Economic Trucking Trends: Loss of capacity, not increase in demand, will lead recovery

Freight conditions are expected to remain soft through the remainder of the year, and when conditions finally do improve, it’ll be because of a loss of capacity rather than an increase in demand.

That’s the assessment of Avery Vise, vice-president – trucking with industry forecaster FTR, which presented a State of Freight webinar this week.

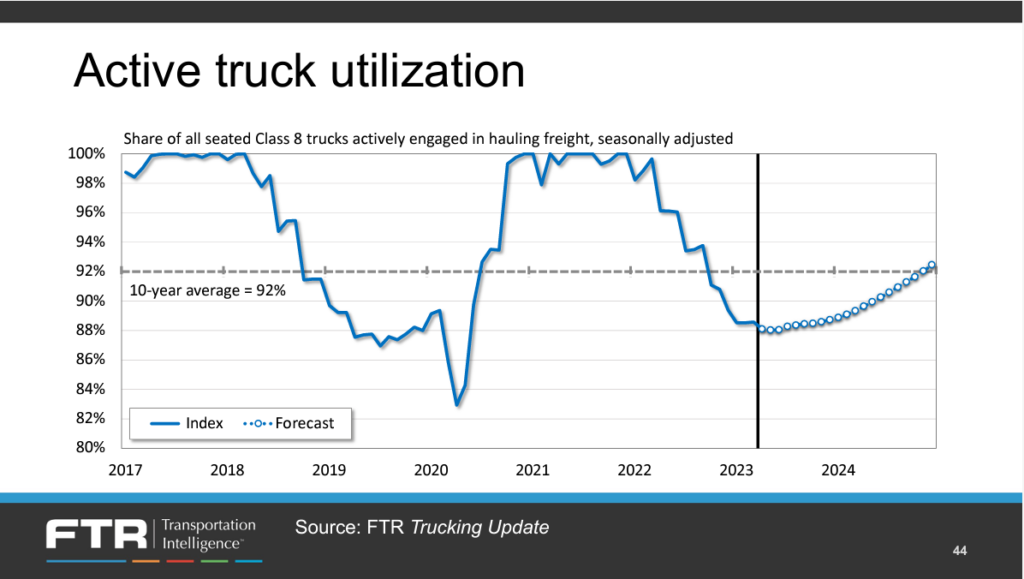

“This is going to be a capacity-driven recovery of utilization, not a freight-demand-driven recovery,” Vise said, noting truck utilization has likely bottomed and will begin a slow climb back to the 10-year average through 2024. “We do expect utilization to improve primarily because we’re going to lose drivers.”

Fleet bankruptcies in the U.S. are climbing, especially among smaller carriers. But larger fleets are increasingly feeling the pain as well, he adds. In the first five months of 2022, only 10 carriers with more than 100 trucks lost their authority. That has climbed to 31 carriers in the first five months of this year.

When it comes to rates, Vise said those on the spot market appear to have bottomed and are beginning to increase incrementally. Contract rates aren’t expected to bottom until later this year. Contract rates are now similar to those seen in 2018, but trucking costs are significantly higher.

Spot market rates may have bottomed

U.S. load board Truckstop reported a reduction in load and truck postings for the week ended June 2, and that was expected due to the Memorial Day holiday. Rates, however, held steady.

“Based on seasonal expectations, both van segments [dry van and refrigerated] should see stronger rates and volume in the second half of June,” the company projected. “If so, dry van rates likely will have bottomed out in early May while refrigerated rates likely will have bottomed out in April.”

Class 8 orders bounce

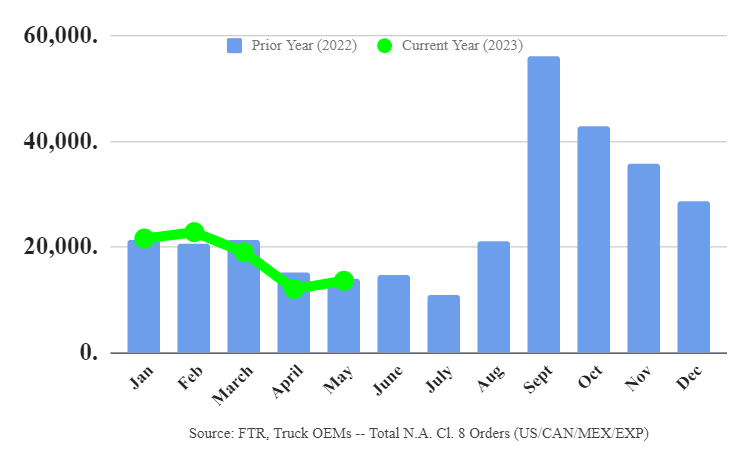

FTR reported preliminary May Class 8 truck orders of 13,600 units, a 9% increase from April and relatively in line with last May. But despite the surprise to the upside, the industry forecaster says those order levels are below replacement demand.

“With essentially all the build slots accounted for in 2023 and 2024 slots not yet open, a low level of activity in orders was no surprise. In fact, there was an expectation that the number could move below 10,000 units. Sub-10,000-unit order months are still possible over the summer. No surge in order activity would be expected until the OEMs open build slots for 2024, which would likely be August at the earliest,” said FTR chairman Eric Starks.

“Fleet demand for equipment does not appear to be waning as they still want to take delivery of new equipment. Strong backlogs are keeping build demand strong, and FTR doesn’t anticipate any negative impact on build activity due to the recent order activity.”

ACT Research reported an even higher 15,500-unit order month, with Classes 5-7 orders surging 27% year over year to 19,000 units.

“Given robust Class 8 orders into year end and the ensuing backlog support, coupled with normal seasonal order patterns, orders were expected to moderate into Q2 and remain at relatively soft levels into mid-Q3 2023. May orders were in line with this view,” said Eric Crawford, ACT’s vice-president and senior analyst. “The relatively few build slots still free in second half 2023 suggest order intake is unlikely to find meaningful traction in the coming months.”

He added, “Medium-duty demand surged 27% higher year over year to 19,000 units (+3% month over month), reversing course after three straight months of year over year declines.”

ICYMI: M&A activity heats up

The last few weeks saw a flurry of merger and acquisition activity in Canadian trucking. In case you missed any of the announcements, here’s a recap:

Trapper Transport buys Plett Trucking

Peavey Industries buys Guys Freightways

GLS Canada buys Altimax Courier

Trimac buys Transport Sylvain Lasalle

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

It will be from a number of drivers and owner ops leaving

Then a year the large trucking companies will want to bring more cheaper foreign workers from low countries

This will make the housing shortage worse in ont and B C . We need a range of min to max rates and to set min pay rates by the hour with overtime at the Ave hourly wage paid in Canada.