Electric trucks get reality check at ACT Research conference

Paul Rosa knows people are enthusiastic about battery-electric trucks. He just believes it leaves a false impression about the number of such zero-emission vehicles in service.

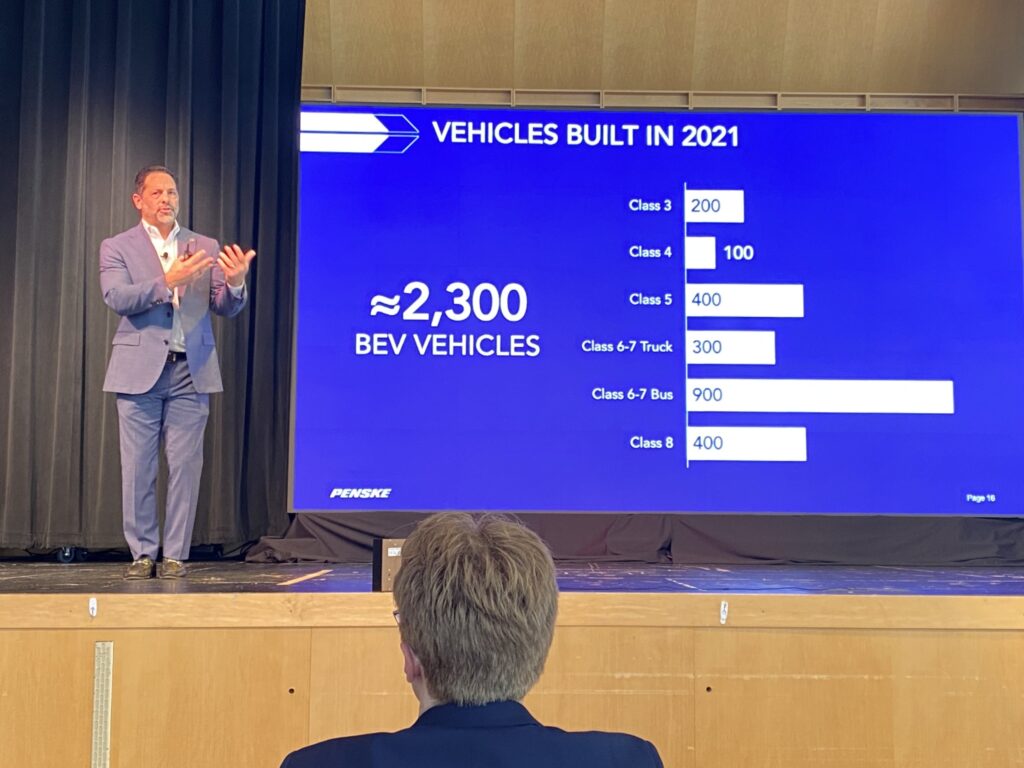

A mere 2,300 Class 3-8 electric vehicles were built in 2021, noted Penske’s senior vice-president – procurement and fleet planning. Only 400 of the vehicles were Class 8 trucks. Another 400 were Class 5 units. The biggest share of the total included 900 Class 6/7 buses.

Compare that to the 800,000 Class 3-8 vehicles manufactured overall.

He wasn’t the only speaker at an ACT Research conference to offer a reality check for battery-electric vehicle supporters.

Battery-electric vehicles account for 0.5% of all vehicles on the road when all vehicle classes are considered, noted Patrick Manzi, chief economist at the National Automobile Dealers Association (NADA). “It’s going to take a long time before they’re the dominant powertrain on the road. It could be one or two decades before they begin to displace the number of combustion engines.”

Not-so-fab four

Rosa said there are “certain circumstances” where battery-electric trucks make sense. But he stressed they’re not ready for every application because of a “not-so-fab four” list of factors including range, weight, charging needs, and cost.

Range-related questions include the maximum distance per charge, range variations linked to temperature, and the difference between installed and useable battery capacities, he said. Weight and spec’ing questions surround available energy densities per battery pack, powertrain weights, thermal systems, auxiliary needs, and up-fitting challenges.

Charging needs represent hurdles such as overall charging times to replenish the first 80% as well as to top off batteries, not to mention different charging standards and limited infrastructure.

“I don’t know how a public charging facility can work for a commercial driver,” Rosa said, referring to factors such as Hours of Service. Truck drivers don’t have two extra hours of charging time in the middle of the day to gain an extra 45 minutes of range.

To compound matters, utility providers can need two years to prepare a facility for charging needs, and it doesn’t make sense to invest in a charging station before the power is available, he said.

Then there’s the matter of cost. Battery-electric trucks can cost double or triple their diesel-powered counterparts, and that’s before accounting for investments in charging stations and building upgrades.

‘Not one solution fits all’

“It’s not one solution fits all,” said Puneet Jhawar, general manager of Cummins’ global natural gas business. “We certainly don’t think that every fleet is going to want battery-electric.”

While Cummins is investing in multiple energy sources, including electric power, the adoption rate of natural gas engines is expected to outstrip battery-electric vehicles for the next few years, he said. There’s no range anxiety with the gaseous fuel, and the all-important infrastructure is already in place.

Shippers are clearly interested in options to eliminate emissions, though.

“We’re getting customer calls all the time,” said Chad Dittberner, senior vice-president of Werner’s van/expedited division. Sustainability reports are now issued by 92% of S&P 500 companies, while 66% have carbon reduction targets, he said. And 84% of investors report Environmental, Social, and Governance (ESG) matters have grown in importance in the last two years.

“I have yet to see a technology come at us – a decarbonization technology come at us – that fits everything we do,” Dittberner said. But diesel fits every application from shorthaul to longhaul.

A question of ROI

“There’s still that big question of ROI,” said Steve Bassett, owner of General Truck Sales. Customers ask why they would spend $400,000 on a battery-electric truck when a combustion-powered model worth $160,000 can do the same thing. “That’s not even going into the infrastructure and whatever else.

“It’ll happen,” he said. “It’s just going to take time.”

“What politicians want and what we all want is not that easy,” added Rusty Rush, CEO of Rush Enterprises. “Everybody thinks it’s like, you know, plug your hairdryer in or something you know, but it’s not.

“Just because you want it doesn’t mean you can have it. Plus, we don’t have that many.”

He even questioned how many of the battery-electric trucks on the road have been sold outright rather than introduced into pilot projects.

Complex spec’s

Medium-duty vehicles are often referenced as a better fit for battery-electric powertrains because of their lighter weights and shorter ranges, but Rosa says there are many challenges to overcome there as well.

“I think it’s going to be a slower adoption because of the complexity of the spec’ in a medium-duty vehicle,” he told TruckNews.com.

Shorter wheelbases will leave less room for batteries, further limiting available range. Refrigeration and power take-offs (PTOs) also present a challenge.

OEMs will limit the focus on such issues until battery density improves, because the trucks will work in certain applications, Rosa said. But even there, questions remain.

“We have a small adoption rate because they can’t afford the costs. They don’t have the infrastructure capabilities,” he said. “Where’s the limitation in their grid? Where’s the limitations with power lines to carry the energy.

“We can only do it at the speed of what the utility companies in that state can provide us.”

Have your say

This is a moderated forum. Comments will no longer be published unless they are accompanied by a first and last name and a verifiable email address. (Today's Trucking will not publish or share the email address.) Profane language and content deemed to be libelous, racist, or threatening in nature will not be published under any circumstances.

I would assume the hybrid of both diesel and electric vehicles would be the only perfect solution to the lack of electric charging stations. HOS is fluid and adaptive for exemption during charging break. Charging infrastructure should be reimagined into free solar charging at metrolink (southern California) stations, Malls, and incorporated at all Amazon warehouses (part of their contribution to climate and community services). Unless there is an event Nation wide Empty stadium, shopping, convention centers, and airports should adapt solar powered free to charge units. Money is being given away to adapt and install charging for Trucking should be free. If charge for charging is needed let the Billionaires split it annually.

Wow. Reality bites. Delusional dreamers like Gavin Newsome, Justin Trudeau, the Green Elite and Enviro Lefties have never been grounded in facts and common sense. Too dull for them but it’s what the people who make the world work have to cope with. Sell your Lion Electric stock and stick with Paccar.