Increased freight, tight capacity to provide trucking tailwinds in 2021

BLOOMINGTON, Ind. – Freight growth exceeded expectations in the third quarter, and the picture for 2021 is improving, according to industry forecasters from FTR.

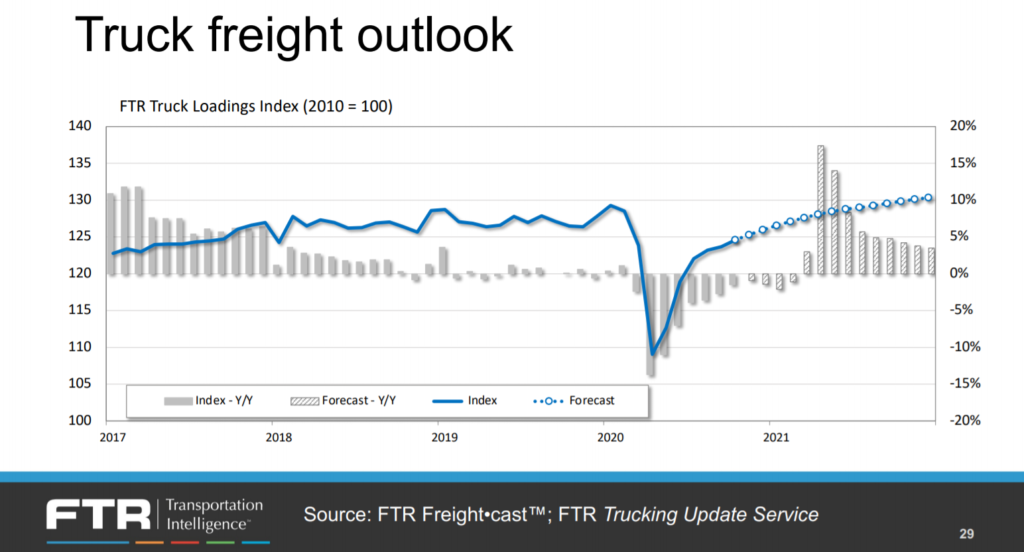

Providing a 2021 market outlook last week, FTR experts painted a positive picture for trucking. But Avery Vise, FTR’s vice-president, trucking, reminded that what looks like a fully recovered freight market is skewed by surging spot market volumes and rates, which only account for a third of the total market. Total truck loadings are down about 4% this year, but expected to bounce 5% next year.

Flatbed is the segment that will see the strongest bounce, but also took the biggest hit in 2020. Dry van, reefer, and specialized are all expected to increase loadings by about 6% next year, while tanker lags at 3%.

But, Vise warned, “there is considerable risk to this forecast, more downside risk than upside.”

Even if loadings disappoint, Vise said capacity constraints will keep the market healthy for truckers. There has been a sharp decline in CDL holders in the U.S., thanks to closures at state licensing agencies and a reduction in training due to social distancing measures. Meanwhile, many drivers have retired or jumped into the booming courier/messenger delivery segment. The drug and alcohol clearinghouse has also sidelined more than 40,000 drivers, who may never return.

So, a strong freight forecast combined with a tight labor market should translate to higher rates and increased profits for trucking companies. Vise said trucking rates are up about 2% this year compared to last year, “which is pretty amazing given what we saw in the second quarter.”

The forecast for next year is another 8% increase, with truckload contract rates expected to surge as much as 10%. While trucking start-ups are surging, Vise said they are mostly one-truck operators or small fleets, pulling capacity from existing carriers to chase rising spot market rates.

“The issue is not necessarily having a big impact on capacity,” Vise said.

Fleets race to secure build slots

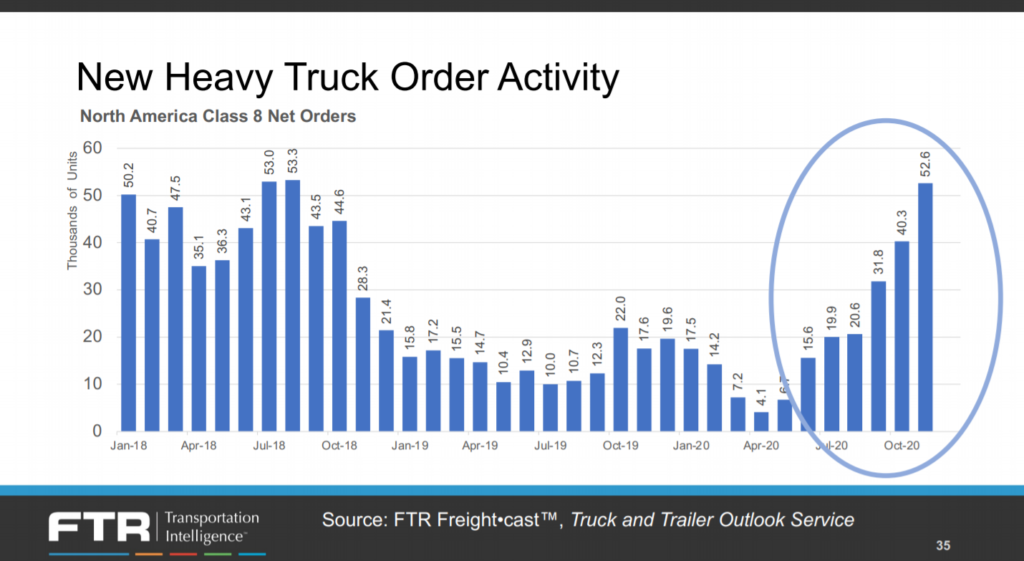

The healthy environment for trucking has caused fleets to race to secure 2021 build slots for new equipment, according to Don Ake, FTR’s vice-president, commercial vehicles. Preliminary Class 8 orders for November were the third best month on record, and trailer orders for October, the best ever. But Ake warns it’s not a normal market.

Some OEMs are experiencing supply and labor shortages, causing fleets to worry about their ability to secure new equipment next year.

“The response to that is to order in advance – nine to 12 months out – in order to reserve that capacity,” Ake explained.

Manufacturers are experiencing supply chain disruptions on parts from China, Mexico and even domestically, he added. And they can’t hire assembly workers fast enough. Ake projects a strong first half to 2021 for equipment demand, exceeding pre-pandemic levels. The second half of the year will see the market return to more normal levels.

“We are expecting a good year for equipment next year, not a record year,” Ake said. “If you get to the middle of the year and the economy opens faster than we think, then a lot of these orders are going to stick. Other than that, you can expect some order cancellations in the second half.”

Looking further out, Ake predicts 2022 equipment demand will be “a very good year, close to a great year.”

The general economy

Bill Witte, FTR economy expert, said 2021 GDP growth will run above the long-term norm at about 2-2.5%, but economic growth will still lag pre-pandemic expectations. Economic output is still down about 10%, exceeding the worst of the decline seen during the Great Recession.

“Even though we have growth in our forecast all of next year above the long-run average, it doesn’t get us back near our pre-pandemic path,” Witte said.

“People have dropped out of the labor force and they won’t all come back.”

Bill Witte, FTR

He attributed this to high unemployment, which, though improving, is worse than the number suggest when taking into account the sagging labor participation rate – a reflection of those workers who continue to sit on the sidelines without looking for work.

“Relative to the pre-pandemic (forecast), it’s a pretty grim picture,” he said of U.S. employment rates. “Fewer workers are going to get less output. People have dropped out of the labor force and they won’t all come back.”

Some of these can be attributed to retirements, and others to women, who have been harder hit during the pandemic as more work in service industries and are primary childcare providers who must stay home with their children where schools have not reopened.

Will stimulus help?

Witte’s forecast doesn’t take into account any further government stimulus, since there is so much uncertainty surrounding it. “The timing is up in the air,” said Witte. “If they pass stimulus this month…it means it could affect the economy in the first quarter. If they wait until there’s a new Congress, which is more likely, we probably won’t see any economic benefits until the second quarter. What is included and how large, is totally opaque at this point.”

Even if stimulus measures are taken, it won’t be enough to save everyone, he added.

“We can prop up a lot of small businesses for a couple months, but a lot of those businesses are effectively not going to make it. That’s the sad truth.”

He noted New York City office occupancy is currently below 20%. “Eighty per cent of the people in those offices aren’t there, they aren’t buying lunch every day keeping a restaurant alive. My guess is those offices are going to remain mostly empty for quite a while and a lot of restaurants in New York City are walking dead,” he said.

Vaccine to the rescue?

Will the rollout of a vaccine come to the rescue? That depends on whether or not people will take it. Todd Tranausky, vice-president, rail and intermodal, said he sees a lot of reluctance to take the vaccine where he lives in Texas.

“There is not an appetite to take a vaccine,” he acknowledged. “People down here are saying ‘I don’t need your vaccine and I don’t need the government telling me to take the vaccine.’ There is a healthy amount of pushback.”

Could that actually be a good thing for trucking? Tranausky acknowledges widespread vaccinations could allow people to shift some of their spending back from goods to services, negatively impacting freight demand since services don’t travel by truck or rail.

But Witte said there will be good reason to take the vaccine, as event venues will require proof of vaccination, and so a return to normal life won’t be attainable without it. “If IU (Indiana University’s NCAA basketball team) says you need it to get into the game, people around Bloomington, Ind., who are reluctant (to get it) will line up.”

Ake said a vaccine will be a tremendous boost for manufacturers currently struggling to secure the labor needed to produce.

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

Many people have stopped driving truck and are taking other jobs. A number of women have left trucking to be P S Ws. at nursing homes. Many homeless people used to drive truck including myself. The long term effects of long hours and lack of medical care and safe places to park is making health issues often means they can no longer pass the medical. A group in Huron Country is looking at setting up a 10 to 12 person group homes for homeless including former truck drivers and Vets.