Class 8 orders plummet, but market remains ‘strong’: FTR

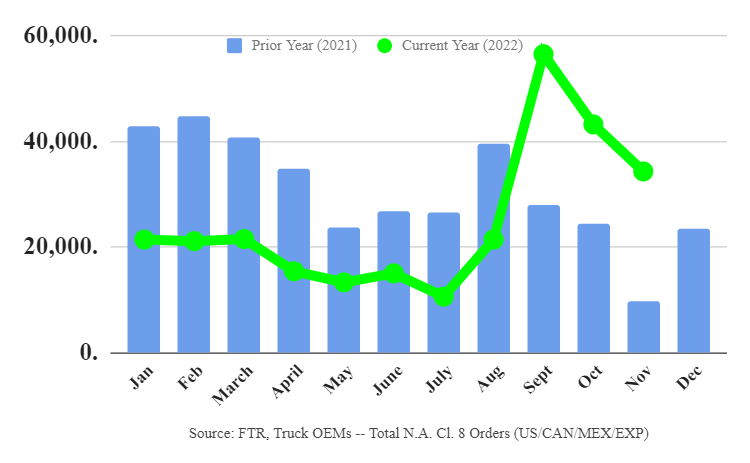

Class 8 truck orders plummeted to 34,300 units in November, according to preliminary data from industry forecaster FTR, well off the 56,000 ordered in September.

However, while orders have slid the past two months, FTR says they are showing “tremendous gains” over last year’s weak totals. November orders were down 20% from October, but up 254% year over year, FTR reported.

“Much of the year appears to have been slotted for production in 2023,” said Jonathan Starks, FTR’s chief executive officer and chief intelligence officer. “That means further moderation of levels as we get into the new year. The market remains strong despite the economic uncertainties, and production still will be limited to some extent by supply chains and labor.”

ACT Research, meanwhile, reported Class 8 net orders in November were 33,000 units, while NA Classes 5-7 net orders were 21,400 units.

“OEMs having opened their order boards for 2023 more broadly, and ongoing pent-up demand – with tailwinds from strong carrier profitability and elevated fleet age – is proving resilient,” said Eric Crawford, ACT’s vice-president and senior analyst.

“We continue to expect a freight recession, and an eventual economic recession (mild to medium in magnitude), but OEMs at this point have clear visibility to a strong first half of 2023 (barring any unforeseen cataclysmic events).”

About medium-duty orders, he added, “demand was solid, albeit against somewhat challenging comparables. Over the past 12 months, the MD market has seen 232,700 orders booked.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

-

Very well observed, Mack. The media is always trying to paint a very rosy picture of the economy.

In reality, the world economy is in very poor shape. I have repeatedly said that a very severe economic depression is on the cards for 2023.

What is coming our way is going to make the depression of the 30s’ look like a walk in the park. -

Well said the wait for reefer or dry van trailers is still 15 months unlesz pay a extra 10 tp 15% premuim over order prices

I find these articles misleading. They lead the reader to think that there is less demand in the market all of a sudden. But that’s not how equipment ordering works these days. OEMs have everyone on allocation. They typically release their numbers they are going to sell each quarter. Then they close their order boards until all those spots are filled, then open up the next quarter.

This article does nothing to enlighten readers on the state of the economy or equipment demand.

A more accurate article would say something like “After opening order boards last month, OEMs pause accepting new orders”.

They way you guys put these articles out, I’d expect another article saying that there were lots of orders in January, then another article saying low orders in Feb, March, then lots of orders in April, and so on until the recession actually does happen. Which I doubt will be in 2023.