fell 9% on average in the first quarter, Truckstop reports. Carriers in the spot market saw a decline in Q1 compared to Q4 2022 (71%) and 48% said they saw lower volume growth from the year prior. Dry van carriers were the hardest hit, with 85% reporting a decrease in demand compared to the year prior.

“We agree with the sentiment of those surveyed that spot market conditions are near a turning point,” said Kendra Tucker, chief executive officer, Truckstop.

The last word

For this week’s last word, I turn it over to Scott Taylor, head of tax firm TFS Financial Services. Scott just finished up tax filing season for his roster of owner-operator and small fleet customers. How they doin’?

“Lots of owner-operators are driving a lot of old equipment, that’s the truth,” he told me. “Between new technologies and high costs, it has scared many and they keep running their old stuff. That’s great when they can get parts and stay on top of maintenance, but sooner or later that’s going to run out.

“Truthfully, a lot of owner-operators have also sold and closed down, or become company drivers because of the ridiculous money they could get for their equipment.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.