Class 8 order pullback due to lack of supply, not diminishing demand

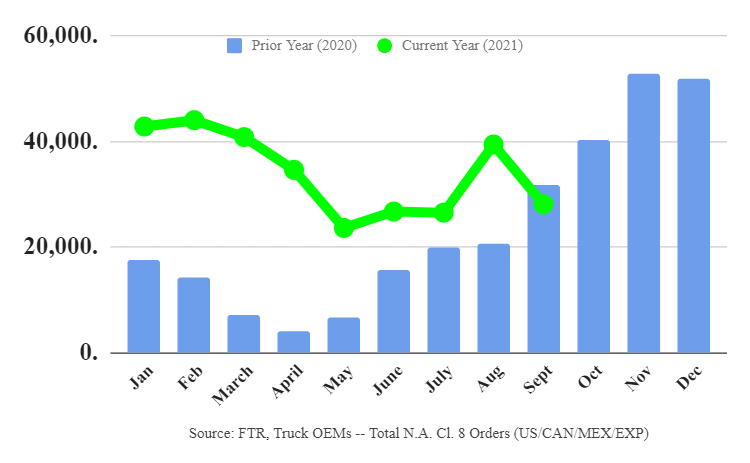

FTR reported preliminary Class 8 orders of 28,100 units in September, down 29% from August and 12% year over year.

However, the industry forecaster says the pullback is due to OEMs managing Q1 production slots in various ways, including rolling 2021 orders into the new year and delaying 2022 bookings.

“This is a complicated, bizarre situation that OEMs have never before encountered,” explained Don Ake, FTR’s vice-president – commercial vehicles. “There are many orders that were expected to be built in 2021 that cannot be completed due to the severe component shortages, most notedly, semiconductors. The OEMs are unsure when they can build the leftover 2021 orders and any new orders because the parts shortages are now expected to continue well into next year. They can’t schedule production because they don’t know their actual build capacity.”

Ake added September’s order weakness is not a true indicator of 2022 truck demand.

“There is significant pent-up demand for trucks leftover from 2021 because OEMs were limited in their output,” he added. “Add to this the robust demand expected for 2022 due to sturdy freight growth. The fleets have a tremendous need for new trucks in 2022, however, the OEMs are delaying entering orders until the supply-chain situation is clearer. Unfortunately, the supply chain remains a huge mess. Parts and components are so constricted, as well as raw materials, it will take many months to rectify, and conditions are expected to improve gradually, over an extended period.”

ACT Research, meanwhile, reported Classes 5-7 net orders of 24,500 units and Class 8 orders of 27,400 units.

“September traditionally marks the transition from the annual summer order trough into fall peak order activity,” said Kenny Vieth, ACT’s president and senior analyst. “However, with demand indicators from freight activity to freight rates and carrier profits in blatant contrast to equipment shortages and capacity constraints across all transportation modes, it is understandable that September’s Classes 5-8 order volume could be construed as disappointing relative to the economic set-up.”

Vieth added, “It is important to note that it is not demand, but supply that is dictating new order activity, as OEMs are being judicious in fully opening 2022 order books when there is not clear visibility of supply-chain capacity next year. And, while the story is just starting to develop, recent reports of energy sector issues in China dampen hope for the current supply situation to surprise on the high-side in terms of recovery timing.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

If more trucks and cheaper foreign truck drivers were available we would have a repeat of 2008. The current shortage is caused by insurance problems in my opinion

Also good drivers with 5 years experience are looking for other jobs with shipping companies trying to push truck drivers on E logs

Smaller trucking companies with under 50 units need to have more freedom in hiring of truck drivers and get gov assistance with insurance. We also n a plan to house and treatment of workers in the transport industry